DTN Fertilizer Outlook

US Wholesale Anhydrous Ammonia Prices Fall in April Despite Strong Preplant Demand

April proved to be a strong month for preplant fertilizer demand -- an adjustment the fertilizer market welcomed wholeheartedly after a disappointing show in 2022 due to a combination of poor weather and high prices. Anhydrous ammonia prices -- perhaps against expectations -- fell, however, as a long-overdue price correction coincided with the spring preplant period, which saw offers nearly halved from late 2022. Urea saw an early season bump in pricing, while the UAN market remained somewhat dormant ahead of top-dress and sidedress applications.

The following is a recap of fertilizer price trends and market developments for April:

AMMONIA

Domestic: Despite increasing spot demand for anhydrous ammonia in April, price levels fell last month on account of a weaker global market putting pressure on prices. This was at odds, however, with the high amount of stocks in the U.S., which had been purchased above $1,000 per short ton (t) free-on-board (FOB -- or sale cost per ton without transportation costs included) in late 2022, which led sellers to fight for higher values and limit their losses.

Ammonia in the Corn Belt was last reported from $750-$840/t FOB at the beginning of April and end-of-March period. Following the lower Tampa settlement set for May, prices at the end of last month were heard at $250/t lower in the $500-$550/t FOB range.

Offers fell to a lesser degree from eastern Oklahoma area ammonia producers compared to the Midwest. This was due to the ex-works market having fallen lower earlier in the year due to building length on supplies, reaching $475-$500/t FOB in April compared to the $500-$525 range at the end of March. Ex works is a shipping arrangement in international trade where a seller makes goods available to a buyer, who then pays for transport costs.

U.S. ammonia prices are expected to continue declining once the spring rush for product is over, following alongside the global market. While logistics remain constrained as usual via trucking routes, the U.S. entered the spring season with a considerable amount of length in the market, preventing the usual price hikes one might expect during the period.

International: Further decreases to production costs in the European ammonia market continued to put pressure on global ammonia prices in April, following the trend over the past year with EU countries as the world's swing producers while Russian ammonia shipments remained constrained.

Yara and Mosaic settled at $380 per metric ton (mt) cost-and-freight (CFR -- or sales cost per ton with delivery costs included) Tampa for May deliveries. This is down $55/mt on the $435/mt CFR Tampa agreed by the parties for April deliveries. It is also the lowest settlement at Tampa since February 2021.

Black Sea ammonia pricing continues to be quoted on a nominal basis given the ongoing conflict in Ukraine complicating shipments from the region. But the pressure in the world market still brought estimated values lower regardless. Price ideas fell in April to $300-$310 FOB from $380-$400 in March.

Meanwhile, in Europe, delivered prices on ammonia fell to $390-$430/mt CFR by the end of April, down from $400-$460 at the beginning of the month, on account of the falling natural gas prices noted above.

The global ammonia market was quiet elsewhere in April, including in the Far East. In the short term, we are expecting world ammonia pricing to continue falling into the summer across both hemispheres as production costs decline in Europe. Another decrease is expected in the Tampa ammonia price for next month as well, but by a smaller, two-digit increment.

UREA

Domestic: Urea barges at the trading hub in New Orleans, Louisiana, (NOLA) were assessed $340-$450/t FOB at the end of April, up sharply from our last price assessment in March of $290-$315, as tighter supply and increasing domestic demand during the spring rush drove prices for April well above the $400 mark.

The large spread in the range was due to urea available for April shipping as fetching a much higher price versus May deliveries toward the end of last month, which made up the low end of the latter prices. May barges sold at $340/t FOB in the last week of April, while near-month shipping barges traded as high as $450 on prompt as well as loaded barges. Upriver barges traded another $5 above this rate at a $455/t FOB NOLA equivalent.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Several logistical problems brought on by major flooding on the Upper Mississippi River severely affected northbound barge traffic for fertilizers in April, which also led to delays for stevedoring operations in NOLA once the floodwaters collected in the U.S. Gulf, further increasing delivery times for fertilizers and causing higher prices at affected areas.

Minnesota river terminal prices reached $500, $60 higher week-over-week as the region kicked off its planting season and much higher from the $370-$410/t FOB range at major river terminals at the end of March. Supplies were also constrained from urea plants in the north, forcing distributors to rely on rail cars in similarly short supply to fulfill orders, as well as costly long-haul trucking.

Demand is expected to persist in the short term but may see some pressure toward the end of May as the world's excess tonnage is sold to the U.S.

International: Global urea markets pushed slightly higher in limited trading at the end of April amid still lackluster demand from Brazil and India, two of the world's largest urea importers. Urea prices in the Southeast Asia region were supported by the loss of production from Petronas' urea plant in Sipitang, which has been out of action already for two weeks due to a gas leak.

Elsewhere, major exporter Egypt saw sales at the end of April at $360/mt FOB, up from $335-$345 in March with the U.S. market having saved the day last month with the rally in NOLA urea as the sole light of demand in absence of Brazil and India.

Brazilian urea prices were also higher, ending last month at $330-$350/mt CFR compared to $310-$315 at the end of the first quarter. Farmers here seemed in no rush to purchase urea yet, although demand is expected to resurface eventually, and higher offer levels from the Middle East lifted sticker prices in April.

As mentioned above, the global urea market was supported with the burst of sales at NOLA and sporadic sales elsewhere, but without fresh demand from key markets such as India and Brazil in the second quarter, these recent gains in FOB levels could be quickly eroded.

UREA AMMONIUM NITRATE (UAN)

The UAN market remained somewhat dormant last month with buyer focus centered on preplant fertilizers and urea, and demand was especially slow for barges from NOLA.

