Todd's Take

Are Russian Wheat Farmers Outcompeting the World or Is Something Else Going On?

Back in the months leading up to Russia's invasion of Ukraine, I remember thinking that Russia's got a pretty good deal here. All they have to do is put troops near the border and just the threat of invasion scared the market prices of wheat and crude oil higher. Russia was making money without firing a shot and, for that reason, I wondered if Russia would actually invade or not. After all, the international uproar would be enormous. Did Russia really want to face the opposing sanctions that would certainly come from the U.S. and Europe?

We know now that Russia did invade, and even though taking control of Ukraine has become a much more difficult and expensive venture than anticipated, Russia's President Vladimir Putin shows no sign of giving up yet.

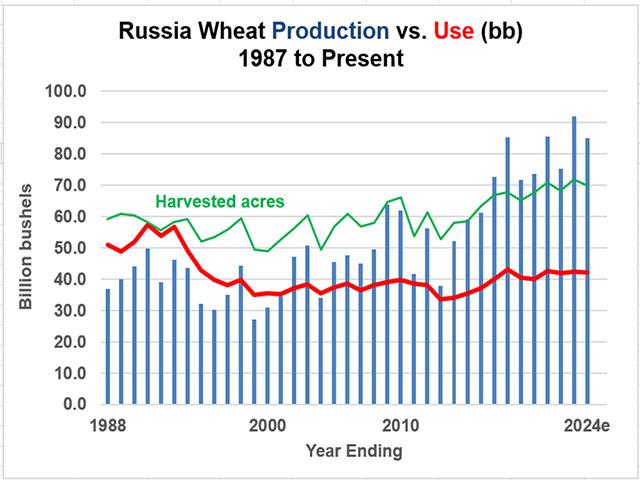

Aside from the war, Russia has gotten more of my interest lately in trying to understand just what they're up to in terms of agriculture, especially in the wheat market. Estimates from different sources vary, but according to USDA, Russian wheat exports hit a record-high 46.0 mmt or 1.69 billion bushels (bb) in 2022-23 and are on track for a new record of 49.0 mmt or 1.80 bb in 2023-24. Including 2023-24, Russia has been the world's top wheat exporter in six of the past seven years and, in the past year, cheap Russian wheat has been the main source of bearish pressure, holding international wheat prices down, even at a time when USDA is estimating the lowest ending world wheat stocks outside of China in 15 years.

Russia's rise to the top has been no accident. Back in September 2012, the website, World-Grain.com, quoted President Putin as promising a doubling of grain production, saying that "our country will be producing 120 to 125 million tons of grain a year by 2020,"

(https://www.world-grain.com/…). The plan proved true for wheat as Russia produced 85.35 mmt or 3.14 bb of wheat in 2020, more than twice the 2012 total of 37.72 mmt. Of the increase, 35% came from increased acres devoted to wheat and the rest came from higher yields.

On the surface, there are obvious reasons for Russia wanting to increase wheat production. Russia has seen times of rising bread prices and keeping wheat supplies widely available is a good way to keep your fellow countrymen content. Gaining greater market share by undercutting other wheat-exporting nations is not necessarily a highly profitable venture for Russian wheat farmers, but it does benefit friends of Putin that move the wheat from Russian farms to ports and helps with Russia's foreign currency reserves. Western grain firms, like Cargill, have pulled out of Russia, but are still involved in shipping Russia's grain.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Since the plane crash and death of Yevgeny Prigozhin in late August, there has been much discussion in the news about the Wagner Group Prigozhin headed and the complicated web of illicit activities the group conducts unofficially, on behalf of Russia. According to the Africa Center for Strategic Studies, a research group funded by Congress within the U.S. Defense Department, Russia has deployed the Wagner Group in at least six African countries, taking advantage of Africa's weak governments and abundant resources to advance Russia's strategic objectives.

As the director of research at the Africa Center, Joseph Siegle Ph.D. testified before the House of Representatives in September 2022, "Moscow has followed a pattern of swooping in with irregular (Wagner mercenary) forces to prop up politically isolated authoritarian leaders facing crises in geostrategically important countries, often with abundant natural resources. These leaders are then indebted to Russia, which assumes the role of regional powerbroker (read the entire testimony at https://africacenter.org/…)."

As we read more of the report, it is not much of a stretch to see Russia's cheap wheat policy has become a way of currying favor in countries with poor populations, a humanitarian cover for malevolent goals that has expanded Russia's influence in Africa and at the United Nations. Even the West has refrained from the public relations nightmare of sanctioning the movement of Russian grain, not wanting to be seen as depriving poor nations of an important source of food.

Russia belongs to a group of countries, known as BRICS, an acronym for Brazil, Russia, India, China and South Africa. The group is inviting six other nations to join: Argentina, Egypt, Ethiopia, Saudi Arabia, Sudan and the United Arab Emirates (UAE). In August, the UAE arranged $500 million of financing for Egypt to keep buying wheat for five years, much of which will come from Russia. Quite a cozy group this is becoming.

The testimony from Africa Center also explained one of Russia's objectives is to establish a naval presence along the southern Mediterranean Sea, near two important trade chokeholds, the Suez Canal and the strait between Yemen and Djibouti. No wonder Russia bends over backward to be the cheap wheat provider to Egypt and why it has shown special attention to Libya, Egypt and Ethiopia.

Here in 2023-24, U.S. wheat exports are estimated at their lowest levels in 50 years and profitability has been sucked out of the wheat sector. The U.S. has seen a steady decline in wheat acres for over 30 years as farmers turned their hopes to corn, burdening corn prices this year with the largest planting in 10 years. American farmers are continually threatened, not just losing market share and profitability, but of losing livelihoods.

Some will say that's just how markets work. Russia is being rewarded because it's the low-cost producer, and U.S. farmers aren't keeping up. I would argue Russia is not a market-based producer, but is politically using cheap wheat as a tool for advancing military goals that are dangerous to international trade and to the African nations Russia pretends to serve.

As is often the case, this is a situation that goes beyond economic theory and is challenging the future of American agriculture and international trade. Unfortunately, we probably won't hear much about this topic during the national election in the year ahead, but it is the kind of conversation we as a nation need to wake up to -- the sooner the better for all our sakes.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.