Reps Say USDA Lax in Tracking Ag Land

Lawmakers Raise Concerns About 'Lax' USDA Tracking of Foreign Ag Land Purchases

LINCOLN, Neb. (DTN) – A group of 28 federal lawmakers is calling out the USDA for what they describe is a lax in tracking foreign investments in U.S. agriculture land, in a letter to U.S. Secretary of Agriculture Tom Vilsack on Monday.

The agency has faced increased scrutiny regarding how extensively it attracts foreign ag land purchases, most recently playing out when a U.S. unit of China's Fufeng Group Ltd. Planned to buy farmland near an Air Force base in North Dakota. The transaction was ditched by local officials after Air Force officials raised concerns about building a corn mill near an air base.

In particular, the members of the U.S. House of Representatives questioned the Vilsack department's decision not to assess any penalties between 2015 and 2018 related to lapses in reporting foreign purchases of U.S. farmland. The USDA later resumed penalties.

The lawmakers said in the letter that more oversight is needed as foreign acquisition of ag land increases.

While concern about foreign agriculture land ownership in the U.S. and news headlines center primarily on China, Russia, North Korea and Iran, the real-world data shows all of those nations are small players in the U.S. ag market game.

Clayton Michaud, USDA agricultural economist for the Economic Research Agency, said during an Ag Outlook presentation last week in Washington, D.C., that historically concerns about foreign ag investments have centered primarily on economics.

"More recently it has kind of evolved where now we have a lot more concerns that are rooted in things like national security," he said.

"The prospect of foreign companies buying up land close to the military bases, for example. We also have natural resource scarcity concerns, right, so foreign companies using land and in drought-ridden areas to produce, let's say alfalfa that then they shipped back for domestic cattle production. And then also, of course, we have supply chain issues that given COVID and the war in Ukraine have become all the more relevant."

Legislative efforts in Congress aimed at preventing land from getting in the wrong hands have focused on China, Russia, North Korea and Iran.

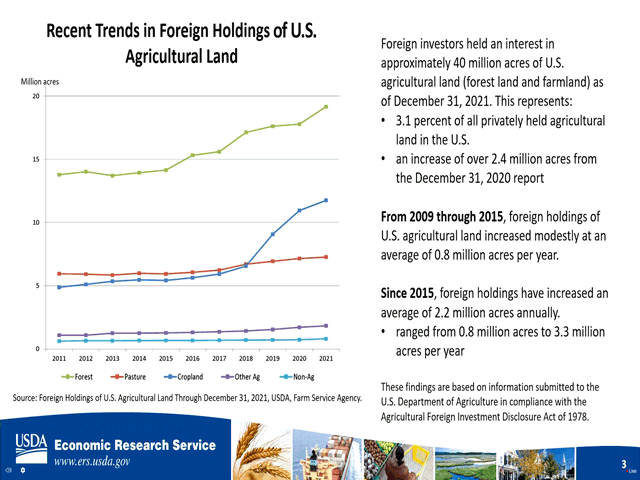

As of Dec. 31, 2021, foreign investors held about 40 million acres of American land. Michaud said that is about 3% of all the privately held agricultural land. That is an increase of about 2.5 million acres since the previous year.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In 2021, Canada accounted for 12.7 million acres or 32% of all land holdings in the U.S., according to USDA. The Netherlands came in a distant second at 4.7 million acres, followed by Italy, United Kingdom and Germany. Those five countries, Michaud said, accounted for 62% of all foreign holdings in the U.S.

China's holdings in U.S. ag land comes in at about 1% of all foreign holdings, Michaud said, while North Korea, Iran and Russia all come in below .01%.

CHINA'S LAND HOLDINGS

Mykel Taylor, associate professor at Auburn University, said in total China owns about 352,000 U.S. acres.

"But you'll notice their big entry into our market came in 2013 with the purchase of Smithfield Foods, which acquired the subsidiary Murphy Brown and all of their land holdings," she said. "And so that was a big jump up and in Chinese land holdings in the U.S. with just that one purchase."

The rate of foreign investment in ag land, however, has increased since about 2015. Between 2009 and 2015, foreign holdings increased by about 800,000 acres per year. Since 2015, Michaud said, the rate of increase is about 2.2 million acres annually.

Taylor said data shows there's been a "significant amount of acquisitions" of cropland by foreign entities in the past 30 years. Taylor and her colleagues at Auburn have been studying land acquisitions in the U.S.

By state, Texas leads the way with about 4.8 million acres of agriculture and forest land owned by foreign interests, according to 2020 data collected under the Agricultural Foreign Investment Disclosure Act. Maine is second at 3.5 million acres, with Alabama (1.8 million) and Colorado (1.78 million) rounding out the top four.

When you look at states with the highest ag and non-ag land acquisitions, the four Plains states of Oklahoma, Texas, Colorado and Kansas lead the way in foreign investment. Taylor said that is because many countries have been investing in expanding wind energy.

Taylor has studied foreign ag land purchases in the U.S., looking for differences and similarities between land purchases made by U.S. and foreign entities.

FOREIGN SALES DATA

In particular, Taylor looked at AFIDA sales transactions and collected information from the Farm Service Agency covering sales from 1900 to 2020. Her study focused on foreign land sales in 11 states including Illinois, Indiana, Iowa, Kansas, Michigan, Minnesota, Missouri, Nebraska, North Dakota, South Dakota and Wisconsin.

Taylor said foreign buyers are likely to be "systematically different than domestic buyers." They target different types of farmland, different geographical regions or pay different prices because of transaction costs of buying in the U.S.

Most notably, the study found foreign buyers paid higher average prices than U.S. buyers -- on average $6,536 per acre compared to $5,745 by domestic buyers.

"Foreign buyers in the Midwest pay a 13.7% premium for agricultural land over domestic buyers," Taylor said.

Although China has been a minor U.S. ag land investor, Taylor said the current environment is "very politically charged" when it comes to China and ag land purchases.

Earlier this year, Air Force officials sounded alarm bells about the Chinese owning a corn mill near Grand Forks, North Dakota, located near a U.S. air base.

Many states have been putting forth legislation to restrict or even ban foreign ownership of ag land, as have federal lawmakers.

"I'll go back to this chart that I showed you earlier and say where's China on this list?" Taylor said.

"It's actually number 18 and for some people they don't realize that they're not a big player in this market. They actually hold very few acres."

Todd Neeley can be reached at todd.neeley@dtn.com

Follow him on Twitter @DTNeeley

(c) Copyright 2023 DTN, LLC. All rights reserved.