NOLA UAN barge prices ended April at $265/t FOB, slightly lower from the range of $270-$280/t FOB at the end of March. As was the case with most fertilizers in spring, U.S. Gulf barge prices were generally less supported due to more demand for faster-shipping volumes already positioned in tanks in the country.

River terminals remain similarly flat from the prior week at $300-$340/t FOB for UAN 32% N, a generally wider range compared to the $325-$330/t FOB offered in March with hub markets generally falling lower in price due to built-up length on supplies, while locations positioned away from storage and production were priced higher.

Eastern Oklahoma area UAN production facilities were last reported offering product from $300-$310/t ex-works in April, higher from end-of-March offers at $290-$295/t FOB and attributed to the same fundamentals as described above.

The East Coast market began to take off at the end of the month, with prices having also slid lower from the month earlier during the slow period leading up to spring. Tank offers were heard $10-$20/t lower from March at around $310 FOB.

As the country moved from preplant needs to sidedress and top-dress activity, UAN and other nitrates prices were expected to remain supported through May with the potential to soften after the season and heading into summer.

PHOSPHATES

Domestic: With the spring kickoff commencing in April, phosphate demand finally hit a stride not seen in well over a year, with the 2022 season having been a notoriously poor period for preplant fertilizer demand due to uncooperative weather and near-all-time-high prices.

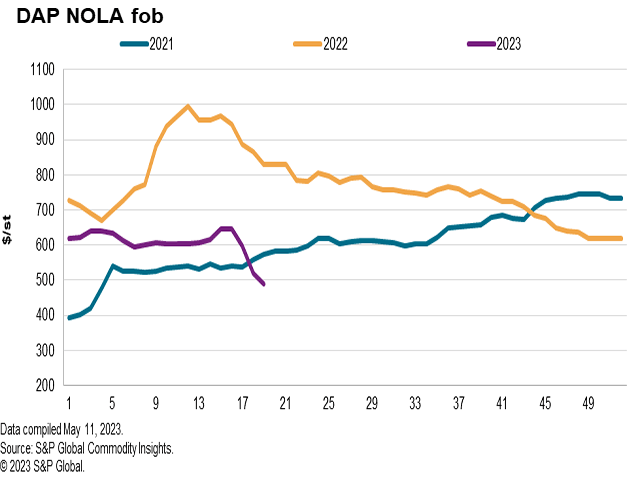

DAP barges were assessed from $515-$646/t FOB NOLA, wider compared to the prior month range of $600-$610. NOLA MAP trades were seen similarly wide to end April and was assessed $499-$625/t FOB, versus a flat $575 assessment in March.

A relative shortage of DAP to MAP availability in the U.S., as well as earlier emerging demand on the former, contributed to the continued premium of DAP over MAP. Like urea, prompt-shipping product had a $100-plus premium compared to month-ahead loading barges for May.

River terminal pricing ended higher last month at $690-$750/t FOB DAP at hub markets including St. Louis, Tulsa, and Cincinnati, up from $655-$695 DAP and $625-$645 MAP in March. MAP values fell as well to $670-$750/t FOB versus $720-$750 in the prior weekly report.

Last month, the U.S. Department of Commerce announced changes to its countervailing duty rates for Moroccan- and Russian-origin phosphates, lowering the rate for OCP by about 5% to 15%, and raising the rate on PhosAgro from 9% to around 50%. The new PhosAgro number is closer in line with the rates initially set for phosphates produced by fellow Russian producer EuroChem. A pending international court challenge to the duties assigned to Moroccan phosphates also has yet to be resolved.

Phosphate pricing appeared poised to invert in May and potentially raise MAP prices back over comparative DAP values as the Southern states finished preplant work while the North was winding up for field activity.

International: Prices for phosphates continued to come under pressure in a quiet market globally last month, with falling values in the west linked to positions unwinding and attributed in some cases to indexing activity.

Without India as a major outlet ahead of the third-quarter peak shipping season and with demand in North and South America subdued, Southeast Asian importers have been presented with lower offers for DAP, with landed prices in India prices falling to $548-$549/mt CFR DAP by the end of April, down from $578 in March.

Even sharper price deterioration was noted in South America. The Brazilian MAP market saw April prices slip further to $565-$570/mt CFR, down from $600-$620 in the prior month.

Producers will be pinning their hopes on a strong return by Brazil to stop the falling market, but it is unclear whether the country will step back up in any significant way. For prices to move back up in the Western Hemisphere, Latin American buyers will have to return in force, as there is plenty of producer and trader length hanging over the market.

Global phosphate prices are otherwise poised to remain weaker in the short term as a result.

POTASH

The old carryover potash stocks from 2022's ill-fated application periods were finally cleared out of warehouses in April, providing some of the first demand-motivated price increases in the market observed in over a year.

NOLA granular potash barges were assessed at $390/t FOB at the end of April, up from $370-$378 in March, as preplant demand increased and provided support to potash and phosphate prices.

Impeded barge transport from NOLA as discussed above also made U.S. Gulf product less desirable to interior U.S. buyers, with prompt barge values retreating slightly week over week to end April but with upriver barges supported and trading at a $5-$10/t premium.

Mississippi River terminal offers were offered at $440-$455/t FOB at northern terminals, while tight supplies in depleted, southern markets ranged higher to as high as $490 in Oklahoma -- much higher compared to the last week of March, which saw sales ranging from $415-$435/t FOB at major terminals.

Potash prices appear supported in the short term on tighter supplies as well as a second stage of demand from northern corn production areas. The pace of imports has also slowed of late, with few sizeable arrivals from major potash exporters scheduled for April and May, which will keep available product in the U.S. Gulf relatively limited over the next couple of weeks.

**

Editor's Note: This information was supplied courtesy of Fertecon, S&P Global Commodity Insights.

(c) Copyright 2023 DTN, LLC. All rights reserved.