DTN Fertilizer Outlook

Nitrogen Fertilizer Price Spread Sees Crucial Rebalancing

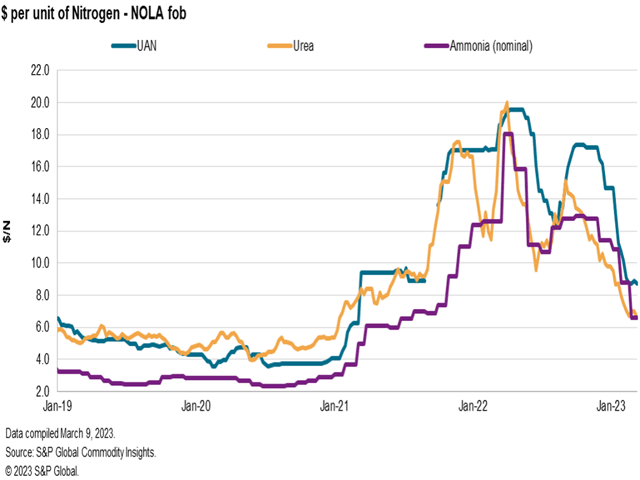

February saw the crucial rebalancing of the nitrogen fertilizer price spread. After sharp decreases in urea prices in recent months made dry bulk nitrogen much more affordable, urea ammonium nitrate (UAN) and ammonia offers from U.S. sellers were also brought much lower. This reset was necessitated by a weak global urea market since 2023 began, as well as reduced natural gas prices in Europe, which is used as a feedstock to make nitrogen fertilizers in a region that became a swing producer in the nitrogen market over the past year.

The following is a recap of fertilizer price trends and market developments for the month of February.

AMMONIA

Domestic: U.S. anhydrous ammonia prices saw a downward correction in February, which was expected in the market ahead of time and came simultaneously with adjusted offers for both urea and UAN as well in the falling fertilizer market. Lower offer levels were attributed to the falling prices in other nitrogen fertilizer markets and decreasing natural gas costs in Europe, which has been a swing producer in the global ammonia market over the past year.

Corn Belt prices fell to $795 to $840 per short ton (t) free-on-board (FOB -- or sales price per ton of fertilizer without transportation costs), down from winter-fill offers around $950 to $1,100. Since ammonia fill offers late last year, the Tampa contract has seen multiple sharp decreases, which alluded to further price reductions to come.

Factory offers fell in February to $625 to $665 FOB ex-plant from eastern Oklahoma area production facilities, versus January levels from $870 to $885 FOB. Building ammonia supplies in the U.S. seemed to be most evident in this region, which saw both the most quickly adjusted and largest degree of price reductions.

We expect U.S. ammonia prices to remain stable to softer in the short term, with more corrections lower possible ahead of increasing spring preplant applications.

International: It was announced late in February that Yara and Mosaic had settled at $590 per metric ton (mt) cost-and-freight (CFR -- or sales price with shipping costs included) Tampa for March shipments. The price, down on the $790 CFR agreed by Yara and Mosaic for February, is the lowest settlement at Tampa since July 2021. It was attributed to several factors, most notably poor ammonia demand on both sides of the Atlantic, lower comparative gas prices in Europe, and a lackluster start to the year for the nitrates market.

Ammonia pricing fell sharply in February in the Baltic Sea, assessed nominally to $585/mt FOB, down from $730 to $775 in January. Black Sea ammonia prices fell similarly to $625/mt CFR last month versus $770 to $780 in the month prior.

Overall, the ammonia market in and around Europe remains at a standstill, with the fertilizer season off to a disastrous start with clarity on nitrates fertilizer requirements still lacking.

The outlook for global ammonia in the short term is weak due to demand and softening prices across the board.

UREA

Domestic: The urea market remained generally weak in the U.S. last month with little emerging spring nitrogen demand to support prices brought lower in the softer international market, as well as a continuously growing import lineup from global exporters reducing earlier concerns over spring inventories.

Granular urea barges at the trading hub in New Orleans (NOLA) were assessed at $310 to $335/t FOB at the end of February, down from $340 to $390 in the month prior. Some bullishness emerged near the end of the month with the announcement of India's latest tender, but as you can see in the almost $100 month-over-month decrease, it was not enough support to erase earlier losses.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

River terminal urea offers ranged from $355 to $390/t FOB last month on sections of the Mississippi River that were still open to barges, down from $420 to $450 in January. A lack of meaningful spring demand in the central U.S. kept prices weaker and moved lower in line with cheaper NOLA barges.

The U.S. market, according to Fertecon estimates, was missing about 1 million tons of imports compared to the 2021-22 period, compounding fears over a lack of supplies due to the strong pace of exports in 2022. However, the deficit was rumored to be all but covered by newly arranged imports from Russia, Nigeria, and the Middle East last month.

U.S. urea prices were seen softer in a bearish global market, but with the potential to firm further with international price developments as well as the fast-approaching spring season.

International: Global urea markets remained under pressure in February with a long-awaited Indian tender announcement providing scant hope for sellers of a price recovery at month's end.

Among the key markets that saw continued pressure, both Egypt and Algeria have abundant stockpiles for March shipment. Egyptian sellers enjoyed the limelight near month's end with a flurry of sales, expected to be mainly traders buying to cover sales into Europe. Egyptian urea prices ended the month at $380 to $395/mt FOB, down from $390 to $400 in January.

