Inflation Pressures Farm Income

2023 Farm Incomes Face Inflationary Pressures From Higher Costs, Support From Higher Commodity Prices

MT. JULIET, Tenn. (DTN) -- Inflationary pressures will drive up the expense side of farmers' balance sheets in 2023, but upward price pressures will likely support commodity prices at a higher level, two nationally renowned ag economists said on Wednesday.

"I think there's still significant pressure on those (commodity) prices to keep them high, or at least in this basic range. The cost side is a concern," said Joe Glauber, former USDA chief economist and senior research fellow at the International Food Policy Research Institute.

He added that many producers purchased their fertilizer for the 2022 growing season in 2021, thus avoiding the worst of price increases. Even though fertilizer prices have declined since the fall, many growers will still pay more for fertilizer out of pocket than they did last year.

"But, again, the picture looks a lot better right now than it did even in September of last year," Glauber said in a webinar hosted by the North American Agricultural Journalists on Wednesday.

Nathan Kauffman, vice president and Omaha branch executive of the Federal Reserve Bank of Kansas City, agreed that income prospects for 2023 are strong. Commodity prices tend to move more quickly than costs, and farmers are very aware of that risk.

"The thing I would like to add is that we may see some pretty significant regional differences in how we actually experience farm income," Kauffman added, noting that drought conditions and basis issues play large roles in a farm's income potential. "If you're a livestock operation somewhere that's been really affected by drought ... you may be in a very different environment than someone else that's not experienced the same acute increases in costs."

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

USDA's Economic Research Service will release its first farm income forecast for 2023 in February.

Generally, Kauffman said, the inflationary pressures in agriculture are consistent with the broader economy. In the years following the COVID-19 pandemic, economic growth has fueled "remarkably high" demand for food, feed and fuel.

"Generally speaking, the economy has been operating a fairly high level, and this has led to ongoing demand for these products, not just in the United States, but globally," he said, noting that in 2021, GDP growth surpassed 5% and farm incomes set new record highs.

Supplies have been unable to keep pace with demand for a variety of reasons, including supply chain disruptions and labor shortages. One additional pressure that affects agriculture differently than the general economy is weather-driven supply problems, mostly related to drought conditions reducing grain supplies.

"And then, third, recognizing that for any business, whether it's an agriculture or the production of food, production expenses have also increased, and in many places, those expenses are being pushed on to customers or further along the supply chain when that's possible," Kauffman said.

Looking ahead, Kauffman said these inflationary pressures appear likely to ease, but, "I want to be clear that it doesn't necessarily mean that costs will decline."

He explained that the Fed's goal for inflation is 2% growth over the long term, and that still means higher prices.

"A lot of times what consumers and households care about is the level of prices, and it may not be entirely satisfying to see that inflationary pressures are softening while prices are still rising."

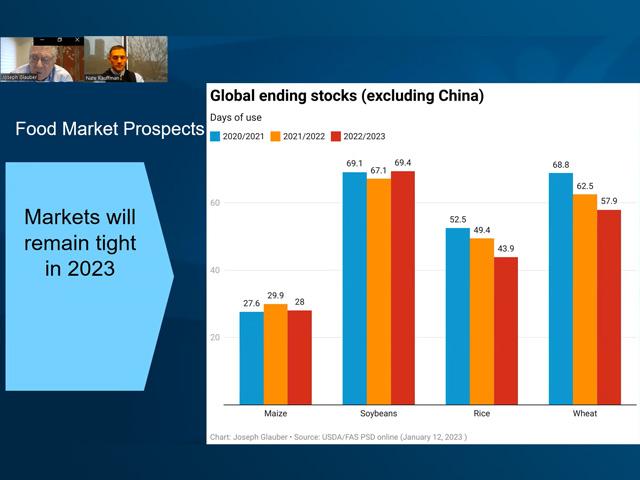

Despite some softening in upward price pressure, Glauber expects volatility. Tight global grain stocks mean people are going to be monitoring crop development and production very closely, including in markets that don't normally contribute much to global exports, like India.

"The problem here is that we're already starting in the hole with reduced production in Ukraine because of the war and the continued uncertainty of the war. The bottom line here is, I think price volatility will continue throughout the year, and I think that while these prices are going to be down from the spikes we saw last February, they're still going to remain high relative to the pre-2020 years."

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her on Twitter at @KatieD_DTN

(c) Copyright 2023 DTN, LLC. All rights reserved.