Corn Market Rallies on Weather Fears

Corn Market Rally More Likely Weather Scare Than Structural Shift, Analysts Say

MT. JULIET, Tenn. (DTN) -- Reid Thompson's farm in McLean County, Illinois, hasn't received a measurable rain since Mother's Day. He typically doesn't mind dry weather this time of year. It gives plants time to get established and makes it easier to apply nitrogen in a timely manner.

"But this might be a little too dry. Really the only thing saving us is we've had five days of heat, not weeks of heat like we would typically see in a dry spell," he said. Unless the crop is on compacted ground, a spot where cover crops weren't terminated on time, in a conventionally tilled field or a hillside, it still looks okay. "But if we don't rain this week, it's going to be real tough."

Farmers across the Eastern Corn Belt are watching as abnormally dry and moderate drought conditions spread, fueled by an upper-atmosphere high pressure system over Canada that's deprived the Midwest of moisture. Read more on how the drought conditions developed here: https://www.dtnpf.com/….

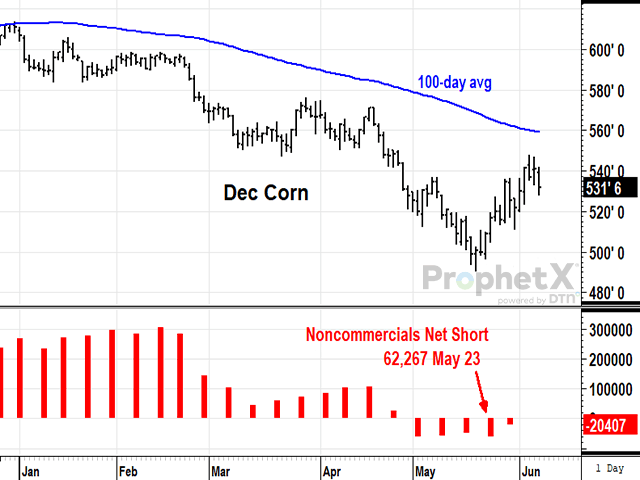

"This is the first real challenge to the bearish scenario in corn," DTN Lead Analyst Todd Hultman said. The December corn futures contract, which most closely tracks along with new-crop supply and demand fundamentals, has gained around 40 cents since May 17, when it closed below $5 for the first time since April 2021.

Whether or not this bump up in the corn market marks a shift in the long-term pattern or is just a temporary rally depends on the weather. While Thursday's Drought Monitor report is expected to show expanding and deepening drought conditions, longer-range weather forecasts show rains returning.

"The pattern really changes with the cold front coming through this weekend," DTN Ag Meteorologist John Baranick said. "We'll get some more widespread showers to move through the entire region."

After that, he expects summer weather to feature frequent disturbances that bring scattered showers and thunderstorms. The variable nature of that pattern means there will likely be areas of have and have-nots.

"Now that we've taken a step back in terms of soil moisture, it might take a little bit longer for some of these showers to hit all the spots they need to break whatever dryness or drought spell we've been in. It may not get rid of it all completely, but everyone is going to get increased chances going forward," he said.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

You can read more on the latest long-run forecast in Baranick's article, "Weather Pattern Becoming More Active, Drought Relief for Corn Belt Uncertain," at https://www.dtnpf.com/….

That's why Hultman said the recent corn market rally feels more like a weather scare than a change in trend. During the past week, the number of traders that were net short the corn market dropped from 60,000 to 20,000.

"In my mind, the easy part of the rally has been done because the guys that are short are obviously the most nervous in the market, and you would expect them to jump out first," he said. From a technical perspective, the December corn contract hasn't tested the 100-day moving average price of $5.60, an important indicator of trend.

"For me to change and take the drought situation more seriously, I would have to see a combination of some strong weather factor, like a strong ridge, and I'd like to see some serious technical break, like charging through and closing above $5.60 and being able to hold that."

Jim McCormick, co-founder of ag marketing and consulting firm AgMarket.Net, said this current market move looks like a traditional weather scare. "There's nothing that suggests this is a demand-driven rally. This is all fear that supply will be restricted."

USDA's crop forecasts still include a trendline yield, which is estimated at 181.5 bushels per acre (bpa). This dry spell has probably done enough damage to take that record production estimate off the table. While USDA will update its global supply and demand estimates on Friday, few expect it to make significant changes to production estimates. Find more on what to expect from the WASDE report here: https://www.dtnpf.com/…

McCormick said that, if farmers harvest 83.2 million acres, USDA's current estimate, with a 176 bpa estimate, 5 bpa less than currently estimated, production estimates would fall by 416 million bushels (mb).

Production cuts usually also translate into demand cuts, and there's plenty of room to slash those estimates, too, McCormick said. For the 2023-24 season, USDA sees total corn use increasing 755 mb from last year. If USDA eventually cuts that demand in half and yields drop to 176 bpa, the U.S. could still have a carryout in excess of 2 billion bushels (bb) -- significantly more than last year's 1.4 bb ending stocks estimate.

"We need to keep in mind that we can give the production outlook a pretty significant haircut and balance a lot of that out with demand reductions," said Angie Setzer, co-owner and analyst at cash-grain marketing consulting firm Consus.

She added that Brazil's safrinha (second-crop) corn will likely be able to feed global markets for the next six months. Global demand is also poor. China's likely rebuilt its inventories and is managing them more closely. Cheap wheat from Russia is competing for a share of feed rations. Until the world end user gets nervous that they may not be able to cover their demand, the return to higher U.S. ending stocks will continue to drive the markets.

Setzer is using the current rally to help her customers make sales, and in some cases guiding them to min-max cash grain contracts offered by local originators. Min-max contracts establish a minimum price but allow that price to rise a certain amount if the market moves higher.

Setzer said the psychological change from a tight market to a well-supplied one is difficult for producers. With lower prices, farmers need to produce more bushels to cover their costs and turn a profit. Production concerns are, indeed, very real in Michigan where she lives.

"To a certain extent, when the price drops, you're more likely to try to provide as much anecdotal evidence to the market that it needs to go higher," she said, explaining the outpouring of photos of curling corn leaves and drought stress on Twitter and social media. "The worries are going to be there no matter what, but are we louder about it because the price has fallen? I would say maybe, because the worst thing is if it doesn't rain, and you have low prices."

Illinois' Thompson said he's grateful for this year's crop insurance reference prices: $5.91 per bushel for corn and $13.76 for soybeans.

"Yeah, we've got risk because we don't know what we're going to grow," he said. "But on the other side, we've got a pretty large safety net going in, whereas some years we wouldn't."

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her on Twitter at @KatieD_DTN

(c) Copyright 2023 DTN, LLC. All rights reserved.