US Ag and India's Market Potential

India, Brazil Succeed China as Countries of Greatest Ag Interest

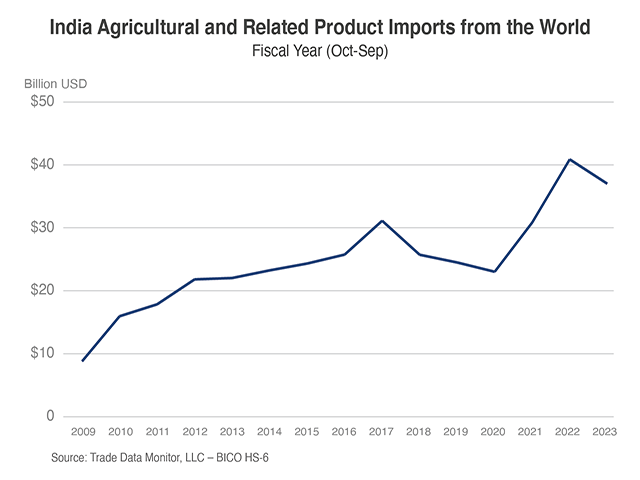

AVENTURA, Fla. (DTN) -- India is the country of the future in terms of the greatest food import needs, while Brazil has become the country that the world depends upon for sugar, analysts said here Monday at the International Sweetener Colloquium.

Michael Zerr, the long-term model lead for Cargill, said that despite economist Thomas Malthus's concern in the early 19th century that the population would exceed the food supply, humans have been able to feed a growing population since the 1700s because "we can grow crops."

As an analyst for Cargill, Zerr noted that he follows world population trends into the future. Cargill, he said, focuses on population growth and income growth to determine food consumption patterns.

The analysis comes while a group of land-grant university economists released an analysis showing U.S. agriculture is turning "inward" and losing export market share to Brazil.

Today, he noted, there is more concern about depopulation, especially among the richer Western countries and China. The United States, he noted, continues to grow but only because of immigration, both legal and illegal. Even Brazil, a middle-income country, is below replacement levels. At some point, he said, with current trends, the world population will decline.

India, he pointed out, is now the world's most populous country, and population growth has shifted to Southeast Asia and Africa.

Mexico and China are already middle-income countries, and India "is knocking at the door" of classification as a middle-income country.

In low-income countries, people consume mostly grains. As countries get richer, consumers are "not concerned about calories" but want more variety, especially meat and products with sugar and sweetened products.

India is an outlier because, for cultural reasons, it consumes so little meat.

"As global calorie demand becomes more centered in India, meat growth will be less of a driver than other products compared to when China grew," Zerr said. India, he noted, "has a huge culture around sweetened products."

"In a lot of places around the world sweetener consumption is going down, but in India it is rising," he added.

Today, China is a "huge market" for corn and soybeans, but "fast forward 50 years when China's population is 600 million not 1.5 billion," the Chinese could become an exporter of agricultural products.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

On a panel, three market analysts said there have been so many weather problems in so many countries that the world has become dependent on Brazil as a supplier of sugar.

India has ceased to be a sugar exporter, James Liddiard of Agrilion Commodity Advisers noted. Whether India returns to world markets depends on the size of the crop. "It needs a good monsoon," Liddiard added.

Fortunately, Brazil has had a record harvest, Vincent O'Rourke, a trader and market analyst with Czarnikow Sugar LLC, pointed out.

Thailand has had reduced sugar production, and Mexico has seen its worst sugar crop in a decade while Central America has been stable, he added.

The drop in Mexican production means that the United States is more dependent on the world market, O'Rourke said.

"Global consumption is increasing, but production is a lot less steady and is stagnating," he said.

Jeff Dobrydney, the senior vice president and head of futures and options at JSG Commodities, said the Brazilian real is the best-performing emerging market currency.

As analysts noted that commodities traders are focused on cocoa because its price is the highest in 45 years, Dobrydney said that if there is any disruption in Brazilian sugar production, sugar prices "won't go the way of cocoa" but they will rise.

What's happened in the cocoa markets "is a stark reminder of what happens when a market becomes so ill supplied," Dobrydney said.

O'Rourke counseled the sugar buyers at the meeting "to learn Portuguese. It is going to be really helpful."

U.S. Trade Ambassador Katherine Tai earlier this month at the USDA Agricultural Outlook Forum also touted some of the tariff reductions for U.S. commodities as "meaningful wins" for farmers under the Biden administration's trade strategies.

"We had some major breakthroughs with ... wait for it ... India last year, a 70% reduction of the tariff on pecans, removal of retaliatory tariffs on several products including almonds, apples, chickpeas, lentils, and walnuts," Tai said.

She added that India also made commitments for tariff reductions on frozen turkey, frozen duck as well as fresh, frozen, dried and processed blueberries and cranberries. "That is 10 commodities that have seen large tariff reductions from India in just over a year," Tai said.

SOYBEAN ANALYSIS SHOWS US AG TURNING INWARD

Beyond the analysis that India is a growing market, a separate article by four economists on the U.S., Brazil, and China soybean trade "triangle" shows that U.S. agriculture is turning inward, Scott Irwin, a professor of agricultural marketing at the University of Illinois at Urbana-Champaign, wrote last week.

"My explanation is that the U.S. crop sector is in the process of re-insulating itself from world markets," Irwin wrote.

"We did it with farm bill programs through supply control from the 1930s through the 1990s. The 1995 Freedom to Farm programs largely ended the direct supply interventions. Apparently, U.S. crop farmers prefer insulated domestic markets.

"But this time we are re-insulating through the demand side rather than the supply side. It started with the Renewable Fuel Standard (RFS) in 2005 and 2007, accelerated with the renewable diesel boom, which has priced the U.S. out of the global soybean oil market, and new low carbon fuel incentives will be the next step in the decoupling.

"The one negative demand side policy in this period was (President Donald) Trump's trade war with China, but I think it was another important data point in the movement toward insulating the domestic U.S. crop sector from the world market."

USDA Chief Economist Seth Meyer has also said in recent speeches that due to increased competition from Brazil in the export markets, the United States needs the biofuels market to absorb some of the soybeans.

FAS report looking at export opportunities in India: https://fas.usda.gov/….

Scott H. Irwin -- U.S. Agriculture Turns Inward: https://scotthirwin.com/…

DTN Ag Policy Editor Chris Clayton contributed to this article.

Jerry Hagstrom can be reached at jhagstrom@nationaljournal.com

Follow him on X, formerly known as Twitter, @hagstromreport

(c) Copyright 2024 DTN, LLC. All rights reserved.