Destruction and Crop Losses in Ukraine

Six Key Challenges Facing Ukrainian Farmers in the Midst of War

OMAHA (DTN) -- Ukrainian farmers continue to face a range of pressures trying to grow a crop in the midst of the war with Russia.

The damage to equipment and storage and lack of access to fuel and fertilizer will drop production forecasts for 2023, said Antonina Broyaka, an Extension associate in Agricultural Economics at Kansas State University.

Broyaka was a professor and researcher at a university in Ukraine before the invasion last year. She left Ukraine in March and accepted a position at K-State.

The following are some of the challenges the farmers face:

1. MACHINERY, STORAGE CAPACITY LOSSES

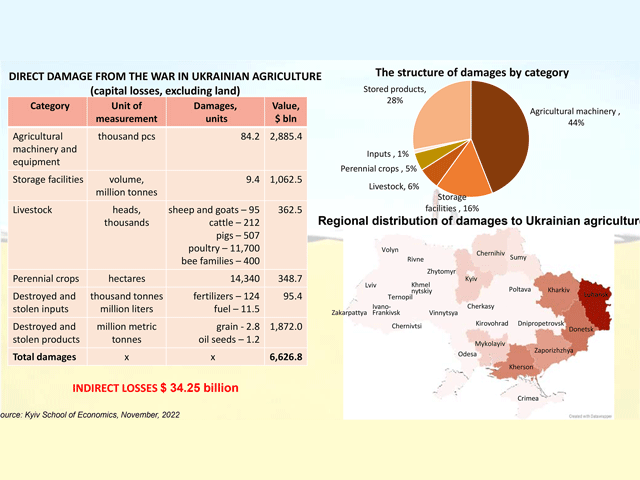

Broyaka cited statistics that Ukraine agriculture has suffered about $6.6 billion in losses. A big chunk of those losses includes roughly 84,200 pieces of destroyed farm machinery.

"We are working every day to replace what has been damaged but every day we have new bombings unfortunately," she said.

On top of that, Ukrainian farmers and agribusinesses have seen storage capacity for 9.4 million metric tons (mmt) of grain destroyed. More grain storage capacity is not accessible because it is in land controlled by Russia.

The losses also include 2.8 mmt of grain and 1.8 mmt of oilseed, along with 212,000 cattle, 507,000 hogs and 11.7 million in poultry flocks.

Overall, Ukrainian officials estimate the country has suffered as much as $136 billion in damage. Broyaka pointed out Russian bombs continue to target key infrastructure.

"We are losing a lot of infrastructure, but we are also losing a lot of people," she said.

2. ESTIMATED HARVEST LOSSES

Corn production fell from 42.1 mmt, or 1.66 billion bushels) in 2021 down to 21.4 mmt (842 million bushels) for 2022. A lot of the crop also was left in the fields to dry because of the lack of fuel to dry it down, Broyaka said.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Wheat production fell from 33 mmt (1.2 bb) to 20.2 mmt (742.2 mb).

Sunflower seeds also declined from 17.5 mmt to 10.5 mmt.

Production overall saw a 14.9% reduction in total grains.

Fuel and transportation costs also have skyrocketed. Broyaka highlighted the cost to move grain to port is now triple what it was before the war.

"It makes no economic sense sometimes for farmers to harvest," she said.

DTN Lead Analyst Todd Hultman also pointed to the high transportation cost just to move the grain.

"I don't see how farmers are getting paid for all of this work," he said. "When you figure out everything that is going on, they are in a tough situation."

3. PLANTED WHEAT ACRES DOWN

Looking at winter crops, overall planted acres are down nearly 37% to a forecast of 14.12 million acres.

For the winter wheat crop, the largest chunk of acreage, planting is down 39% to 9.28 million acres.

These totals do not include some of the eastern provinces of Ukraine now under Russian control. Those areas were also some of the dominant regions for winter wheat production.

4. LESS FERTILIZER ACCESS EXPECTED

Looking at spring crops, Broyaka said Ukraine could expect a sharp decline in access to fertilizer. The forecast is farmers could see as much as 47% less nitrogen fertilizer for crops. She said that will translate into yield drops of 20% to 50%, depending on the crop and region.

Production of spring cereal grains could decline 44%, due partly to lack of fertilizer and partly because of lack of land. Broyaka said as much as 22% of arable land is not in use because of military action. That translates into nearly 9.4 million acres that won't be planted.

5. BLACK SEA EXPORT AGREEMENT

The agreement with the United Nations between Ukraine and Russia, as tenuous as it is, has gotten more grain and oilseeds out for exports. Ukraine exported 38.9 mmt total in 2022, which includes roughly 19.45 mmt through the ports from September through December. The Black Sea initiative accounts for about 17.7 mmt.

Hultman pointed out that Broyaka also showed the challenges of trying to get grain and oilseed out of the western parts of the country through rail or vehicles.

"They are really stuck with the Black Sea initiative to move anything," he said.

6. PRICES, CREDIT, INPUT CHALLENGES

The gap between global prices and Ukraine prices has widened dramatically. There's a $213 price spread per metric ton between U.S. wheat prices and Ukraine wheat prices. For corn, the spread is $174 per metric ton.

Credit is also a challenge. Ukrainian farmers look for a chance to expand access to credit. They also face problems with higher costs because of exchange rates.

AID TO FARMERS

The U.S. Agency for International Development (USAID) has offered some aid to farmers and households and some agricultural corporations are also offering support. On Thursday, USAID and Bayer announced they will donate vegetable seeds to help Ukraine. USAID and Bayer will first ship carrot seeds to supply as many as 25,000 family gardens or small farmers, "with priority given to farmers in newly liberated areas."

Bayer had already donated 40,000 bags of corn seed to the country and invested $35 million to boost seed-processing capacity in Ukraine.

USAID has provided farmers with more than 8,000 sleeve bags to help farmers store grain. The United Nations Food and Agriculture Organization also has provided sleeve bags to help store grain.

For more on Ukraine's winter wheat crop and the impact on the U.S. crop, watch for this week's Todd's Take column.

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on Twitter @ChrisClaytonDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.