Todd's Take

Trouble Brewing for Bearish Funds in Chicago Wheat

To paraphrase a popular song by Jim Croce from my younger years, "You don't tug on Superman's cape, you don't spit into the wind, you don't pull the mask off that old Lone Ranger, and you don't go short wheat when supplies are tight and the companies that know the wheat market best are net long."

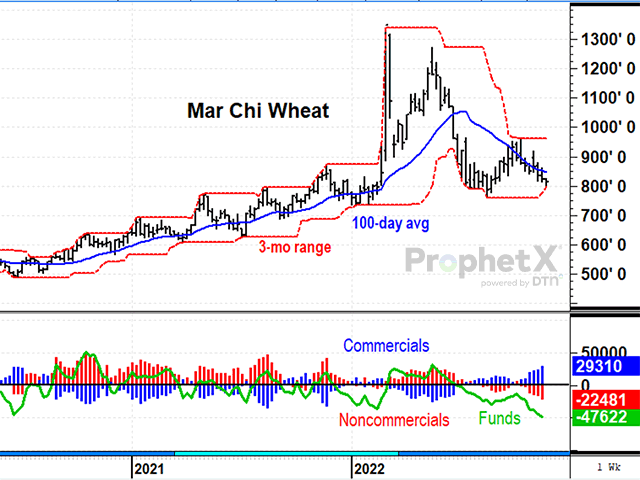

OK, maybe the young guns running the managed futures funds that are net short 47,622 contracts of Chicago wheat haven't heard that particular rendition, but if licenses could be revoked for subjecting customer funds to insane risk, this situation would qualify.

I'll admit again that I can't guarantee how the future will unfold, but consider the following. Not only is USDA estimating U.S. ending wheat stocks at 571 million bushels (mb) in 2022-23, the lowest total in 15 years, but global ending wheat stocks apart from China are being estimated at 4.54 billion bushels (bb), also the lowest level in 15 years. USDA is estimating ending soft red winter (SRW) wheat stocks, the variety Chicago wheat is based on, at 87 mb, the second-lowest total in 15 years. There's more.

As the days in the Northern Hemisphere grow shorter, USDA has rated the newly planted U.S. winter wheat crop at 32% good to excellent, the lowest assessment in at least 40 years, maybe ever. Granted, early ratings in SRW wheat states are higher than those in hard red winter (HRW) wheat states, but that is no argument for going short Chicago wheat, especially this time of year. Australia's wheat crop will be the only source of significant new wheat supplies for the world market the next six months.

With wheat supplies fairly tight almost everywhere but Russia, end users are likely to find it increasingly difficult this winter to obtain the wheat they need. Even the United Nations has been issuing warnings of concern about increased food insecurity in 2022-23.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

From my view, the above points should be enough to keep specs away from the short side of wheat, but we haven't even talked about Russia's war on Ukraine yet. Fighting has been intense in eastern Ukraine lately, the region where much of Ukraine's famous wheat crop is grown. Fall planting of winter wheat has been estimated by some Ukrainian sources as down 40% versus a year ago, but don't be surprised if the final harvest in 2023 is less than half of the previous year.

Do I also need to mention the dirty business of war, especially as conducted by Russia, has plenty of uncertainty that goes with it? President Vladimir Putin has casually tossed around threats of escalation. Attacks on Zaporizhzhia have come dangerously close to Ukraine's nuclear plant several times, including earlier this week. What do we think the price of wheat would be if a missile got too close to the plant and exposed not only Ukraine, but Eastern Europe to dangerous levels of radiation?

In principle, I have no problem with a limited amount of speculation in markets and admit it can have positive benefits when performed properly. Also, it is quite possible wheat will trade quietly this winter and avoid disaster. That does not justify the danger funds are taking in this situation with customers' money.

I should mention the last time funds held this large of a short position in Chicago wheat was May 2019. Heavily short in May, as July Chicago wheat prices neared $4.20 a bushel, it took just over a month to hit a peak of $5.57 in June as excess rain drenched the SRW wheat crop. Customer accounts also took a bath as funds scrambled to cover their shorts, turning net long near the top of the June rally.

The notion of specs being obligated to provide a commodity they don't own has always been a dicey proposition from the start. In a market as dangerous as wheat is today, it is absolutely insane for funds or any speculative accounts to be short, almost as crazy as putting your life savings into owning binary code. At least the owners of cryptocurrency know the most they can lose. For those short wheat, the only limit to the risk they face is everything they own.

For anyone invested in a fund that is short wheat, or any other commodity they don't own, it is time to wake up and get out.

**

This year's DTN Ag Summit will be held virtually on Dec. 12 and 13, meaning you can watch this premiere ag event in the comfort of your favorite chair, at a time that is convenient for you. Check out the topics and speaking lineups at www.dtn.com/agsummit. We'd love to have you join us!

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com.

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.