USDA June 1 Cattle on Feed Report

Feedlot Placements Exceed Pre-Report Estimates in USDA June 1 Cattle on Feed Report

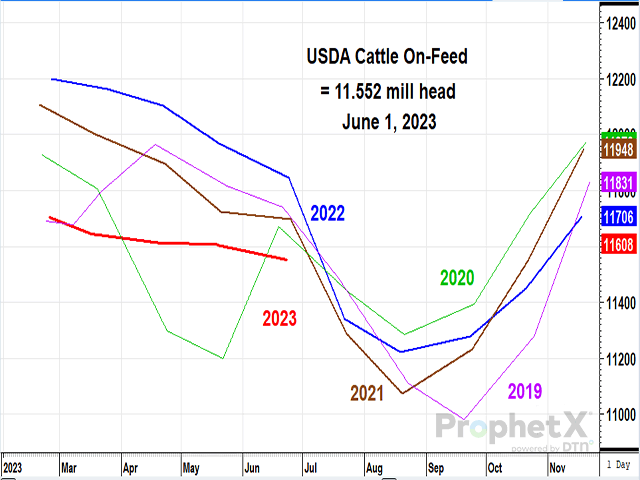

OMAHA (DTN) -- Cattle and calves on feed for the slaughter market in the United States for feedlots with capacity of 1,000 or more head totaled 11.6 million head on June 1, 2023. The inventory was 3% below June 1, 2022, USDA NASS reported on Friday.

Placements in feedlots during May totaled 1.96 million head, 5% above 2022. Net placements were 1.88 million head. During May, placements of cattle and calves weighing less than 600 pounds were 380,000 head, 600-699 pounds were 295,000 head, 700-799 pounds were 480,000 head, 800-899 pounds were 505,000 head, 900-999 pounds were 215,000 head, and 1,000 pounds and greater were 80,000 head.

Marketings of fed cattle during May totaled 1.95 million head, 2% above 2022.

Other disappearance totaled 74,000 head during May, 3% below 2022.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

DTN ANALYSIS

"Friday's USDA Cattle on Feed Report line by line laid out what the market expected: fewer cattle on feed than a year ago, higher placements than a year ago, and slightly fewer marketings," said DTN Livestock Analyst ShayLe Stewart. "But where some will say the report got 'ugly' is in the placement data, as analysts forecast placements to range anywhere from 100.1% to 103.7% of a year ago, and Friday's placement data came out at 1.96 million head, or 5% above 2022.

"That leads us to the biggest question of all: How does this data affect the cattle market? And will it affect both the live cattle and feeder cattle markets in the nearby and long-term markets?

"Unfortunately for the nearby market, traders will likely view Friday's report as bearish, problematic or hindering for the market, as the report's 'actual' data fell outside the range of analysts' predictions. But I ask you to consider the following before you jump on that bandwagon. First, before the unveiling of Friday's report, we knew that net imports of feeder cattle from Mexico and Canada were up 31% from last year and that sale barn receipts for May were up 29%, so higher placements shouldn't come as a shock to anyone. Secondly, sale barn receipts have been drastically lighter in June than they were in May, as some producers elected to market their calves early to capitalize on the market's strength when it was available to them. That could mean that by next month at this time, we will be looking at a new Cattle on Feed report showing lighter placements. The point is this: The market is going to ebb and flow, and placements are going to ebb and flow with the various changes in the cattle cycle and as producers make marketing decisions based on what prices are available to them.

"Friday's COF report shared that compared to a year ago, the following states all saw greater year-over-year placements: California (up 16%), Colorado (up 6%), Idaho (up 11%), Kansas (up 3%), Nebraska (up 14%) and Oklahoma (up 6%). And when looking at the industry's placements on a weight basis, the only weight category that didn't see an increase in placements compared to a year ago was feeders weighing 900 to 999 pounds. All other weight divisions saw greater placements than a year ago.

"Surprisingly, the market seemed to look beyond Friday's Cattle on Feed report and the fact that actual placements data fell outside analyst's range and allowed both the live cattle and feeder cattle contracts to close mixed by Monday's end. At this point in time, traders and cattlemen alike seem to find more merit in the market's fundamentals and believe that the bull run of 2023 has more in store for the market.

"When you observe Friday's data with a long-term perspective, I don't believe that this latest report's findings will derail the market's desire to continue to rally through 2023. Time and time again, the biggest placement months of the year are May, September and October. And when prices are as good as they are, you're darn right that producers are going to sell. And let us not forget that when you look at the market, the big picture, Friday's report also showed that total on-feed numbers totaled 11.552 million head, which is the lowest in six years. And when beef demand is as strong as it is, feedlots are going to need to have more cattle coming down the pike to keep up with demand," Stewart said.

For more analysis on the market's reaction to the June 1 Cattle on Feed report, see "Sort & Cull: Cattlemen, Traders Prioritize Fundamentals Over Recent Cattle on Feed Report" by ShayLe Stewart here: https://www.dtnpf.com/….

**

DTN subscribers can view the full Cattle on Feed reports in the Livestock Archives folder under the Markets menu. The report is also available at https://www.nass.usda.gov/….

| USDA Actual | Average Estimate | Range | |

| On Feed June 1 | 97% | 96.8% | 96.4-96.9% |

| Placed in May | 105% | 102.2% | 100.1-103.7% |

| Marketed in May | 102% | 101.6% | 101.1-102.0% |

(c) Copyright 2023 DTN, LLC. All rights reserved.