Todd's Take

Following a Sharp Decline, May Corn Prices Defy Bearish Week

Wednesday, March 15, is often referred to as the ides of March, remembered as a time when the Roman emperor Julius Caesar was stabbed to death by Roman senators. We haven't seen blood spill yet, but investors felt a series of betrayals after witnessing three bank closures since Thursday, March 9. Two of the three were mandated by authorities and two of the closures were related to exposure to cryptocurrency businesses.

Sudden losses at Silicon Valley Bank, however, prompted the second largest bank failure in U.S. history and were made worse by the string of interest rate increases over the past year. As the Fed is expected to keep raising rates, it is making many wonder if there will be more casualties ahead. Markets were further shocked to see shares of the European mega bank, Credit Suisse, trade 30% lower at one point Wednesday, before being put on life support with a $54 billion loan from the Swiss National Bank.

With the financial meltdown of 2008 still fresh in the minds of many, trader anxieties spiked higher this week. From Wednesday, March 8, to Wednesday, March 15, KRE, an exchange traded fund of regional bank stocks plummeted 23%. Spot crude oil broke below $70 per barrel Wednesday, its lowest close in over a year, and the yield on 10-year T-notes briefly traded below 3.40% Thursday with confusion as to what the Federal Reserve will do from here.

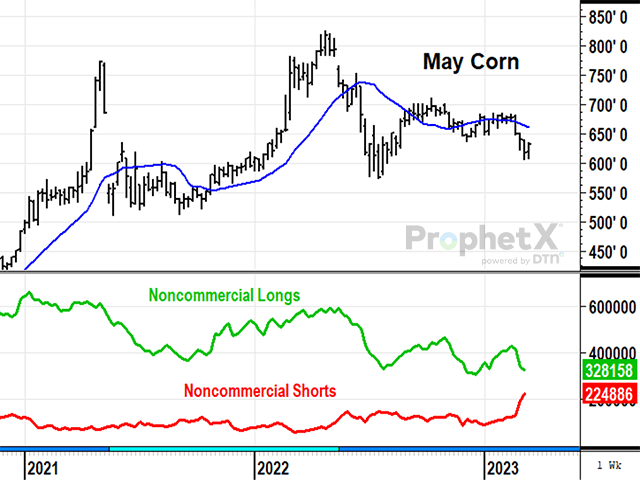

As of Thursday's close, March 16, grain and oilseed prices have actually held up fairly well. In the Todd's Take originally posted on March 13 (available here https://www.dtnpf.com/…), I mentioned corn, soybeans and live cattle had the most exposure to outside market fears because that was where noncommercials had the largest net-long positions.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The trader data I had Monday was as of Feb. 21, due to technical problems at the CFTC. Thanks to two weeks' worth of updates this week, we can now see that net longs in corn dropped from 283,023 on Feb. 21 to 103,272 by March 7, a much lower exposure before bank problems erupted. I would have assumed the bulk of selling came from longs bailing out of corn as May prices dropped 46 cents over the two-week period, but it was surprising to see over half the reduction in net longs was from specs increasing their short positions in corn by 93,407 contracts.

Had there not been a big increase in specs going short corn, May corn prices might not have responded to this week's corn sales to China by as much as they did. Three consecutive days of old-crop corn sales to China, totaling a little more than 75 million bushels (mb), likely pressured corn's new shorts and helped May corn prices climb over 24 cents from Tuesday to Thursday -- a welcome boost in a week when traders were terrified by outside events. (Note: a fourth sale to China of 7.5 mb of old-crop corn was announced Friday, March 17, as this column was being posted.)

Just how much more U.S. corn will China want is the question of the moment. USDA's persistence in trying to tell us that China has 8.16 billion bushels (bb) of surplus corn remains an embarrassment to the agency and I wish they would correct the situation. USDA's other estimates that China's corn demand will outpace production in 2022-23 by 779 million bushels (mb) is more credible and offers some guidance to China's needs. The best clue continues to be China's corn price and, so far, that hasn't changed much. May corn on the Dalian exchange ended at the U.S. equivalent of $10.44 per bushel Friday, March 17, still expensive enough to suggest more purchases ahead.

With USDA estimating 1.34 bb of old-crop ending corn stocks, old-crop prices may be content to finish out their days in a trading range above $6.00, helped by China's new interest in corn. New-crop corn prices, on the other hand, remain weighed down by expectations for larger crops from Brazil and later from the U.S. this fall.

There is also a good chance commodity markets will be pestered by more negative headlines this year as the Fed continues to try to bring down prices with higher interest rates, a scenario that may expose more cash flow problems along the way. I hope everyone got their crop insurance secured this year. Already in March, new-crop prices are facing more bearish risk than usual in 2023.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.