DTN Fertilizer Outlook

Low River Levels, Slow Start to Fall Harvest Push Wholesale Fertilizer Prices Lower

October saw the full impact of low water levels on the Mississippi River affecting fertilizer barging logistics. This had a few effects in the market, including added delays to barge deliveries from the U.S. Gulf and lesser spot barge availability, as grain movement was likewise hampered. With physical barge delivery a less attractive prospect, some products saw terminal levels supported, as opposed to falling lower alongside less-desirable physical New Orleans, Louisiana, (NOLA) barge volumes. A slow start to the fall harvest also dealt a blow to phosphate and potash demand, as well as prices.

The following is a recap of fertilizer price trends and market developments for October:

AMMONIADomestic: With the fall harvest surpassing 50% completion at the end of October, applications of anhydrous ammonia were said to be in full swing. Direct applications began to take off in the Corn Belt around mid-October and were temporarily halted by rains in Illinois, but deliveries on prepaid tons continued. Orders put on the books earlier in the year were strong, as expected, and spot availability in the last month was tighter as a result.

Spot prices did not immediately react to the increase in activity or a lower Tampa ammonia contract settlement for November, however, with fourth-quarter 2022 requirements having been filled earlier with the prepaid sales. Corn Belt ammonia offers were unchanged from late-September at $1,300-$1,400 per short ton (t) free-on-board (FOB -- or the charge for fertilizer by the ton without trucking fees or other transport costs).

Ex-factory offers at eastern Oklahoma ammonia plants were also stable, with October prices heard at $1,150/t -- flat from the previous high end of pricing in the state in the preceding month.

Another deadline is quickly approaching for U.S. railway worker unions and railroad companies. If a deal is not made more than a week ahead of Nov. 19, ammonia rail shipments could see an interruption for the second time in two months.

In September, when negotiations had reached one week until the deadline, carriers issued notices to customers carrying hazardous cargo that shipments would be paused, citing matters of safety should a strike or work stoppage occur. Trucking rates are likely to spike during the period if both rail lines as well as barge shipments become untenable or unreliable.

Looking at the supply and demand fundamentals at work, we expect U.S. ammonia prices to stay stable to softer in the short term.

International: Last month, Yara and Mosaic had, as anticipated, agreed on a lower price for November of $1,150 per metric ton (mt) cost and freight (CFR -- sales price plus shipping costs) Tampa. The price for November, down $25 on the $1,175 CFR Tampa agreed on by Yara and Mosaic for October, will come as no surprise given developments in Europe, where the cost of natural gas has slipped further in the past month.

The Dutch TTF month-ahead price hit a four-month low in October before edging higher, settling at a level that would suggest a gas cost per metric ton of ammonia of around $1,050 and a total cost of production of just over $1,100/mt. The fall in the price of gas narrows the gap between the theoretical cost of producing ammonia in Europe and the actual price to import it, boosting the prospect of an increase in ammonia output in the region as some facilities tentatively restarted production in October.

Nominal derived price ranges of $1,005-$1,130 FOB Black Sea and $1,030-$1,085 FOB Baltic were determined in October based on delivered prices reported in sections of the Med Region -- with both assessments seeing increases of about $30-$40/mt compared to our September prices. Ammonia spot activity in these regions remains constrained as the conflict in Ukraine continues.

Our outlook for the global ammonia market in the short term is stable to soft in the Western Hemisphere amid the decline in European gas prices, perhaps the largest driver of prices over the previous month.

UREADomestic: A softer tone set into the urea market with only India tender activity to stimulate trading fundamentals in October. Fertecon assessed urea barges at the U.S. trading hub in New Orleans, Louisiana, (NOLA) from $540-$585/t FOB in the last week of October, down from sales in September from $600-$635.

