Call the Market

How 2023 Bullish Cattle Market Differs From 2014-15 Rally

The funny thing about the cattle market is that we know it runs in a habitual 10-year cycle. Typically, the years ending in the digits of 3, 4 and 5 typically garnish higher prices, while the rest of the years in the cycle extend weaker price points.

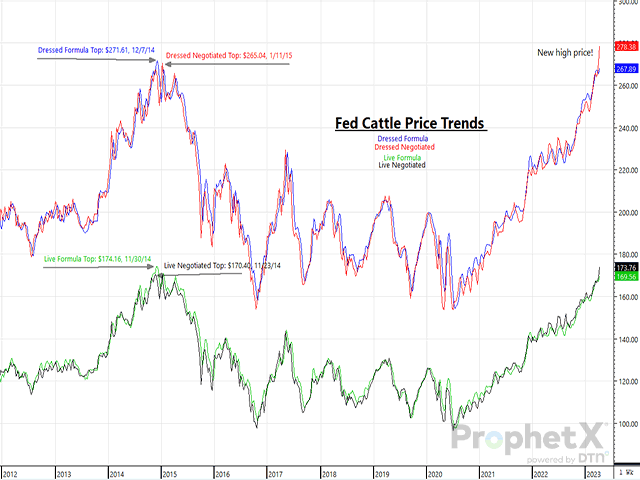

Even though the market has historically operated in this cycle, we know that no two markets are ever the same and that no two years will ever be identical. There's been much comparison between the early 2023 and the 2014-15 bull runs, but even these two cycle highs will be different than one another.

So, how does today's bullish market differ from that of 2014-15? There are three main points that are strikingly different to me about this bull run than the last: 1) tighter supplies, 2) stronger demand and 3) that the market is more susceptible to outside pressures.

TIGHTER SUPPLIES

Heading into the bull run of 2014-15, supplies were thin, but they were nowhere as thin as they are today. January's Cattle Inventory report highlighted that the beef cowherd sank to 28.9 million head, shrinking past the previous record low established in 2014 when the U.S. beef cowherd was at 29 million head. A mere 100,000 head difference in our beef cowherd may not seem like a catastrophic change, but the ramifications that this decrease will have on the market are significant.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

First, there's the realization that there are going to be fewer feeder cattle for feedlots to procure. The April 10 CME Feeder Cattle Index closed at $193.01, and from a feedlots' breakeven standpoint, today's feeder cattle prices are extremely high and outpace what breakeven figures indicate feedlots should be willing to give cattlemen for their feeder calves. When you take into account that there's a $25 to $28 price spread between the April 2023 feeder cattle contract and the September 2023 through November 2023 contracts, one could argue that paying the cheaper prices of today are still more affordable than the projected futures market prices of $229.75 in October and $230.95 in November.

Second, not only are there fewer cattle in the market to be had in this cycle phase, the cattle that are here aren't carrying the carcass weights we've become accustomed to during the last two to three years. Thus far into 2023, steers have averaged 906 pounds, whereas in 2022 at this time steers were averaging 921 pounds, and in 2021 steers were averaging 912 pounds. This past winter's brutal, harsh conditions kept cattle from gaining like feedlot managers expected them to and now, with market-ready cattle in tight supply, cattle continue to be pulled from showlists earlier and earlier, which continues to keep carcass weights low and drive the need for more cattle to keep up with current beef demand.

BEEF DEMAND

During the bull run of 2014-15, beef demand was nothing like what it is now. Toward the end of 2015, our export markets grew substantially, but that was at the end of that cycle peak. As we continue to work our way through 2023 and just kick off this bullish run, beef demand is thriving and shows no signs of weakening any time soon. Thus far in 2023, choice cuts have averaged $279.71 throughout the year. During the whole year of 2014, choice cuts averaged $239.09, and throughout all of 2015, choice cuts averaged $237.01.

High boxed beef prices can be risky and given the economic state that our country is in, I worry about boxed beef prices becoming too high for most Americans to afford. Back in 2014, the median household income was $53,657. In 2021, the median household income had grown to $70,784, according to the United States Census Bureau. Inflation is undeniable, and while U.S. consumers are feeling the economic pinch of our weakened economy, at this point consumers continue to yearn for beef and remain willing to spend their hard-earned dollars on it.

OUTSIDE PRESSURE

The way that the futures market trades is nothing like it was back in 2014-15. Electronic and algorithmic trading has completely changed the futures complex and just how fast any market can change on any given day. Unfortunately, I wish we could go back to the days when the market seemed somewhat protected from rumors and twitter chatter, but that's never going to happen. During the course of the next two to three years, we will see both live cattle and feeder cattle markets trade lower, and some outside pressure will affect the complex from time to time, but hopefully it only lasts for a short duration. At our recent spring planning meeting, DTN's Lead Analyst Todd Hultman said it best, "It doesn't have to make sense to affect the market."

CONCLUSION

It's odd to me that everyone knows when the cattle market is poor and when prices are unrewarding. However, just last week the negotiated cash cattle market took out the highs previously established in 2014-15 in the North, and yet the market doesn't seem to be getting the hype it deserves. The strong fundamental footing that the market possesses is incredible, and so long as no devastating outside pressures rob the market of its rally, we are just beginning to see what the cattle market could do during the next two to three years. Let's enjoy this ride friends, it doesn't come around very often!

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.