2021 Cotton Outlook

Marketing - 2021 Cotton Outlook

Cotton prices and demand are "remarkably" strong despite the ongoing worldwide COVID-19 pandemic and financial crisis, economic and policy experts say during the recent Beltwide Cotton Conferences.

March cotton futures surpassed 85 cents per pound in mid-January, up more than 30 cents in the past 10 months. January USDA projections indicate U.S. cotton use and exports will eclipse production during the 2020-21 marketing year for the first time in three years, which is a good sign for prices.

But, is the upward cotton price trend, as well as the demand, sustainable?

That depends on a number of factors, explains Jody Campiche, vice president of economics and policy analysis with the National Cotton Council of America, which hosted the virtual event, and Stephen MacDonald, an economist and fibers analyst with the USDA World Agricultural Outlook Board. Factors include how fast the pandemic subsides as COVID-19 vaccines are administered, when people can get back to their normal routines and spending habits, and future government intervention, among other things.

"Current cotton prices are not generally reflective of the global balance sheet and large stocks outside of China," says Campiche, who provided the U.S. cotton market outlook.

However, she says the price surge is supported by

the following:

> lower production and stocks in the U.S.

> low supply-chain inventories

> increased purchases from China

> speculative money flow

> a weaker U.S. dollar

> higher grain and oilseeds prices

> post-COVID demand.

"I think we're seeing a lot of influences on prices that are outside of typical supply and demand fundamentals," Campiche adds.

It's possible but unclear if cotton growers will enjoy profitable prices, which they were as of mid-February, for the year. Texas A&M University reports the cash price farmers receive is generally 4 to 8 cents less than the futures market. The university estimates the break-even price for farmers is generally 60 to 70 cents per pound, depending on individual costs and yield.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

MacDonald, who provided the international outlook, asserts the demand for goods, including cotton products, was stronger than expected worldwide during the pandemic, especially the latter half of 2020. China's purchases of U.S. cotton increased last year partly because of the phase-one trade deal between the two countries.

"I think it comes back to the fact savings went up, and people have been spending a lot of money on goods, and that contributed to the remarkably higher price," he says.

But, in today's world, when COVID-19 and international politics can quickly affect trade and commodity prices, nothing is for certain.

"I personally expect [cotton] consumption in 2021 to grow," MacDonald says. "[But] We have a lot of questions about how or what extent the economy will look like when people are able and willing to consume services again like they used to."

Bart Fischer, economist and co-director of the Agricultural and Food Policy Center at Texas A&M University, says the outlook for 2021 is "vastly improved" over earlier estimates.

"I want to be very clear that there's still a lot of risk ahead," he says.

FARMER PERSPECTIVE

Lee Gibson and his son, Braden, are contemplating what to plant on their 3,000-acre farm, near Dumas, Texas. Cotton, corn, soybeans, milo and wheat are all possibilities -- and all are profitable, Gibson says. Most of the crops grown by Gibson Farms are sold to local dairy farms and feedlots, except cotton.

Two years ago, the Gibsons planted 2,500 acres of cotton. This year, they're leaning toward 500 acres, the same as 2020, as long as prices remain profitable.

"I think cotton prices could get to 85 cents per pound with China demand and the drought," says Gibson, a self-described cotton fanatic. "But, the market is so volatile. If we grow cotton, we would market early to manage risk."

If the Gibsons grow cotton, they will have to irrigate before they plant. The soil-moisture profile as of mid-January is not adequate to get plants off to a good start. If the drought worsens or prices fall, cotton could be scratched, he says.

"I'm positive about cotton prices, but not sure about growing it," Gibson adds.