Terminal prices along Mississippi River hub markets fell similarly last month to $615-$630/t FOB from $660-$680 in the month prior. The divide between Upper and Lower Mississippi urea volumes is also reshaping now that terminals north of St. Louis will not see new fertilizer barges until next year, with Twin Cities offers reported holding a premium of $35-$45/t.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Barging along the Mississippi River have been heavily affected by low water levels in September and October. Tow sizes were reduced on newly departing boats, while those that were loaded earlier were at higher risk of groundings due to inadequate depth along certain sections. Groundings developed to become a daily issue, especially in Louisiana and other parts of the river south of St. Louis. Dry conditions and low rainfall totals from the summer are to blame, and with no significant rains arriving in October, the poor conditions have persisted.

The U.S. will need to attract a substantial amount of urea for spring needs next year due to a strong pace of urea exports in 2022 so far, along with higher production rates for ammonia and UAN. We see the necessity for imports to increase substantially and predict a rally in pricing after the year-end holidays.

In the short term, however, we see urea prices as stable to soft.

International: Urea sellers in some key regions were under pressure in October with demand remaining weak outside of recent Indian purchase tender activity, following Indian fertilizer company IPL issuing letters-of-intent for 1.51 million metric tons of urea from its Oct. 17 tender.

Most notably, North African on the sales side and Europe and the Americas were under the most pressure last month. Concerning the former, Egyptian urea prices ended October at $650/mt FOB -- about $150/mt lower than sales levels in September.

The Brazil market had been similarly weaker last month on account of cheaper Russian products available and high stocks pressuring the market, falling to $610-$630/mt CFR from the prior month highs at the end of September at $675.

Volatility has been the common theme in Europe lately, with gas prices coming off recent highs as previously discussed. Buyers are taking a wait-and-see approach heading into winter as a result.

The market remains uncertain with the potential for more downward pressure ahead. Sellers will be looking toward the next Indian tender, which could come by early December. The next few weeks will determine what that tender offering will look like.

UANThe UAN market continues to operate on mixed fundamentals, driven mostly by the absence of producer offers in the U.S., as much of the country's production for the third quarter into fourth-quarter 2022 was booked for export to Europe and Latin America.

NOLA UAN 32% barge prices ended October at $550/t FOB, flat from the previous month low end but down from higher indications of $560 in September. Besides the poor barging conditions on the Mississippi River making physical deliveries from NOLA undesirable, fundamentals in the UAN trade have been steady in recent weeks.

Terminal UAN 32%, in the meantime, remained supported at the $590-$600/t FOB mark at primary hub markets in St. Louis and Cincinnati, due to the above-mentioned lack of volumes on offer. Demand, however, remains muted, as it is an off-season period for UAN, so prices have not been pressured too much higher either.

Oklahoma area plant prices did see some reduced pricing near the end of the month, however, as lower offers were reported at $545/t FCA -- down $20-$30 from early October highs.

While supply fundamentals are still somewhat bullish for UAN in the short term, there is an outsized premium compared to urea and ammonia as nitrogen sources, which may be contributing to the somewhat softer tone that has been emerging. Perhaps a winter-fill offer or bidding program may be announced to gauge what buyers will pay for UAN, but for now, we see prices as stable.

PHOSPHATESDomestic: Phosphate prices continued to weaken in October as demand did not quite emerge in force for post-harvest applications, likely due to the slow start to the harvest period in addition to increased pace of import product at NOLA.

In the U.S. Gulf, NOLA DAP prices fell as low as $710/t FOB in October, down from $735-$755 in the month before. Competitive offers were reduced in the absence of bids at the end of October as barge delivery was largely unable to compete with warehouse and terminal pricing.

MAP barges were assessed similarly lower to $695-$700 versus $755-$765 FOB in the previous report. The drop in price levels at a more severe rate compared to DAP was attributed to increasing import cargoes from Russia, which featured a split more weighted toward MAP, and a similar lack of barge interest versus existing U.S. stocks.

River terminal DAP offers consolidated into a higher range, as emerging demand and a tightening of availability drove a firmer tone to phosphates prices, in addition to barge transit issues. October offers ranged from $795-$810 on DAP compared to $790-$820 in September.

Terminal MAP, meanwhile, held its value and saw prices increase to $820-$845 FOB, $10-$25 higher from prior month offers as the cheaper imported volumes from NOLA did not immediately displace existing stocks.

