Boersen Farms to Sell More Property

Boersen Farms Battles Debt and Lawsuits, Seeks Court Approval for 10th Asset Sale

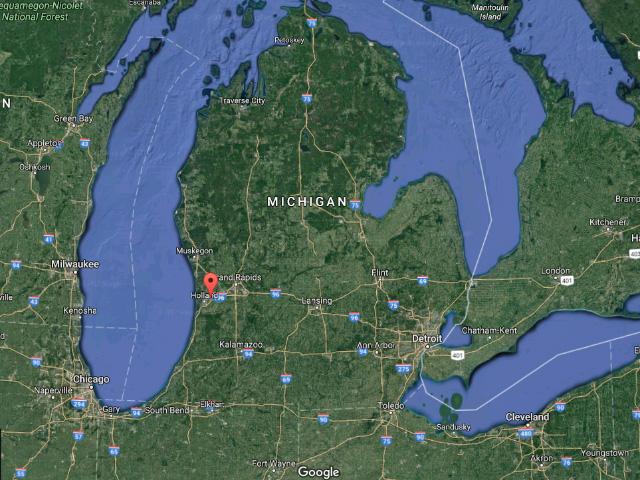

LINCOLN, Neb. (DTN) -- Zeeland, Michigan-based Boersen Farms has asked a federal court to lift a restraining order to complete what would be the operation's 10th sale of land and other assets connected to a lawsuit filed by a Utah-based equipment leasing company. This time, Boersen Farms is seeking to sell two parcels of land in Calhoun County, Michigan, as part of an effort to liquidate assets.

Boersen Farms leased more than 120 center pivots and other equipment from TFG-Michigan, a subsidiary of Utah-based TFG, according to court records, and has yet to pay for the leases.

TFG sued Boersen Farms in 2017 and later received a court order preventing the farm from selling property, as well as garnishment on the debt that is estimated at $33.2 million. TFG-Michigan is the judgement lien creditor in the case because the company won a judgement for that debt from the court.

This week, Boersen Farms asked the U.S. District Court for the Western District of Michigan to lift the restraining order to let the farm sell two parcels to KCFCU Properties LLC for $300,000.

"The Battle Creek property is encumbered by a mortgage held by B&K Holdings, LLC, as assignee of Farmland Capital Solutions, LLC, (FCS)," according to the motion filed by Boersen Farms, owned by Dennis Boersen.

FCS is the assignee of mortgagor First Farmers Bank and Trust, according to the filing.

"The purchase price, net of closing costs, will be paid to B&K at closing," the motion said. "No proceeds will be available for judgement lien creditors."

LIST OF ASSET SALES GROWS

Boersen Farms has now filed 10 motions to amend the restraining order granted to TFG-Michigan, leading to multiple sales of property in an attempt to pay off the debt.

If the latest sale is approved, by DTN's calculations, Boersen Farms will have sold more than $6 million in assets related to the TFG lawsuit.

Those motions include:

-- On Jan. 8, 2021, Boersen Farms motioned the court to allow the sale of land at 2941 Van Buren St. in Hudsonville, Michigan, to Jackson Hill LLC. That includes Calhoun County, Michigan, property on South Helmer Road and at Watkins Road in Battle Creek.

Boersen Farms entered into a purchase and sale agreement on Oct. 28, 2020, with James M. Austin, but the court document lists no amounts for the sale.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

-- On March 30, 2021, Boersen motioned the court to allow the sale of three parcels of land in Allegan County, Michigan. Court documents show the land contract was "in foreclosure" scheduled for sale on April 1, 2021.

Boersen told the court he had an agreement for the sale of the property to B&K Holding LLC, who would pay off the land contract, pay $100,000 to counsel for the plaintiff as well as any closing costs.

-- On Sept. 21, 2021, Boersen Farms motioned the court to allow it to enter a land contract for the sale of land and irrigation equipment to a John and Joyce Scherer in Cass County, Michigan.

"Boersen Land shall otherwise be restrained from delivering a warranty deed of the property to the buyer until and unless plaintiff receives the $100,000 payment on or before Dec. 28, 2021, as required by the land contract," the court document said.

-- Then, on Nov. 24, 2021, Boersen filed a motion to allow the sale of two parcels of land in Allegan County, Michigan, to the Match-E-Be-Nash-She-Wish band of Pottawatomi Indians of Michigan, also known as the Gun Lake Tribe.

Interestingly, in the court motion, Boersen Farms describes itself as a "dissolved Michigan corporation." The amount of the sale is not disclosed in court records.

-- On Oct. 24, 2022, Boersen Farms motioned the court to allow for the sale of three parcels of land in Hillsdale County, Michigan, and Van Buren County, Michigan.

"The property is encumbered by a mortgage held by Farmland Capital Solutions, LLC as assignee of First Farmers Bank and Trust," the motion said.

"Boersen reports that Acretrader 195 LLC, an Arkansas limited liability company, has agreed to purchase portions of the property for $3,610,000 and that the Acretrader purchase price, net of closing costs, will be

paid to FCS. No proceeds will be paid to Boersen.

"Boersen reports that B&K Holdings LLC, a Michigan limited liability company, has agreed to purchase portions of the property for $75,000 plus closing costs and that the B&K purchase price will be paid to AVT. No proceeds will be paid to Boersen."

-- Boersen Farms filed a motion on Dec. 5, 2022, asking the judge to allow for the sale of a tract of land in Ottawa County, Michigan, for $1,925,000 to PW Byron Road LLC.

-- On Dec. 29, 2022, Boersen filed a motion to be allowed to sell land at 3756 Riley St. in Hudsonville, Michigan.

"The property is encumbered by a mortgage held by Farmland Capital Solutions LLC as assignee of First Farmers Bank and Trust," the motion said.

"Boersen Farms reports that Raul R. Montiague and Lenore A. Montiague as part of a West Michigan Regional Vacant Land Purchase Agreement, have agreed to purchase the property for $985,000. The purchase price net of closing costs will be paid to FCS. No proceeds will be paid to Boersen Farms."

-- Boersen filed a motion on March 11, 2024, to sell three parcels of land in Lawrence, Michigan, to Ceres Farms LLC for $50,000.

-- On Jan. 27, 2025, the court handed down an order to allow Boersen Farms to sell land in Ottawa County, Michigan, for $450,000 with net proceeds paid to TFG-Michigan, L.P.

In addition, the court ruled Boersen could sell land in Battle Creek, Michigan, for $179,000, with the net proceeds going to B&K Holdings LLC, the assignee of First Farmer's Bank and Trust and Ceres Partners. Ceres is an investment management firm focused on food and agriculture based in South Bend, Indiana.

Boersen Farms has faced lawsuits for years from companies that provided products and services to the farm that once operated about 83,000 acres. Those lawsuits were filed to force Boersen Farms to pay money owed to the companies.

The farm was moving toward Chapter 11 in 2017 on the $145 million in loans owed to CHS Capital LLC, but a then newly formed lender based in Zeeland, LT Capital LLC, agreed to take on the Boersen Farm debt to CHS.

Read more on DTN:

-- "Boersen Farms Ordered to Pay Creditors," https://www.dtnpf.com/…

-- "Boersen Farms Liquidating to Pay Debts," https://www.dtnpf.com/…

-- "Suit Alleges Boersen Stole Equipment," https://www.dtnpf.com/…

-- "Michigan Farm Raided by IRS Sues Feds," https://www.dtnpf.com/…

Todd Neeley can be reached at todd.neeley@dtn.com

Follow him on social platform X @DTNeeley

(c) Copyright 2025 DTN, LLC. All rights reserved.