Inside the Market

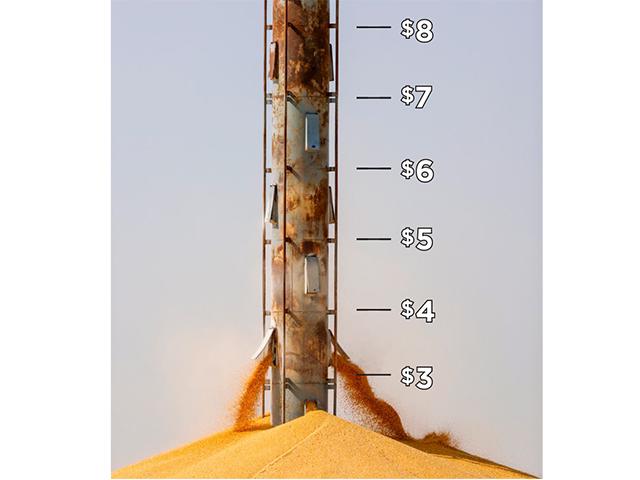

Can Corn Hold Above $6 in 2022?

According to USDA, the U.S. harvested its second-largest corn crop on record in 2021, coming in at an impressive 15.115 billion bushels (bb) on a record national yield of 177 bushels per acre (bpa). For a year that saw serious drought in the Dakotas and Minnesota, it was an achievement producers should be proud of.

Typically, a big harvest like that would take corn prices down and hold them down for a while, but not this crop. March corn fell to an early harvest low of $5.06 3/4 on Sept. 10 and chopped higher from that point on.

On Oct. 27, March corn posted a new two-month high, largely fueled by a rally in ethanol prices that turned ethanol plants into aggressive buyers of corn. By Thanksgiving, USDA reported the value of ethanol and distillers grains in Iowa were worth $5.25 more than the bushel of corn it took to produce them. Corn bids firmed throughout the Midwest, and a few days before Christmas, March corn closed above $6 for the first time in more than six months.

Also in late December, news of dry crop conditions in Argentina and southern Brazil added bullish excitement to corn prices, but the weather threat has not been enough to keep March corn above $6 consistently. Even after USDA's Jan. 12 WASDE report lowered its Brazil corn-crop estimate from 118 million metric tons (mmt) to 115 mmt (4.23 bb) and Argentina's crop estimate from 54.5 mmt to 54 mmt (1.98 bb), March corn still couldn't stay above $6.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Traditionally, late May is the time to expect corn's seasonal high, but of course, there is no guarantee when the high will come. For those hanging on to old-crop corn, I'd like to point out current prices are among the highest levels in eight years, a very attractive bird in the hand.

Corn's best chances for going higher in early 2022 hinge on the dry weather threat in southern Brazil and whether it extends to Brazil's larger second corn crop. That could very well happen, but there are also bearish risks in early 2022.

Since Thanksgiving, the price of Chicago ethanol dropped from $3.755 per gallon to $2.15 a gallon in mid-January, a steep drop that has slowed the pace of ethanol production and pushed ethanol inventory to its highest level since February 2021. The sudden slowdown in ethanol demand is likely seasonal, as demand for gasoline remains strong, but it does affect the demand for corn nonetheless.

On Jan. 12, USDA lowered its corn export estimate by 75 million bushels (mb) to 2.425 bb. It may seem odd for USDA to cut the corn export estimate in the same report USDA also lowered South American crop estimates, but there seems to be concern that if China does buy more corn in 2021-22, the corn will come from Ukraine.

Fundamentally speaking, USDA's 10% ending stocks-to-use ratio estimated in the January WASDE report translates to an expected cash corn price of $5.10 a bushel, well below current levels. Further drought in South America is corn's best chance for trading above $6 in early 2022, but it's not certain. Without that bullish factor, current prices are looking quite attractive.

**

-- Read Todd's blog at about.dtnpf.com/markets

-- You may email Todd at todd.hultman@dtn.com, or call 402-255-8489.

[PF_0222]

(c) Copyright 2022 DTN, LLC. All rights reserved.