Mosaic announced on Oct. 3 that its phosphates facilities in Florida were negatively affected by damage caused by Hurricane Ian. The storm's path extended over the company's mining and concentrates facilities in central Florida, with significant flooding and high winds causing modest damage to its facilities and supporting infrastructure. Repairs were estimated to be completed over the one to two weeks that followed.

In the short term, we see DAP and MAP prices as softer. If fall demand builds during November for application or replacement tons, however, we could see price levels stabilize ahead of the year-end holidays.

International: An unexpected power outage was reported at a Saudi Arabian phosphate plant late in October, which led to traditional importers of its DAP to make pricier purchases to fill in the missing contract metric tons. Elsewhere, east of the Suez Canal, markets have been quiet, while looking westward, demand remains minimal, leading benchmark prices to diverge last month.

Activity in the global market late in October was limited to the purchase by India of Moroccan DAP at a higher price of $745/mt CFR. The latest Indian business represents a $5/t increase on the previous round of DAP sales concluded in early October and settling toward the higher end of the previous sales range of $720-$750 in September.

Meanwhile, Brazil MAP prices ended October at $635-$650/mt CFR -- down from $690-$700 in September with Brazilian demand for phosphates currently in-between seasons and having left buyers with little urgency to make purchases.

Despite availability from China constrained by quotas and reports of there being no Saudi Arabian MAP available to load prior to January due to the production downtime, we still see pricing as under pressure in the short term due to the general lack of demand from a majority of the world's biggest importers.

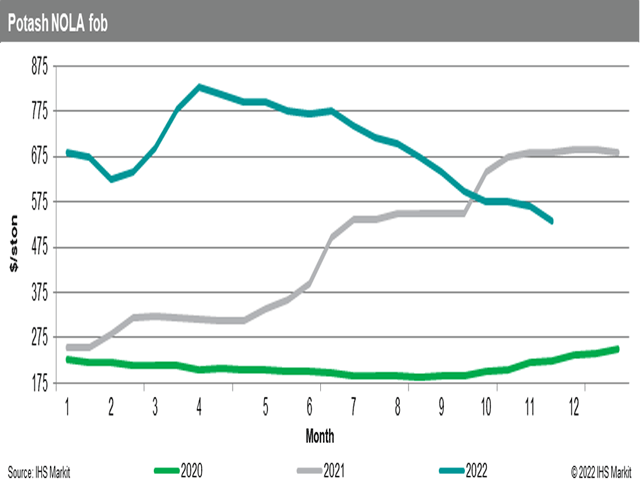

POTASHPotash barges were under pressure at NOLA with prices at the end of October assessed at $565/t FOB, down $10 from September price levels. The fall harvest progressed at a slow pace to start the season, leaving U.S. potash with the same problem that it had in spring of this year -- field conditions hampering early season applications and demand.

Barging issues on the Mississippi River also made NOLA barge buying an unattractive prospect for those with immediate needs due to uncertain delivery timing and reduced barge drafts. Price levels on both barges and terminal volumes suffered as a result with sellers trying to bring prices down to attract more buyers during a crucial time in P&K markets.

River terminal potash offers declined along the most active river markets by anywhere from $30/t to up to $70 against September offers to $620-$640 FOB in hub areas like St. Louis and Inola, Oklahoma. Along the Ohio River, which saw some more resistance against falling prices, volumes were still offered as high as $665.

In the short term, U.S. potash prices are seen similar to phosphates with barge prices and warehouse volumes also under pressure by association. However, sales volumes in the U.S. interior have also suffered over the past year due to a light spring application on account of the delayed start to fieldwork, and the carried-over product has weighed on prices into third-quarter 2022.

North American producers in their third-quarter 2022 financials also seemed committed to the increased levels of production, which were raised in late 2021/early 2022 to combat the loss of sanctioned Belarusian volumes, also supporting the view of a falling price scenario.

**

Editor's Note: This information was supplied courtesy of Fertecon, Agribusiness Intelligence, IHS Markit.

(c) Copyright 2022 DTN, LLC. All rights reserved.