Cost of Carry Adds Pressure to Basis

Elevators Will Lower Bids, Widen Basis as Higher Interest Rates Push Grain Storage Costs to Records

MT. JULIET, Tenn. (DTN) -- The cost of grain storage at elevators is expected to hit records this year, and that could translate into lower cash grain bids and wider basis levels, according to a recent report from CoBank's Knowledge Exchange.

Higher interest rates are colliding with an inverted futures market as well as higher labor, insurance and operational costs that make storing grain more expensive, said Tanner Ehmke, lead grains and oilseeds economist for CoBank, in the report.

"For grain elevators, the sharp rise in interest rates couldn't have come at a worse time as they borrow higher-priced funds on commodities that have also remained at historically high prices," said Ehmke.

"And while grain elevators are motivated to move inventory as fast as possible to lower carrying costs, processors and end users will want to delay ownership of commodities to reduce their own inventory costs," he said.

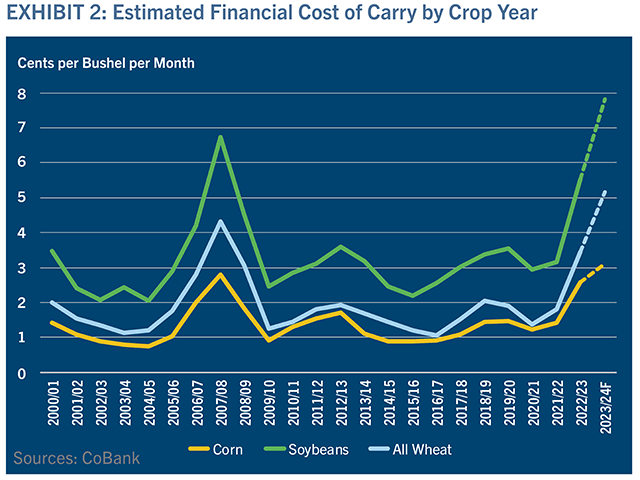

The average annual interest rate for grain merchandisers is forecasted at 7.75% for the 2023-24 crop season, the report said. Using USDA's marketing year average prices, that raises the interest-related cost of carry, or cost of storing grain, compared to last year to:

-- 3.1 cents per bushel per month for corn, up 21%

-- 7.8 cents per bushel per month for soybeans, up 42%

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

-- 5.2 cents per bushel per month for wheat, up 50%.

Cooperative elevators face additional challenges because they are in business to buy and market their members' grain, which means they're "obligated to carry inventory despite the economic disincentive of doing so."

The high-interest rate environment also ties up an elevator's working capital, affecting other business operations, and potentially causing problems if liquidity is needed for managing margin calls on futures hedges.

"It's a challenging situation for cooperative grain elevators as well as farmers, because it comes at a time when farmers are also facing higher costs," said Ehmke in a press release. "Co-op managers will need to closely scrutinize their operating costs and impose greater discipline on cost wherever possible. And if they need to lower their bids and widen basis to cover storage costs, they should communicate early and consistently with farmer members who will be impacted."

The structure of each elevator's cost of carry is unique, depending on its financial structure, interest rate and price of commodities. While interest expense as a percentage of total cost of carry varies widely between elevators and crop years, it normally comprises about 25% to 33% of an elevator's total cost of storing grain.

"The positive news on carrying costs is that the Federal Reserve is expected to hold interest rates at current levels for the foreseeable future, pausing rate hikes as it waits for sufficient evidence that inflation has cooled to the desired level of 2%. But stubborn inflation, a tight labor market and rising wages mean interest rates will likely stay near these higher levels through 2023," Ehmke wrote.

Compounding the problem is an inverted market structure. Grain elevators, however, typically make money by buying grain now and selling when prices are higher. But when a market is inverted, it means that the price of later-dated contracts are lower than spot-month prices.

This typically happens when gain supplies are short. CoBank notes that global corn and soybean stocks-to-use ratios are the second tightest in the past decade, while the wheat stocks-to-use ratio is the tightest since the 2007-08 crop year.

"These are signals to producers to not only sell commodities now rather than store them for later use, but also to increase production," Ehmke wrote. That leaves elevators with a lot of crop to sell.

"Just as grain elevators are motivated to move inventory as fast as possible to lower carrying costs, processors and end users like flour millers, ethanol plants, feedlots and soybean crushers are motivated to delay ownership of commodities to reduce their own inventory costs," Ehmke wrote. Logistical issues also make it harder for elevators to move all their bushels as quickly as they might like.

"Elevators that have been proactive and have managed their interest rate risk will be positioned to handle the potentially lower-margin environment," he said, but others will have to watch their operating costs and margins closely.

There could be an upside to wider basis levels, too.

"The wider basis could potentially attract more export business this fall, meaning domestic users may have to pony up if they want to assure their supplies through the 2023-24 marketing year."

You can read the full report here: https://www.cobank.com/…

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her on Twitter @KatieD_DTN

(c) Copyright 2023 DTN, LLC. All rights reserved.