DTN Fertilizer Outlook

Wholesale Fertilizer Prices Fall Throughout June

Summer in the fertilizer industry is typically a waiting game for buyers who eagerly await potential discounts from suppliers on ammonia, UAN, potash and phosphates. The ammonia market in June waited no longer, as summer-fill offers were announced in mid-June from Koch and CF at levels approximately $500 per short ton (t) below last year's programs, and more than $100/t below ammonia offers in early June.

Phosphates buyers stepped in for some volume as well despite no formal program announcements. Meanwhile, nitrogen buyers for other products remained on the sidelines last month. Overall, fertilizer prices fell throughout the month with peak spring demand for fertilizers now having passed for the year.

The following is a recap of fertilizer price trends and market developments for the month of June.

AMMONIA

Domestic: The big news in the U.S. ammonia market last month was summer-fill offers announced in mid-June from Koch and CF at levels approximately $500 per short ton (t) below last year's programs, and more than $100/t below ammonia offers in early June.

Initial announcements came from Koch and were quickly followed by offers from CF. The first round of third-quarter shipping offers were set at $260/t ex-works (price a buyer of a shipped product pays for the goods when they are delivered to a specified location) from eastern Oklahoma ammonia plants, $345/t free-on-board Nebraska (FOB -- or sales price with any additional transport costs paid by the buyer), $300-$325 FOB Kansas, $350 FOB Iowa, $360 FOB Illinois, and $365 FOB Indiana.

Oklahoma plant offers would rise to $280-$300/t ex-works in the days following. Buyers had a positive reaction to the prices, and sellers noted good volumes moved during the program.

For comparison to initial summer offers in 2022, announcements came during the first days of July with list prices including $805-$825/t ex-works in eastern Oklahoma, $850/t CFR Minnesota, $900/t CFR Iowa, and $825/t FOB Nebraska.

Prices settled at these levels for the rest of the month as the market entered its slower summer period. Alongside a lower Tampa price for July, we expect U.S. ammonia prices to remain stable until buyers return for any remaining fall needs ahead of post-harvest applications.

International: The global ammonia market continued to see prices correcting lower in June.

Yara and Mosaic settled at $285 per metric ton (mt) cost-and-freight (CFR -- sales price with freight costs to buyer included) Tampa for July deliveries. The price, down $55/mt on the $340/mt CFR the parties previously agreed for June, is the lowest monthly contract settlement at Tampa since January 2021 and the ninth-consecutive monthly decrease at Tampa.

The lower settlement was attributed to poor seasonal demand for ammonia in the United States, and it was also heard that prior to negotiations, prices roughly equivalent to the level agreed by Yara and Mosaic were easily attainable at Tampa.

Ammonia prices in northwest Europe continued to decline in June to $330-$360/mt CFR, duty paid, down from $380/mt CFR at the end of May. The continent continues to be a swing producer due to volatile natural gas costs as well as fewer volumes available from Russia and Eastern Europe.

Values in the Black Sea declined similarly on a nominal basis considering deliveries from the region are still throttled by armed conflict. End-of-June prices reached $270-$275/mt FOB, down $20 from $295-$305/mt FOB in May.

Our outlook on global ammonia prices as a result of June's developments was soft in Europe and the Americas but stable to firm in the east.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

UREA

Domestic: U.S. urea barge trading in the New Orleans (NOLA) market thinned out following the lackluster market response to the June India tender. U.S. buyers also turned their focus more generally onto the August and September trading period rather than the month ahead with prompt demand on the decline.

The Fertecon NOLA urea assessment fell to $285-$317/t FOB at the end of June, lower on average from the trade range of $270-$435/t FOB in May with much of the prompt spring demand having been filled already. Available volumes at NOLA became scarcer in June, however, and prices continued to see some support as buyers with immediate needs were still required to pay a premium.

River terminal urea prices fell similarly in June $420-$475/t FOB, down from $480-$500/t FOB in the prior month at major hub markets including St. Louis, Cincinnati, and Tulsa. The same fundamentals that supported NOLA barge prices were also at play here, capping potentially sharper losses following the peak spring demand period.

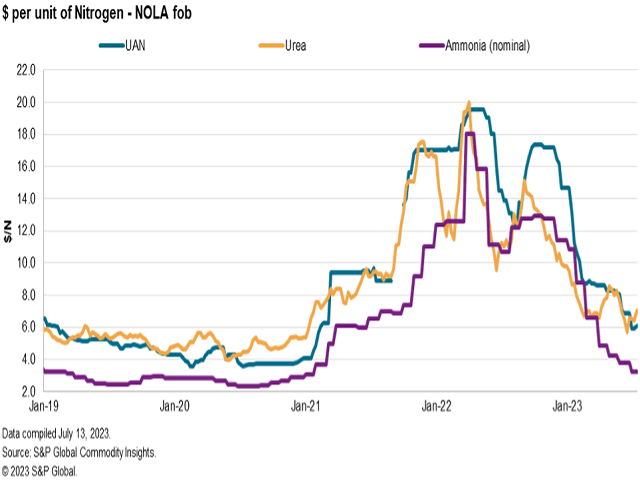

With the spring now passed, buyers will begin looking ahead toward any fall needs as well as how much supply the U.S. can expect for the rest of the year. Nitrogen prices across the fertilizer complex seem poised to fall lower later in 2023, following prices near all-time highs in 2022 and the following softer trend since then.

