Brazil Corn Exports to Surge in 2023

Brazil Poised to Become World's Largest Corn Exporter in 2023

MT. JULIET, Tenn. (DTN) -- If USDA estimates come to fruition, Brazil will oust the United States as the world's largest corn exporter this year.

Brazil and China reached a deal on phytosanitary requirements for corn last spring, and the first load of Brazilian corn was shipped to China in November. Even though China was only its 11th largest customer, it was enough to propel Brazil to a record 48 million metric tons of corn exports in the 2021-22 marketing year, up from 21 mmt the prior year.

Analysts expect Brazil could sell 6 to 10 mmt of corn to China this year.

With a new buyer in town and forecasts for yet another record-breaking corn harvest, USDA's estimating Brazilian exports at 50 mmt for the 2022-23 growing season. If realized, it will surpass the U.S., which is forecast to export 48.9 mmt.

EXPORT GAP CLOSED DRAMATICALLY

DTN Lead Analyst Todd Hultman said the gap between U.S. and Brazilian exports has closed dramatically the past two years. "Brazil still has cheap corn supplies available from last summer's record crop. That's really hurt our corn exports early this season," he said.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

"And, of course, as they keep expanding their acres -- soybeans are the primary incentive for that, but they're double cropping that with corn -- that corn production can keep setting new record highs also."

Brazil is expected to harvest 5.6 billion bushels (bb) of soybeans when harvest wraps up in the next few months. That's a 22% increase from last year, driven by a 4% increase in acreage to 107 million acres, according to Joana Colussi, a member of the Farmdoc team at the University of Illinois.

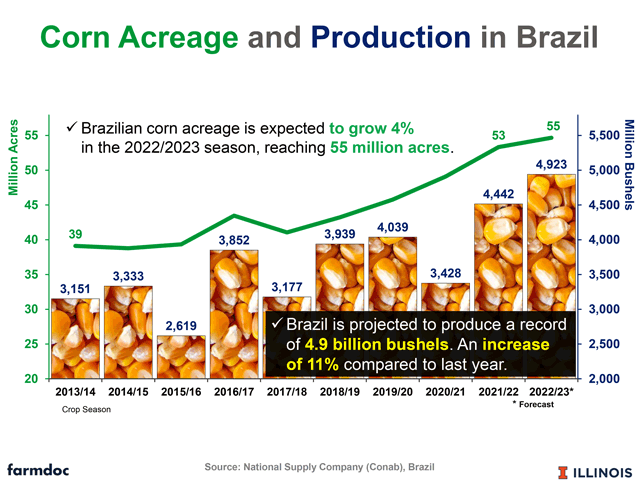

For corn, production is expected to rise 11% from last year to 4.9 bb. Nearly 75% will come from the second crop, also known as safrinha, which is being planted now. Colussi said corn acreage is expected to grow to 55 million acres this year.

In September, USDA's Economic Research Service said Brazil could bring another 49 million acres of cropland into production by 2031. Hultman said most of that is driven by soybean expansion, but it also means larger second-crop corn potential.

"The safrinha crop is an opportunity for Brazil to double its corn production in the coming years," Colussi said on a recent webinar. She also noted that there's a part of Brazil that can grow three crops in a season. It currently represents less than 2% of the country's production.

"But if you go back 20 years ago, safrinha -- little harvest in Portuguese -- was very small, and today represents more than 70% of the corn production in Brazil," she said. You can view the webinar here: https://farmdocdaily.illinois.edu/….

RISK TO PRICES

For U.S. growers, expanded global corn production poses a risk to prices. If Brazil delivers on forecasts for record crops and U.S. farmers plant more than 90 million acres and achieve trendline yields, the global supply situation could move into a surplus.

"If the new cost of production is $5 a bushel, we're at risk of prices trading between like $4.50 and $6," Hultman said. "It's kind of like $5 will become the new $3."

The tight corn economics are unlikely to tip acreage to soybeans' favor, Hultman said. Farmers like to stick to their rotations, and many are integrated into domestic demand channels, like ethanol and livestock.

"I have to say that domestic demand has been very good for corn this year," he said, adding that drought in the Western Corn Belt played a role in some of it. "I don't think they'll give up on corn anytime soon. It'll have to get really painful to change that habit."

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follower her on Twitter at @KatieD_DTN

(c) Copyright 2023 DTN, LLC. All rights reserved.