COTTON FUNDAMENTALS

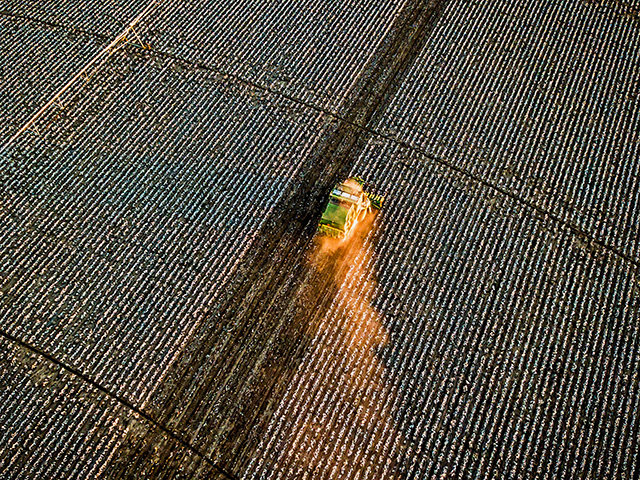

The USDA January World Agricultural Supply and Demand Estimates report estimated U.S. 2020 cotton production at 14.95 million 480-pound bales, 1 million bales less than the previous month. More than 12 million acres of cotton were planted in 2020, according to the report, but only 8.7 million were harvested due to drought, hurricane damage and other issues.

Domestic cotton use and exports for the 2020-21 marketing year are estimated at 2.4 million bales and 15.25 million bales, respectively, the report indicates. China is the top buyer of U.S. cotton during the current marketing year, at 4.4 million bales, with 2.6 million bales shipped as of early January. Based on China's imports of U.S. cotton during the last 10 years, the country is expected to import between 4 to 6 million bales from the U.S. in 2020 and 2021 under the phase-one trade agreement, Campiche concludes.

"Export [numbers] are definitely good news for U.S. cotton, because there were significant issues with COVID shutdowns," she continues.

MacDonald adds China's robust purchases are good, but it "adds uncertainty" to future demand and prices. Namely, the tenuous trade and political relationship between the two countries. Investor interest also contributed to the price surge, which could change, experts believe.

USDA estimates U.S. cotton ending stocks for the current marketing year at 4.6 million bales, the lowest number in three years, according to the report. World cotton ending stocks are projected at 96.3 million bales for the 2020-21 marketing year, a slight reduction from the December estimate as total use is expected to exceed production by about 3 million bales.

COVID-19 disruptions dropped world cotton consumption to 102.6 million bales during the 2019-20 marketing year, the report says. World mill use is expected to rebound to nearly 116 million bales during the current marketing year, which is still 4 million bales less than 2018-19.

"What we're seeing is a faster recovery than initially expected, but we're not back to where we were," Campiche explains. "There's been a significant reduction in U.S. ending stocks for the 2020-21 marketing year compared to earlier expectations. Strong export sales could result in an even larger reduction in the U.S. stock level."

DTN COTTON OUTLOOK

DTN Lead Analyst Todd Hultman says cotton prices have come a long way from the spring of 2020, when coronavirus concerns ignited a selling panic throughout commodity markets and sent spot cotton prices below 50 cents a pound for the first time since 2009.

Drought cut 2020 U.S. cotton production to its lowest in five years, and exports stayed firm, largely thanks to the resilience of Asia's economies. Hultman adds that helped push prices above 80 cents per pound.

"Growers have reason to be a little more optimistic planting cotton this spring, but don't expect cotton to take acres away from corn, soybeans or wheat, as grain and oilseed prices are enticing growers with their best prices in several years," he asserts. "I don't expect cotton acres to expand more than 1 million acres in 2021, and extreme to exceptional drought remains well-entrenched in West Texas."

USDA estimates the average farm price at 68 cents per pound in 2020-21. Hultman says 70 cents seems more likely by the time the season ends on July 31, as higher prices are likely to remain well-supported through the middle of the year.

"Demand for cotton exports held up remarkably well in 2020, and for now, I expect that firm demand to continue," Hultman explains. "But, with coronavirus still a serious threat, it is difficult to estimate the economic climate in 2021."

He predicts a sideways trading range between 70 to 80 cents per pound seems likely for spot cotton prices in 2021, with weather offering the most potential to disrupt that scenario.

**

FOR MORE INFORMATION:

> National Cotton Council of America: www.cotton.org

> Follow Matthew Wilde on Twitter @progressivwilde.

[PF_0321]

(c) Copyright 2021 DTN, LLC. All rights reserved.