Global Fertilizer Outlook - 3

2023 Potash Outlook Sees More Supply, Lower Prices

OMAHA (DTN) -- The global potash (K) outlook in 2023 looks to be a bit of a mixed bag. The entire world fertilizer industry continues to watch closely the continuing war between Ukraine and Russia which could disrupt supply. Russia and Belarus account for 41% of the globally traded K and are the second and third largest producers.

Because of record-high fertilizer prices, farmers across the world cut back on these nutrients which caused much demand to fall. With more supply on deck in 2023, potash prices should push lower in the New Year.

LOWER K PRICES?

Chris Lawson, head of fertilizers for CRU International Ltd., told DTN that much demand destruction has been done to the K market in 2022. It was thought when the war began in February 2022 that this was going to limit the supply of potash, as so much comes from the Black Sea region -- so prices increased significantly.

However, the largest K producer in the world, Canada, responded with increased production. This increased Canadian production has helped to alleviate possible supply concerns, even with about 10 million metric tons annually from Russia and Belarus, he said.

Much like Brazil was an early indicator of what could happen in the U.S. in the phosphorus (P) market, what is happening now in Brazil is what could be seen for the K market in 2023 in the U.S.

Lawson said a build-up of K inventory in the South American country has occurred during the last four to five months after these initial supply concerns. Brazil, which imports nearly all the potash required for its fertilizer needs, pushed hard in half of the year to get nutrients.

However, potash had a substantial price decline in recent months, he said. Potash prices in Brazil dropped from $1,200/ton in April 2022 to just $600/ton in November 2022.

"This potash inventory is weighing on prices, both now in Brazil and to come in the U.S.," Lawson said.

Samuel Taylor, inputs analyst for RaboResearch, agrees there is no shortage of K fertilizer in the world at the end of 2022 and this situation should continue into 2023. The record to near-record high K prices pushed many farmers to curtail K fertilizer applications.

As a result, the price outlook in 2023 could be considerably lower, he said.

"I think we very easily could see a 25% to 30% decline in price on potash fertilizer in the U.S. in 2023," Taylor said.

Josh Linville, director of fertilizer at StoneX, said he also expects K prices to slip in 2023. Demand into the new year will struggle to overcome the downturn seen in 2022, he said.

With so much cutback of K fertilizer application internationally, Linville said the K market might even enter an oversupplied situation in the near future. "It is certainly a bearish situation (for prices)", Linville said.

LOWER K CAPACITY

The International Fertilizer Association (IFA) released its Medium-Term Fertilizer Outlook 2022-2026 in July 2022 (https://www.fertilizer.org/…). World K capacity in 2021 was just under 43.2 million metric tons (mmt) and estimated to be lower in 2022, according to IFA.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Because of the war in Ukraine, IFA presented three scenarios to reflect the uncertainty in the fertilizer market.

The optimistic scenario includes partial recovery of exports, improved affordability and minimal yield impact. The pessimistic scenario is the further deterioration of supply, worsening affordability and chronic shortages. The middle ground scenario would be pockets of availability and affordability crisis and trade-rerouting.

Potash capacity was adjusted on Russia and Belarus based on the ability to export. With the optimistic scenario, K capacity is forecasted to be 4.1 mmt lower than 2021, the middle ground scenario is almost 7.6 mmt lower and the pessimistic scenario is almost 9 mmt lower in 2022.

Potash capacity is forecasted to remain below the 2021 levels in all scenarios during the next five years, due to the high exposure to Russia and Belarus. IFA estimates global K capacity at between 36 mmt and 43.2 mmt in the three scenarios.

The three nutrients (N, P, K) have different levels of exposure to supply from the war limiting fertilizer coming from Russia and Belarus. Potash is a nutrient at far more exposure to capacity disruptions, with more than 80% of forecast expansion located in Russia than nitrogen or phosphorus.

K USE DROPS

IFA reported all global fertilizer use is set to drop by 1.6%, to 200.6 mmt, globally in 2021 after increasing by 6%, to 203.8 mmt, in 2020. The decline can be blamed on less affordable fertilizer and the war in Ukraine.

IFA forecasts world fertilizer consumption to be in the range of 186.8 mmt to 200.1 mmt for 2022 in the three scenarios. The numbers are forecasted to tick up slightly for 2023, ranging from 189 mmt to 204 mmt.

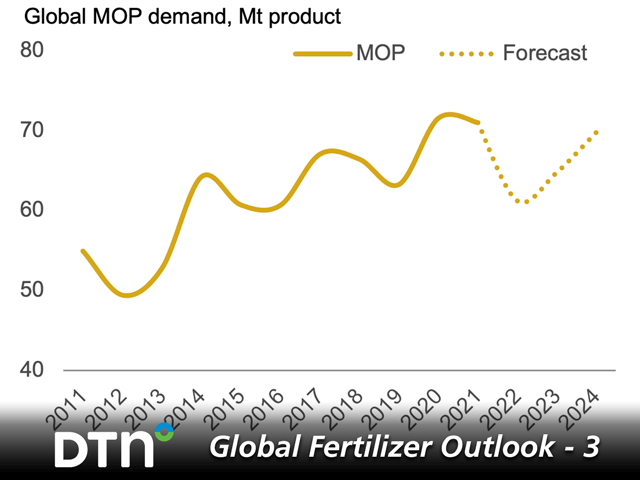

Potash consumption decreased 4% in 2021 after an 11% surge in 2020, according to IFA. The drop in K consumption was directly tied to nutrient availability.

Global K consumption is expected to experience the largest reductions in four regions -- South Asia, Africa, Oceania and West Asia -- in 2022.

IFA estimates the reduction could reach between 30% and 40% in South Asia and in Africa. Only a partial recovery is expected to take place in the following year in these four regions, even under the most optimistic scenario.

In the medium term (2024-26), global fertilizer demand is expected to continue in its demand recovery. Total global fertilizer demand is expected to range from 194.6 mmt to 211.1 mmt in 2026.

Potash consumption by 2026 has a wide range, according to IFA. The pessimistic scenario has K consumption at 36.6 mmt, while the mid-scenario has consumption at 38.3 mmt and around 43 mmt in the optimistic scenario by 2026.

Much of the middle-term outlook will be determined by both nutrient affordability and fertilizer availability.

FERTILIZER LOGISTIC ISSUES

One area that needs to be watched closely in the U.S. in the early part of 2023 is fertilizer logistics. This could affect both nutrient supply and price.

The all-important Mississippi River continues to operate at extremely low levels because of drought lowering river levels. Reports from the river say barges are operating somewhat lighter to negotiate the shallower river.

Linville said how slowly fertilizer moves up the Mississippi River this winter will have a large effect on both nutrient supply and price.

Another winter of dry conditions could make the situation even worse. Any logistics issues limiting the movement of fertilizer could quickly cause large price hikes, especially if the river remains low next spring.

"I can't overstate how important this situation really is when it comes to fertilizer supply and prices," Linville said.

**

Editor's Note: This is the third and final story in DTN's special Global Fertilizer Outlook series.

To see Global Fertilizer Outlook - 1, go to:

To see Global Fertilizer Outlook - 2, go to:

To see DTN's weekly column on Retail Fertilizer Trends, go to: https://www.dtnpf.com/…

See the monthly DTN fertilizer outlook on wholesale prices at https://www.dtnpf.com/…

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2022 DTN, LLC. All rights reserved.