International: Global urea market prices were overall stronger in June compared to the month prior following India's June purchase tender, which took a less-than-expected total of 560,000 mt urea. The impact of the tender was best described as lukewarm, with fewer-than-expected volumes suggesting sellers were not as desperate as expected, most notably China.

Landed sales from Egypt to its export markets rose to $340-$350/mt FOB in June, approximately $20/mt higher from end-of-May pricing at $320-$330/mt FOB. Both the Middle East and Baltic factored heavily in the India tender and were understood to be fairly comfortable for July shipments.

Prices in Brazil didn't rise to quite the same effect without much prompt demand seen last month, with prices wider but falling slightly to $290-$315/mt CFR compared to our last assessment of May from $300-$310/mt CFR. Buyers in the country mostly maintained their hand-to-mouth strategy of waiting for prices to fall while securing only short-term needs.

Extra supply could return later in July, with Chinese exports and Southeast Asian production coming back online. Absent an Indian tender, sellers will look to Brazil for demand given European summer purchasing needs have been met.

UREA AMMONIUM NITRATE (UAN)

Buying activity in the UAN market slowed significantly in June ahead of hotly anticipated summer-fill announcements, which would come in July.

NOLA UAN 32% barges were assessed lower at the end of June at $180-$220/t FOB, down from higher-end May price levels of $255-$260/t FOB. The above-mentioned slowdown in trading contributed to the price decreases, with sellers taking lower and lower bids to offload tons ahead of the big sales programs.

River terminal offers fell as well but to a lesser extent as, per usual, NOLA barges remained a less-popular option for buyers with immediate needs who mostly opted to deal at the terminal level and cut down shipping times. At the end of June, UAN terminal prices fell into a range of $240-$260/t FOB, with the high end brought up by the Cincinnati market and low-end prices reported in St. Louis.

Eastern Oklahoma area nitrogen plants were offering volume at $240/t ex-works, down from $285/t in the prior month of May.

The UAN market is expected to remain slow and steady ahead of any further summer-fill program announcements later in the summer. July fill levels at a $195/t FOB NOLA equivalent were toward the higher end of market expectations, according to participants, leaving the opportunity for sharper discounts or at least further third-quarter offers later this year.

PHOSPHATES

Domestic: Phosphate prices declined through June following the completion of preplant applications, the high point of DAP and MAP demand in the first half of the year, as buying declined overall. Some summer-fill buying emerged during the month, however, as fears over a lack of supply lent some credence to the potential for higher phosphate prices later in 2023.

NOLA DAP barge prices declined from the wide range of $515-$646/t FOB at the end of May to $445-$457/t FOB in June. The Fertecon MAP barge assessment, meanwhile, fell from $499-$625/t FOB in May to $475-$480/t FOB toward the end of June.

Depleted supplies in the U.S. Gulf from the spring season seemed to be a key factor supporting prices in the trading market, along with fewer imports heading into the season compared to early 2022.

River terminal phosphate offers declined from $625/t FOB in May for both DAP and MAP to $520-$550 FOB MAP last month, while DAP prices were reported lower still at $495-$530/t FOB in late June.

The price outlook in the short term for U.S. phosphates is weaker with little demand at the moment, but a thin import lineup for the summer so far may forecast higher prices in fall if demand exceeds available supply. Current prices versus the rest of the globe indicate that more sales from overseas should be booked shortly.

International: Prices in the U.S. NOLA barge market increased in the second half of June, pulling DAP from Jordan and elsewhere. In the rest of the world, however, June saw generally lower prices on weaker demand from the largest importers outside of the U.S.

MAP prices in Brazil fell lower in June after a strong buying period in May, bringing month-end levels to $430-$440/mt CFR -- lower from $480-$490/mt CFR in May. Following stronger sales into Latin America, expectations were that $450/mt CFR and above was set to be achieved on a future round of MAP sales in Brazil.

More robust demand in the west helped offset to some extent the surplus of supply in the phosphate market east of the Suez Canal.

The Indian DAP market, for example, was relatively quiet with stocks ample to meet upcoming kharif (autumn) season demand. India DAP at the end of June was assessed lower at $455/mt CFR, down from $495-$500/mt CFR in May.

Our price outlook for global phosphate prices in the short term is weak in the east but stabilizing and firming in the west.

POTASH

No potash summer-fill programs were announced in June, which left buyers mostly absent from the market last month while awaiting any potentially sharper deals for bulk buying.

NOLA potash barges fell to a flat $390/t FOB, down from the end-of-May range of $390-$400/t FOB during a slower month in the potash barge market. Little changed in June following a softer to stable period in late May after the pre-planting demand rush concluded.

Mississippi River terminal offers fell to the $420-$450/t FOB range, down from $420-$500/t in the previous monthly report, as demand remains limited and offer levels went somewhat untested in June.

Imports have remained slower in 2023 as well with potash exports from Belarus still throttled by sanctions and port access. We expect U.S. potash prices could strengthen later this year as a result of less available supply, depending on how Canadian potash export flows shape up over the coming months.

On June 6, Canpotex announced reaching an agreement with China's potash-buying committee for standard grade potash shipments through 2023 at a price of $307/mt CFR. This news surprised the market, as speculation following a major European fertilizer conference in May believed that a new Chinese contract would not be settled until September the earliest.

**

Editor's Note: This information was supplied courtesy of Fertecon, S&P Global Commodity Insights.

(c) Copyright 2023 DTN, LLC. All rights reserved.