USDA Report Analysis

USDA's Planting Intentions Report Light on Acres

USDA released its 2024 Planting Intentions and quarterly Grain Stocks reports on Thursday. Both reports tend to be followed by volatile price moves, as they also fall at the end of the month and end of the quarter. The outcomes were nervously awaited, with the markets also closed on Good Friday and leaving a limited window for price response.

We're going to focus here on the Planting Intentions, reminding you, as always, that the purpose of the report is to allow producers to make needed course corrections before all the inputs are in the ground and the outcome is up to Mother Nature.

Selected 2024-25 US Planting Intentions

| In millions of acres | USDA Actual | Average Trade Estimate | Range of Trade Estimates | USDA February | 2023 Acreage |

| Corn | 90.036 | 91.8 | 90.0-93.8 | 91.0 | 94.6 |

| Soybeans | 86.510 | 86.7 | 84.3-89.0 | 87.5 | 83.6 |

| Wheat Total | 47.498 | 47.3 | 46.0-49.8 | 47.0 | 49.6 |

| Winter | 34.135 | 34.7 | 34.0-36.8 | 36.7 | |

| Other Spring | 11.335 | 10.9 | 10.1-11.9 | 11.2 | |

| Durum | 2.028 | 1.7 | 1.5-1.9 | 1.7 | |

| Cotton | 10.673 | 11.3 | 10.4-13.0 | 11.0 | 10.2 |

| Sorghum | 6.395 | 7.1 | 6.7-7.9 | 7.0 | 7.2 |

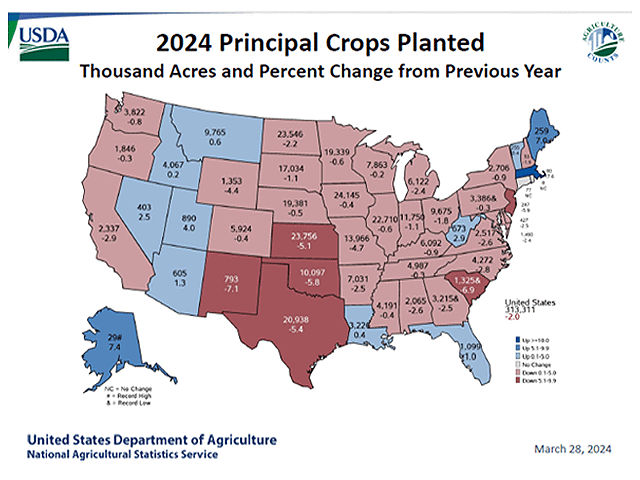

First off, and not in the table above, USDA's count of principal crop acres dropped to 313.311 million from 319.601 million a year ago. That is 6.29 million acres that were planted in 2023 that are not intended to be planted in 2024, according to the March farmer surveys. This is a big number, but not unprecedented. I can recall arguing with NASS about an 8-million-acre March shortfall (year/year) a few years back (which ultimately was down to about 4 million in June).

There are several valid reasons for the number to be lower than last year. Among them are:

1. Lower prices make margins tighter, and some marginal acres don't get planted.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

2. Double-crop soybean acres are double counted. Last year was a high 7% double crop versus more recent history of 4%-5%. That would reduce the bean total by up to 2 million acres. (See No. 1.)

3. There is a certain amount of implied prevented planting acres in the total, as producers are uncertain about weather conditions.

That said, I would anticipate that some of those individual crop numbers in the table will be higher in June. The market's job is to steer them to the appropriate crops. The area shortfalls were particularly steep in the Southern Plains, as shown in map from USDA accompanying this column. But of course, any of the Corn Belt states could also wind up with more.

I anticipated corn area would be down due to the need to fix distorted crop rotations from last year, a persistently high new-crop soy-to-corn ratio, and a less favorable (to corn) crop revenue insurance soy-to-corn ratio than last year. USDA's number was close to the low end of trade estimates, and December futures responded to that surprise with a double-digit rally and a bullish engulfing candlestick on the charts. The biggest percentage decline among the major production states was Minnesota, down more than 8% from a year ago. The sorghum area is also less than the trade expected at 6.4 million acres versus the average trade estimate of 7.1 million, and 7.2 million a year ago.

For soybeans, the intended area is almost a million under the February Outlook Forum number, which is likely the double-crop factor. Kansas is a huge double-crop acreage state. Being down about 1.2 million from the average trade guess was somewhat supportive for soybeans, but planting intentions are still up 3.4% from last year, and South American 2024 production is still likely to be record large and hanging over into first quarter 2024-25 U.S. soy exports.

For wheat, it isn't unusual for USDA to revise winter wheat plantings lower than the number shown in January, and they did so here. Other spring wheat area is up slightly from last year, but comfortably within the range of trade estimates. Durum acreage is surprisingly large at 2.028 million, but is a small piece of the overall pie.

New-crop December cotton rallied hard in January and February, trying to buy acres after old-crop ending stocks estimates began shrinking. The rally stopped and prices went sideways after the data collection period for this March 1 report but appears to have not bought many acres. USDA shows only about 400,000 acres more than in 2023, and almost 600,000 less than the average trade guess.

The bottom line?

For corn, the price reaction tells the story. USDA is likely to tighten old-crop ending stocks a little in the April World Agricultural Supply and Demand Estimates (WASDE) report, through feed and residual use. It is still unclear whether they can get them below 2 billion bushels, and even that is "comfortable" without a new-crop weather problem. That said, tighter stocks create more pressure for a large 2024 crop, and lower-than-expected acreage plans put a bid into the new-crop futures to develop a little more acreage cushion in case yields fall short of the 181-bushel-per-acre figure USDA used in February at the Outlook Forum.

For soybeans, the old-crop stocks were within 10 million bushels of expectations, easily accounted for by negative residual use. Prices tried to rally on the slightly smaller-than-expected acreage number, but the impact on supplies and demand will be minimal. The elephant in the room is still South American export competition and questions about import volumes from China.

Wheat stocks have a lot more cushion than they did the past couple years, and exports continue to struggle from cheap competition out of Russia and Ukraine. French futures have been rallying on short covering, which helps. USDA is likely to have to make their negative residual use larger for the third quarter, cutting annual feed and residual below 100 million. The new-crop acreage number is neutral, with Chicago SRW bulls encouraged by the smaller winter wheat number. Minneapolis tried to go along for the ride, but eventually decided more new-crop acres were not a good thing.

Alan Brugler can be reached at alanb@bruglermktg.com

(c) Copyright 2024 DTN, LLC. All rights reserved.