USDA July 1 Cattle Reports

July 1 Cattle on Feed Down 2%; July 1 Cattle Inventory Down 3%

This article was originally posted at 2:08 p.m. CDT on Friday, July 21. It was last updated with additional information at 2:44 p.m. CDT on Friday, July 21.

**

OMAHA (DTN) -- All cattle and calves in the United States on July 1, 2023, totaled 95.9 million head, 3% below the 98.6 million head on July 1, 2022, USDA NASS reported in its biannual Cattle Inventory report on Friday.

All cows and heifers that have calved totaled 38.8 million head, 2% below the 39.6 million head on July 1, 2022.

Beef cows, at 29.4 million head, down 3% from a year ago. Milk cows, at 9.40 million head, are unchanged from the previous year.

All heifers 500 pounds and over on July 1, 2023, totaled 15.0 million head, 4% below the 15.6 million head on July 1, 2022. Beef replacement heifers, at 4.05 million head, down 2% from a year ago. Milk replacement heifers, at 3.65 million head, down 3% from the previous year. Other heifers, at 7.30 million head, 5% below a year earlier.

Steers 500 pounds and over on July 1, 2023, totaled 13.9 million head, down 3% from July 1, 2022.

Bulls 500 pounds and over on July 1, 2023, totaled 1.90 million head, down 5% from the previous year.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Calves under 500 pounds on July 1, 2023, totaled 26.3 million head, down 3% from a year earlier.

Cattle and calves on feed for the slaughter market in the United States for all feedlots totaled 13.1 million head on July 1, 2023, down 2% from the previous year. Cattle on feed in feedlots with capacity of 1,000 or more head accounted for 85.5% of the total cattle on feed on July 1, 2023, up slightly from previous year. The total of calves under 500 pounds and other heifers and steers over 500 pounds (outside of feedlots), at 34.4 million head, down 4% from the 35.7 million head on July 1, 2022.

CALF CROP DOWN 2%

The 2023 calf crop in the United States is expected to be 33.8 million head, down 2% from last year. Calves born during the first half of 2023 are estimated at 24.8 million head, down 2% from the first half of 2022. An additional 9.00 million calves are expected to be born during the second half of 2023.

**

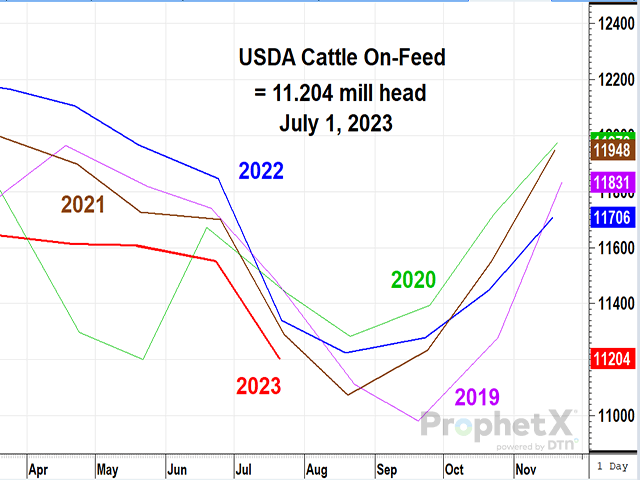

JULY 1 CATTLE ON FEED

Cattle and calves on feed for the slaughter market in the United States for feedlots with capacity of 1,000 or more head totaled 11.2 million head on July 1, 2023. The inventory was 2% below July 1, 2022. The inventory included 6.73 million steers and steer calves, down 3% from the previous year. This group accounted for 60% of the total inventory. Heifers and heifer calves accounted for 4.47 million head, unchanged from 2022.

Placements in feedlots during June totaled 1.68 million head, 3% above 2022. Net placements were 1.61 million head. During June, placements of cattle and calves weighing less than 600 pounds were 390,000 head, 600-699 pounds were 275,000 head, 700-799 pounds were 380,000 head, 800-899 pounds were 368,000 head, 900-999 pounds were 185,000 head, and 1,000 pounds and greater were 80,000 head.

