DTN Early Word Livestock Comments

Market Uncertainty Will Keep Traders Guessing

Cattle: Steady Futures: Mixed Live Equiv: $211.64 +$2.22*

Hogs: Higher Futures: Higher Lean Equiv: $85.59 +$1.04**

*Based on formula estimating live cattle equivalent of gross packer revenue. (The Live Cattle Equiv. Index has been updated to depict recent changes in live cattle weights and grading percentages.)

** based on formula estimating lean hog equivalent of gross packer revenue.

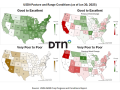

GENERAL COMMENTS:Cattle futures could not extend the strong gains of last week as the market was tempered with the idea that higher fuel prices could have an impact on high beef prices. Over the weekend, the announcement by OPEC that they will cut production sent fuel prices higher, which could have an impact on the economy and the willingness of consumers to purchase high-priced beef. Boxed beef was very strong Monday with choice up $3.02 and select up $3.46. Feeder cattle reacted to higher corn prices with nearby contracts posting triple-digit losses. However, feeder cattle should find support as a major winter storm will be moving through some cattle areas again this week, threatening some of the calf crop.

Hogs showed mixed prices with nearby contracts lower and deferred contracts higher. Nearby contracts reacted to lower cash and cutouts on Friday while deferred contracts maintain some optimism demand may improve due to high beef prices and impending higher fuel prices shifting consumers to lower cost meat. Futures contracts had about a $2.00 price range Monday with contracts spending time on both sides of unchanged. The National Direct Afternoon Hog report showed cash up $0.76 along with cutouts gaining $1.04. This may have an influence on Tuesday's trading as cash generally is not stronger on the first day of the week.

| BULL SIDE | BEAR SIDE | ||

| 1) | Strong boxed beef Monday should provide some support to trading Tuesday as demand remains strong. | 1) | Already high beef prices may impact consumer buying interest as fuel prices this summer look to be higher due to the OPEC cut that will begin in May. |

| 2) | Packers may need to at least pay steady money this week to maintain active slaughter. This should keep futures supported and the uptrend intact. | 2) | A chart gap remains in the June live cattle contract substantially lower than where the market currently is. This gap may be closed sometime before the end of the contract. |

| 3) | There seems to be renewed hope hog prices will improve as time progresses. Outside financial influences may turn more consumers to purchase pork instead of high-priced beef. | 3) | The April hog contract remains close to the index as it has less than two weeks to trade. Price movement will be limited. |

| 4) | Second-quarter pork production is expected to be lower than first quarter, which may support prices if packers maintain current slaughter pace. | 4) | Funds continue to hold record short futures positions with no concern over the market being oversold. |

**

For our next livestock update, please visit our Midday Livestock comments between 11 a.m. and noon CST. Also, stay tuned to our Quick Takes throughout the day for periodic updates on the futures markets.

Robin Schmahl can be reached at rschmahl@agdairy.com

(c) Copyright 2023 DTN, LLC. All rights reserved.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]