Spring Insurance Prices Tumble

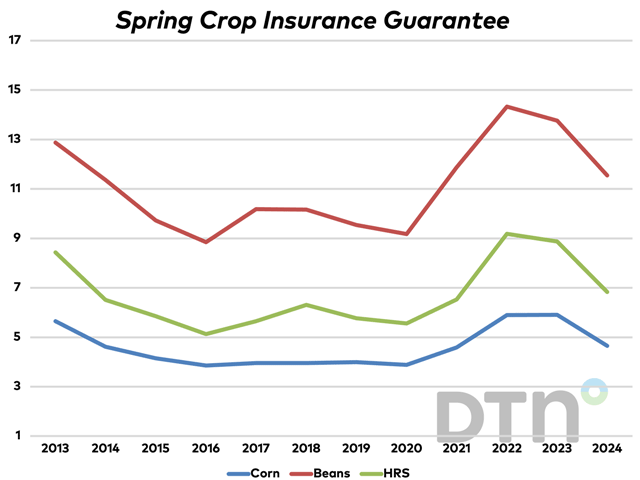

Spring Crop Insurance Projected Prices Settle at $4.66 for Corn, $11.55 for Soybeans

MT. JULIET, Tenn. (DTN) -- Revenue protection crop insurance policies won't cover the cost of production for many farmers in 2024, leaving many vulnerable to financial losses in the case of drought or severe declines in commodity prices.

The corn projected price for 2024 revenue protection policies is 27% lower than last year at $4.66 per bushel, while the soybean projected price is 16% lower at $11.55. Projected prices for spring wheat are $6.85, 30% lower than last year.

"Last year, we had a situation where crop insurance almost made planting corn a risk-free deal because it almost covered the whole cost, and I think that's part of why we got such a big bump in corn acres" last year, DTN Lead Analyst Todd Hultman said. Last year, the corn projected price was $5.91 per acre, while soybeans were $13.76 per acre.

Revenue protection insurance products use the average daily closing price of new-crop futures contracts -- December for corn, November for soybeans and September for spring wheat -- to establish revenue guarantees. Farmers are paid an indemnity when prices or yields drop enough to cause calculated revenue to fall below the guarantee.

Farmers also select a coverage level between 70% and 85%. The higher the coverage level, the lower yield or price losses need to be to trigger a payment. Higher coverage levels also carry higher premiums.

For instance, if a farmer purchases an 85% coverage policy and produces average yields, it would take prices falling to $3.96 on corn, $9.81 on soybeans or $5.81 on spring wheat to trigger an indemnity, Hultman said. At 80% coverage, those fall to $3.72 for corn, $9.24 for soybeans and $5.47 for spring wheat.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

"All of those are under the cost of production, based on the national average," Hultman said. "It's a tough landscape."

Cory Walters, an associate professor of agricultural economics at the University of Nebraska-Lincoln, said on a webinar that it's important for farmers to evaluate their insurance options using their farm's data and risk profile.

He encourages farmers to look forward. "Trade the market you're in, not the one you want. We don't have those prices from six, eight, 10, 12 months ago. We have to manage today's prices."

No one can say for certain what prices will do in 2024, but he said price distribution charts show there's a 5% possibility of $3.40 corn.

"Do you want to be exposed to that? I'm not saying it will happen, but there's a chance," he said. The most important thing to manage this year "is the distribution of outcomes I'm exposed to. I want to get rid of rare, financially devastating events."

Crop insurance, much like a put option, establishes a floor price. Unlike a put, crop insurance covers things like yield damage, and the premium is federally subsidized.

"My best advice is to get crop insurance," Hultman said. "At these lower prices, the good news is that crop insurance will be less expensive this year. The bad news is it's not protecting a very good price."

He'd also encourage farmers to keep their eyes on the options market. There's not much incentive to buy puts -- which give the owner the right to sell the underlying commodity at the strike price -- at current prices, but that could change if there's a weather scare or rally in the market. Hultman said puts would either expire worthless or contribute some money to a hedging account.

Ken Harrison, who spent more than 40 years working in the crop insurance industry, said farmers need to understand that risk is multifaceted. It can come in the form of financial risk, legal risk, marketing risk, production risk, strategic risk or even human risk.

"One of the things about farming is you can't sit on the sidelines for one growing year. You've got to be in it every year, and this is probably a year most of you would like to go sit on a bench," he said. "This is going to be a year with tight margins. This is going to be a year when you need to understand your risk management plan and your risk strategy. Be aware of your total risk environment because they all interplay with each other."

A replay of the webinar can be found here: https://cap.unl.edu/….

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her on X, formerly known as Twitter, @KatieD_DTN

(c) Copyright 2024 DTN, LLC. All rights reserved.