Farm Income Forecast Drops

USDA Expects Farm Profits to Fall 25% in 2024

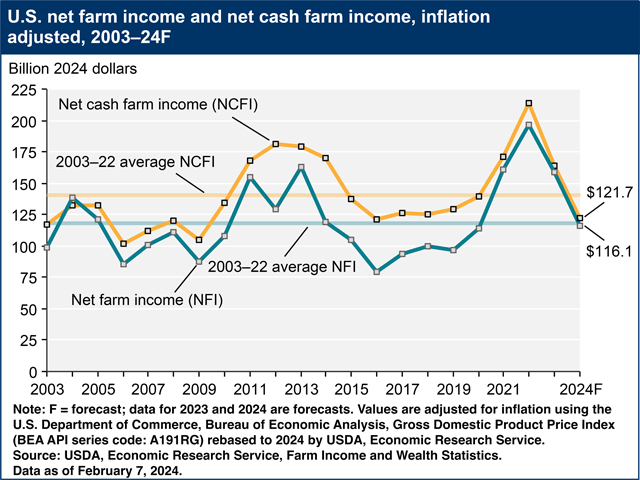

MT. JULIET, Tenn. (DTN) -- USDA's broad measure of profits -- net farm income -- is forecast to drop 25.5% from 2023. That's nearly 41% lower than 2022's record when adjusted for inflation.

USDA forecast net farm income to be $116.1 billion. That's 1.7% lower than the 20-year average.

Net cash farm income is expected to fall significantly below the long-run average. Net cash income measures cash farm-related income from the year minus cash expenses and excludes changes in inventory, depreciation and rental income from dwellings.

USDA expects net cash farm income to decline by 24.1% from 2023 to $121.7 billion in 2024. That's 13.7% lower than the 2003-2022 average and 43.2% below 2022. Lower cash receipts, lower direct government payments and higher production expenses all play a role in declining farm incomes.

"USDA's lower net farm income estimates for 2023 and 2024 reflect the transition of going from corn prices above $6.00 and soybean prices near $15 in early 2023 to less than $4.50 for corn and less than $12 for soybeans today," DTN Lead Analyst Todd Hultman said.

Increased supplies of crops will help the livestock industry and keep both feed and food costs down.

"But the painful part of this transition is that for many corn growers, cash prices in the low or even mid-$4s will not be profitable in 2024, and the protective levels of crop insurance will likely be too low to help," he said.

For soybean growers, current cash prices near $11.50 are roughly 80 cents a bushel below USDA's average production cost estimate.

"Weather is always a risk, but in early 2024, corn and soybean crops in both Argentina and Brazil are looking big enough to offer significant competition for exports for the rest of 2024, adding to concerns about farm profitability 2024," Hultman said.

Sen. John Boozman, R-Ark., ranking member of the Senate Agriculture Committee, pointed to the decline in farm income Wednesday as a reason to increase the commodity safety net. The farm bill remains stalled in committee and Sen. Debbie Stabenow, D-Mich., earlier this week floated the idea of offering farmers the chance for an insurance program with a higher premium subsidy instead of higher reference prices.

Boozman said the lower farm income forecast underscores the need to make meaningful investments in the farm bill's safety net programs.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

"We are witnessing the most rapid and steepest erosion in the farm economy of all time," he said. "This dramatic projected decline reflects what I've heard around the country from farmers and ranchers and is why I have repeatedly said that risk management tools must be enhanced in the next farm bill. Our current farm safety net is not equipped to handle the challenges our farmers are facing. The gravity of the situation drives home the need for Congress to make meaningful investments in the farm bill's safety net programs. We must act now to give producers the risk management tools they need to succeed in the coming years. The farm bill is our opportunity to do that."

REPORT HIGHLIGHTS

CASH RECEIPTS

Cash receipts are forecast to drop by $21.2 billion, or 4.2%. Crop receipts show larger losses than animal/animal products, although both are down.

On the crop side, receipts are expected to decline by $16.7 billion, or 6.3%. Corn and soybean crop receipts are forecast to fall $17.2 billion below 2023.

For animals and animal products, cash receipts are forecast to fall 1.9%, or $4.6 billion, following declines in receipts for eggs, turkey, cattle/calves and milk.

GOVERNMENT PAYMENTS

Direct government payments, at $10.2 billion, are forecast at 16% below from 2023. These payments do not include crop insurance indemnity payments. Rather, they reflect payments made from farm bill programs and supplemental or ad hoc disaster assistance.

Since 2020, supplemental and ad hoc assistance has made up the largest share of direct government payments. It will continue as such in 2024, with USDA estimating this category at $5.9 billion.

Conservation payments are expected to total $4 billion, up $441.2 million from 2023 due to a "marginal increase in Conservation Reserve Program enrolled acres, an increase in payments from NRCS programs, and some expected payments from the Inflation Reduction Act funds allocated for USDA's conservation programs," USDA stated.

Payments from the Agriculture Risk Coverage program are expected to total $39.1 million, down from $231.3 million in 2023.

"Despite the expected decrease in market prices, commodity prices are likely to remain above the levels needed to trigger significant ARC payments," the report stated.

Payments from Price Loss Coverage program are expected to increase as commodity prices fall below reference prices, and USDA expects payments of $40.8 million, up nearly $33 million from 2023. It sees most of the payments going to long-grain rice, seed cotton and grain sorghum.

EXPENSES

Farm sector production expenses, which include operator dwellings, are forecast at $455.1 billion in 2024. That's up $16.7 billion from 2023.

USDA expects spending on feed, labor and livestock/poultry purchases to represent the largest categories of spending. Farmers are expected to pay $80.6 billion for feed, up from $79.9 billion in 2023 but still below 2022's outlays.

Labor expenses, including noncash employee compensation, are expected to rise $3.3 billion above 2023's forecast to $47.4 billion.

USDA expected interest expenses to remain comparable to 2023, around $34.2 billion.

Fertilizer expenses dropped 17.5% in 2023 from 2022. USDA expects farmers to spend 4.3% more on fertilizer in 2024, but the overall expense will remain below 2022's outlays.

Fuel costs are forecast to decline by $1.2 billion, or 7.4%, from 2023.

You can find full details of USDA's Farm Income report here: https://www.ers.usda.gov/…

Chris Clayton contributed to the reporting.

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

You can follow her on X, formerly known as Twitter, at @KatieD_DTN

(c) Copyright 2024 DTN, LLC. All rights reserved.