Marketings of fed cattle during June totaled 1.96 million head, 5% below 2022.

Other disappearance totaled 69,000 head during June, unchanged from 2022.

DTN ANALYSIS

"Friday's Cattle on Feed report will be viewed as problematic as, once again, the placement division of the report fell outside analysts' estimates," said DTN Livestock Analyst ShayLe Stewart. "Placements were forecast to range anywhere from 96% to 100%, but came in at 1.68 million head, which is 3% more than compared to a year ago. So, what gives? Is USDA off in its findings, or were there really that many cattle placed in June? (Please note that it's also important to remember that last month's placements were up 5% compared to last year as well).

"So, again, can it be true? Have there really been that many cattle placed here recently? I'm going to remain cautious until we see what next month's Cattle on Feed report prints because the only way that this data can be sound and true is if we see a drastic fall-off in placements next month or shortly after. Feeder cattle imports from Mexico, especially, are higher than a year ago, which will bolster placement numbers. And producers have been capitalizing on the market's strength, and many have elected to market their cattle earlier than normal to ensure they receive these high prices.

"Compared to a year ago, the only weight divisions that saw greater placements were on the feeders weighing under 600 pounds, those weighing 600 to 699 pounds, those weighing 700 to 799 pounds, and those weighing 900 to 999 pounds. So, placements were fairly steady across the board in terms of weights. The states that saw an increase in placements compared to a year ago were Arizona (up 19%), California (up 14%), Idaho (up 14%), Iowa (up 3%), Kansas (up 5%), Minnesota (up 30%), Nebraska (up 5%), Oklahoma (up 39%), and Washington (up 3%). What sticks out to me about the placement data in terms of the state-by-state breakdown is that 1) states that are apt to receive more Southern border cattle saw big placement jumps, Arizona and Oklahoma, and 2) states that are still battling drought constraints saw greater placements as well.

"But, as mentioned before, the only way this can be true is if placements fall drastically next month, or shortly thereafter, as the U.S. has a smaller calf crop this year.

"Unlike the Cattle on Feed report, the midyear Cattle Inventory report should be viewed as supportive, as the U.S. beef cow herd is smaller than a year ago (down 3% compared to last year), and with beef replacement females down as well (down 2% compared to last year), it's evident that, largely, producers haven't started to build back their cow herd just yet.

"So, in conclusion, Friday's USDA cattle reports were a mixed bag for the cattle complex. It's likely that traders elect to focus on the Cattle on Feed report more than the Cattle Inventory report on Monday, as the biannual report never attracts as much attention as the January report does. Both the live cattle and feeder cattle contracts could be pressured on Monday because of the unexpected spike in placements," Stewart said.

**

DTN subscribers can view the full Cattle inventory and Cattle on Feed reports in the Livestock Archives folder under the Markets menu. The report is also available at https://www.nass.usda.gov/….

| U.S. Cattle Inventory by Class and Calf Crop -- July 1, 2023 | ||

| 2023 | Percent of | |

| (1,000 head) | previous year | |

| Cattle and calves | 95,900 | 97% |

| Cows and heifers that have calved | 38,800 | 98% |

| Beef cows | 29,400 | 97% |

| Milk cows | 9,400 | 100% |

| Heifers 500 pounds and over | 15,000 | 96% |

| For beef cow replacement | 4,050 | 98% |

| For milk cow replacement | 3,650 | 97% |

| Other heifers | 7,300 | 95% |

| Steers 500 pounds and over | 13,900 | 97% |

| Bulls 500 pounds and over | 1,900 | 95% |

| Calves under 500 pounds | 26,300 | 97% |

| Calf crop | 13,100 | 98% |

| Cattle on feed | 33,800 | 98% |

**

| USDA Actual | Average Estimate | Range | |

| On Feed July 1 | 98% | 97.6% | 97.1-98.1% |

| Placed in June | 103% | 97.8% | 96.0-100.0% |

| Marketed in June | 95% | 95.3% | 94.9-96.0% |

(c) Copyright 2023 DTN, LLC. All rights reserved.