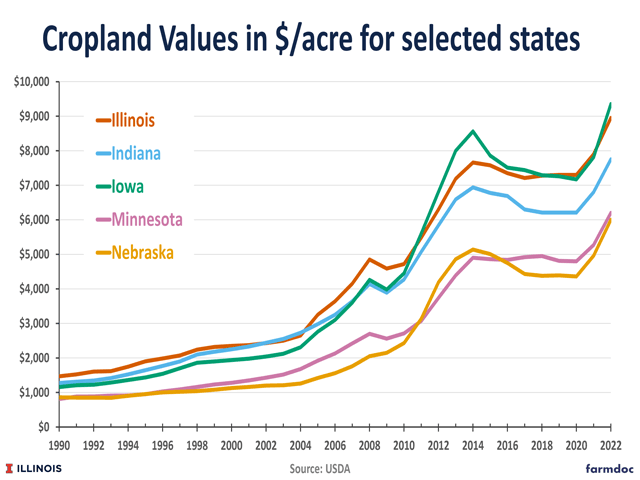

Farmland Values Set Records

Farmland Prices Expected to Stay Strong in 2023

INDIANOLA, Iowa (DTN) -- Despite rising interest rates and higher input costs, the farmland market across the Midwest remains strong, although not quite as robust as last fall.

"You can still have a record land sale, but not every sale will set a record," said Doug Hensley, president of Hertz Real Estate Services based in Nevada, Iowa. "The land market is not backing off, but it is going up at a slower pace than last year, and in some places, it is leveling off."

Paul Schadegg, senior vice president of real estate for Farmers National Company in Omaha, concurred. "About the time we say we've seen our last record sale, another one pops up," said Schadegg.

In southeast Nebraska at the end of October, a 116-acre farm sold for $27,400 per acre, with the price driven up by two local farmers/businessmen who both wanted the tract, Schadegg said.

"Good land continues to attract a strong amount of interest from buyers," he said. Although investors are engaged in the bidding, 90% of the top auction bids at Farmers National auctions are won by owner-operator farmers, Schadegg said.

"With commodity prices remaining strong, farmers continue to have the incentive to expand," he added. "They've seen some pretty impressive returns the past couple years. And even in places where there was a drought this year, yields have come in better than expected."

University of Illinois calculations show that in 2021, Illinois farmers had a return of $477 per acre, factoring a yield of 211-bushel-per-acre (bpa) corn and a price of $6.50 per bushel. In 2022, return per acre of corn in Illinois is predicted to be $193, with a 215 bpa corn yield at an average price of $5.80. Next year, the University of Illinois predicts, farmers' profit on an acre of corn ground will drop to a negative $11 per acre, due to direct costs rising 45% and machinery costs increasing 26% from two years ago.

It's still a red-hot farmland market in Indiana, said Howard Halderman, president of Halderman Farm Management and Real Estate Services, based in Wabash, Indiana. He likes to look at farmland based on its Weighted Average Productivity Index (WAPI) using corn bushels per acre. From 2016-2020, farmland sold for about $50 per bushel of WAPI. So, if your farm had a WAPI score of 150 bpa, it would sell for $7,500 per acre ($50 x 150 bpa).

In the first half of 2021, Halderman said, sales of cropland (excluding woods and pasture) brought $55 per WAPI. In the second half of last year, that shot up to $80 per WAPI, for an average of $71 per WAPI for the whole year.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

In 2022, based on actual cropland sales, Halderman reported these monthly average values: February = $85/WAPI bushel score, March = $87/bu., April-July (a slower time of year for land sales) = $77/bu., August = $92/bu., September = $95/bu., October = $98/bu. The average for the year so far is $87 per bu. WAPI score.

"That equates to a farm sale bringing $12,270 per cropland acre that has a WAPI yield score of 141 bu. corn per acre (141 bpa x $87/bu)," Halderman explained. "We had a recent sale of $12,300 per acre on a farm that equaled $85 per WAPI, and the seller was pleased," noted Halderman.

INCREASING INTEREST FROM INVESTORS

"Historically, farmland has been a great inflation hedge. In fact, the correlation is 1-to-1," said Steve Bruere with People's Company based in Clive, Iowa. "And we've seen investors being the high bidder at some farmland auctions."

At People's Company Auctions, the percentage of buyers that are farmers has shifted from about 70% to 50% to 60%.

"While farmers continue to buy most of the farmland, we're seeing more investor involvement," said Nate Franzen, president of the ag banking division at First Dakota National Bank in Yankton, South Dakota. "As people worry about a coming recession, farmland is seen as a safe haven."

HIGH INTEREST RATES NOT YET A FACTOR

Higher interest rates haven't really been much of an issue in farmland sales up to now, Bruere said. "And that surprised me, but there is a lot of cash out there. Incredibly strong commodity prices have outpaced the effect of increasing interest rates. But going forward, that could be a real challenge for people using leverage for land purchases."

Franzen said that whether a farmer can lock in 5% interest or 6.5%-7% interest is not entering the decision-making process.

"Profitability is stable to strong. That's been the main motivator in the land market," he said. "We continue to see new record sales all across the board this fall."

Halderman added that some buyers may become more cautious as interest rates climb. One potential buyer told him, "Maybe I'll just buy CDs (certificates of deposit)."

Interest rates are not historically high, but they are three times higher than last year, Halderman pointed out. "A farmer with cash may consider a 2.5% to 3% CD competitive with the current return on a farm, although that doesn't take into account potential capital gain on the land," he said.

STILL MORE BUYERS THAN SELLERS

"It amazes me that there are still more buyers than sellers," said Farmer's National Company's Schadegg. "And we are setting a new record for real estate sales in our company's 90 years of operation, not only because of higher prices, but the number of transactions is up, and the number of acres sold is up." The company's auction calendar is booked through the end of the year, and it's actively booking auctions into the new year, Schadegg reported.

Sellers are motivated because they see an opportunity to sell at record prices, although Schadegg cautioned there is the drawback of capital gains taxes. Yet, even with all the sales, stronger buyer interest remains.

CAUTIOUS OPTIMISM AHEAD

"Farmers don't expect these returns to continue forever," said University of Illinois agricultural economist Gary Schnitkey. Brazil planted a record number of acres this year, and good yields could occur in the U.S. next year, rebalancing the global supply and demand picture. Continued high input costs weigh on profits. A recession could cut demand. High prices don't last forever, Schnitkey concluded. More of Schnitkey's thoughts can be seen here: https://farmdocdaily.illinois.edu/….

However, there's a lot to support the farmland market too. To start, the majority of land is owned debt-free. Farms are expecting strong returns. A lofty harvest price option for crop insurance will boost indemnities for those in drought areas. Farmers have the ability to lock in profitable prices for next year. That's why most farmland experts DTN interviewed expect the pace of farmland price increases to plateau or slow to around 10% to 15% year over year in 2023.

(c) Copyright 2022 DTN, LLC. All rights reserved.