Carnival celebrations in Brazil also saw trading activity slow during the month. Spot prices moved down to $340 to $360/mt CFR from $375 to $390 at the start of the month with demand subdued as farmers looked ahead to their summer crops.

At the end of February, global urea markets looked set to remain oversupplied with the Indian tender not expected to be enough to fight the emerging softer price trend. Fresh European demand could help drive up regional prices, but low demand from India, Brazil and the U.S. will keep prices under pressure.

UAN

With last month having seen a huge shift and readjustment in U.S. nitrogen prices, urea ammonium nitrate (UAN) price reductions were able to finally bring pricing closer in affordability with ammonia and urea.

At NOLA, UAN 32%N barges were assessed from $270 to $290/t FOB, down from $335 to $350 in January after spending much of late 2022 in the mid-$500s. Price reductions first began in December around the Christmas holiday and have been gradually falling lower since then, after sharp decreases in urea prices made dry bulk nitrogen much more affordable by comparison.

River terminal prices came down as well to $300 to $310/t FOB across main hub markets in St. Louis and along the Ohio River, with a slight premium in the latter around $5/t. This is down about $90 to $100 from only the beginning of February and motivated by the same fundamentals described above, which brought prices down all over the country.

Prices fell proportionally lower at eastern Oklahoma area nitrogen units, down to $270 to $280/t FOB ex-plant versus $500 to $530 in the last monthly column.

Our U.S. East Coast assessment was likewise lowered to $400 to $420/mt CFR, down from our previous range of $420 to $470 in January. Price ideas in the region were experiencing uncertainty during the sharp price reductions in February, with $400 still said to be in the realm of realistically achievable business on triple-digit freight rates from the Black and Baltic Sea regions.

Nitrates pricing is seen stable to softer in the U.S. for the short term. If urea demand increases into the spring, UAN prices could be in a more stable place after aggressive downward price adjustments in recent months.

PHOSPHATES

Domestic: Some emerging spring demand in the Southern U.S. was said to be providing support to phosphates prices in February, as well as constrained supplies of DAP in the river and interior markets due to a heavier proportion of MAP imported over the past several months.

Nevertheless, NOLA DAP was assessed at a flat $600/t FOB at the end of February, down from the previous month's range $610 to $630. MAP barges fell more sharply meanwhile to $565 to $570/t FOB compared to our last assessment in January of $600 to $605, with cheaper imported product driving prices lower.

Terminal prices fell $20 to $30/t from January levels to $655 to $665 FOB DAP and $625 to $655 MAP. Much of the Corn Belt will not see spring preplant application activity pick up for several more weeks, following a string of snowstorms in February along with periods of extremely cold temperatures.

Sentiment was turning noticeably more positive for the spring season at the TFI Annual Conference in Palm Springs last month, especially for phosphates and potash given the poor application rates over 2022. A cold weather pattern in March could threaten the season, much like last year.

The recent DAP supply shortage is expected to be remedied over the coming months with more imports to come, motivated by the higher landed prices against MAP. Phosphates prices are expected to remain stable in the short term before potential spring demand emerges to support prices.

International: India was the highlight of the phosphate market toward the end of the month, purchasing 300,000 t DAP for March shipment from Morocco, Jordan and China during the last week of February. Other markets were relatively quiet at the time, especially with holidays in Saudi Arabia, Russia and Brazil.

Producers have competed fiercely for a share of India, dropping prices toward the end of the month, as low as $640 to $643/mt CFR from $658 to $660 CFR in early February.

In Brazil, liquidity was affected by the Carnival holiday toward the end of the month, with little change in the fundamentals of the market and buyers showing little interest in fresh purchases. MAP prices tightened throughout the month from $650 to $660/mt CFR to $655.

Producers have been obliged to accept lower prices for DAP despite squeezes on supply, with another outage in Lithuania adding to reported production problems in North Africa of late. The outlook regarding global phosphates pricing in the short term is weak across the board.

POTASH

NOLA granular potash barges were assessed at $375/t FOB at the end of February, down $20 from the previous monthly report. While this assessment reflected most recent sales, cheaper offers at $370 were reported on imported product.

River terminal potash saw little change last month but did notably decrease and was framed from $440 to $460/t FOB at main hub markets along sections of the Mississippi River still open to barges.

Buyers still have yet to return to market, but prices appear to have stabilized for the short term. Market participants are optimistic that a decent spring preplant period will clear much of the carryover volumes from 2022 and pave a path for a competitive summer-fill program once the old stocks are depleted.

The tone at the TFI conference was one of a wait-and-see approach, echoing the common market sentiment that buyers need to reemerge before more clarity on pricing can be found. As mentioned above, participants say this upcoming U.S. season has the potential to be very successful in clearing out old inventories to make way for a larger summer-fill program.

Potash in particular, and by extension phosphates, had a good opportunity to move a lot of volume over the following weeks in lieu of the previous two below-average application seasons in 2022.

**

Editor's Note: This information was supplied courtesy of Fertecon, S&P Global Commodity Insights.

(c) Copyright 2023 DTN, LLC. All rights reserved.