USDA Reports Review

Lower-Than-Expected Winter Wheat Production Sends KC Wheat Futures Soaring

The May USDA Crop Production and World Agricultural Supply and Demand Estimates (WASDE) reports surprised with lower-than-expected all-wheat production and ending stocks, sending KC wheat skyward. In both corn and soybeans, lower old-crop demand and lofty new-crop production estimates sent those markets in the other direction.

In another head fake, USDA chose to leave Argentine soy and corn production unchanged and well above some private estimates, adding to the bearish impact on new-crop contracts.

CORN

For the U.S. old-crop corn balance sheet, the slow pace of export sales and inspections led USDA to lower exports and raise ending stocks more than the average trade estimate assumed. With traders looking for a modest bump in 2022-23 ending stocks to 1.356 billion bushels (bb), the actual number was 1.417 bb, a direct result of a drop in exports of 75 million bushels (mb).

For the 2023-24 corn crop, 92 million planted acres were used, with a lofty 181.5-bushel-per-acre yield (bpa) and production of 15.265 bb -- far higher than the 15.098 expected and sending corn ending stocks to 2.222 bb compared to the average trade guess of 2.034 bb. Feed seed and industrial use was up 55 mb to 6.735 bb, and exports were pegged 325 mb higher at 2.16 bb. Feed and residual was raised from 5.275 bb to 5.650 bb, and corn use for ethanol was bumped up by 50 mb. Imports were expected to fall by 15 mb to just 25 mb. The season average corn price is forecast to fall by a hefty $1.80 per bushel to $4.80 per bushel.

On the global side, there were a few surprises. Of note was no change to Argentine corn production -- left at 37 million metric tons (1.46 bb), and still some 4 mmt to 5 mmt lower than some private estimates. In Brazil, the record crop was raised higher than expected, revealed at 130 mmt (5.12 bb) compared to the 125.9 mmt average estimate.

For the 2023-24 crop year, the Argentine and Brazilian corn crops are expected to be 54 mmt (2.12 bb) and 129 mmt (5.08 bb), respectively, while Ukraine production is likely to fall by 5 mmt to 22 mmt (866 mb). China's corn imports are expected to rise by 5 mmt to 23 mmt (905 mb). While world corn ending stocks for 2022-23 were called up 2 mmt to 297.4 mmt (11.7 bb), the 2023-24 ending stocks are pegged at a huge 312.9 mmt (12.3 bb) -- about 5.4 mmt higher than the average trade guess.

Prior to the reports, both July and December corn were trading down 3 to 4 cents, and at the close, July finished 4 cents higher, while December fell a nickel.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

SOYBEANS

Traders expected little change in the old-crop soybean balance sheet, and that's just what they got. Ending stocks for 2022-23 moved higher by just 5 mb to 215 mb, about as expected. It was in the 2023-24 numbers where significant changes took place. The soy crop, using the same 87.5 million planted acres, was pegged at a record-large 4.510 bb, eclipsing the old record of 4.465 bb and the average Dow Jones traders estimate of 4.484 bb. Using a yield of 52 bpa compared to 49.5 bpa last year, the ending stocks rose to a much larger-than-expected 335 mb.

For the new crop year, crush is increased by 90 mb to 2.310 bb on solid margins, but exports were slashed 40 mb to allow for the expected rebound in Argentina's soy crop, and a near record Brazilian crop. The soybean ending stocks number would be the highest in four years. The season average soybean price was dropped to just $12.10 per bushel compared to $14.20 in 2022-23. Soymeal and soybean oil prices dropped by $90 per ton and 6 cents per pound respectively.

Globally, for the old crop, Brazil's crop was raised to a record 155 mmt (5.69 bb), but, inexplicably, Argentina's crop was left at 27 mmt (992 mb), even though the Rosario and Buenos Aires exchanges have 4.5 mmt to 5.5 mmt (202 mb) less than that.

For the 2023-24 crop year, USDA pegs Argentine soy production at 48 mmt (1.76 bb) and Brazil at another new record 163 mmt (5.99 bb). These are, of course, only pipe dreams at this stage. China's soy imports and crush are both expected to rise, with imports up 2 mmt and crush rising by 4 mmt to 95 mmt (3.49 bb).

The WASDE report was overall bearish for soybeans, and prior to the report, November was trading 10 cents lower and finished down 24 cents, with spot July plunging 15 cents as well.

WHEAT

With the trade expecting the all-wheat production to come out at 1.782 bb, and up 132 mb from last year, the net result was a much lower 1.659 bb -- little change from the previous year and no doubt fueled by greater drought and freeze damage on the hard red winter crop than many had expected. The net effect was a fall in ending stocks by 11% to the lowest level in 16 years at just 556 mb. The trade had expected ending stocks in the U.S. to be little changed.

Some other minor tweaks on the 2023-24 balance sheet included 10 mb lower imports and a 15 mb reduction in seed use, but a 15 mb higher feed and residua, and a decline in exports of 50 mb to just 725 mb.

Winter wheat production was pegged at 1.13 bb and up 2% from last year, but that was 88 mb higher than what the Dow Jones estimate predicted. Hard winter wheat was pegged at 514 mb and down 3%, while soft red winter, at 406 mb figured 21% higher on favorable weather and white wheat fell 11% to 210 mb. The seasonal average price for wheat dropped 85 cents per bushel to $8.00.

On the world front, there were several changes to 2023-24 anticipated production, and world ending stocks of wheat fell modestly from 266.3 mmt to 264.3 mmt (9.71 bb). Some of the notable projections are Argentina's crop moving up to 19.5 mmt (716 mb) from 12.55 last year, Australia dropped to 29 mmt (1.06 bb) from the record 39 mmt last year, and Canadian wheat production rising to a record 37 mmt (1.36 bb) from 33.8 mmt despite concerns over a worsening drought in the Prairies. Both Russian and Ukraine wheat production is expected to fall by 10.5 mmt (386 mb) and 4.4 mmt (161 mb) from a year ago, while China and India are estimated to have crops that are 2 mmt and 6 mmt higher than last year.

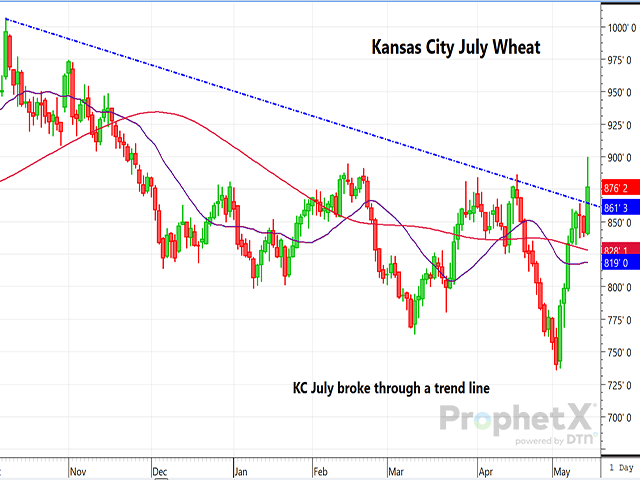

July Kansas City wheat prior to the report was up 13 cents but soared at one point to move nearly 58 cents higher before finishing with a still very strong gain of 35 1/2 cents.

FINAL THOUGHT

While the wheat losses appear to be real, as the extreme drought hurt the hard winter crop, the projections for both corn and soybeans for 2023-24 are merely educated guesses at this time. The markets are likely to return to weather and demand in the coming weeks.

Dana Mantini can be reached at dana.mantini@dtn.com

Follow him on Twitter @mantini_r

(c) Copyright 2023 DTN, LLC. All rights reserved.