Interest Rates Slow Farmland Value Rise

Growth in Farmland Values Slowed in Late 2022 as Interest Rates Rose to Decade Highs

MT. JULIET, Tenn. (DTN) -- The value of farm real estate climbed significantly in 2022, but higher interest rates slowed the upward march, instead of bringing it to a halt, like the housing market.

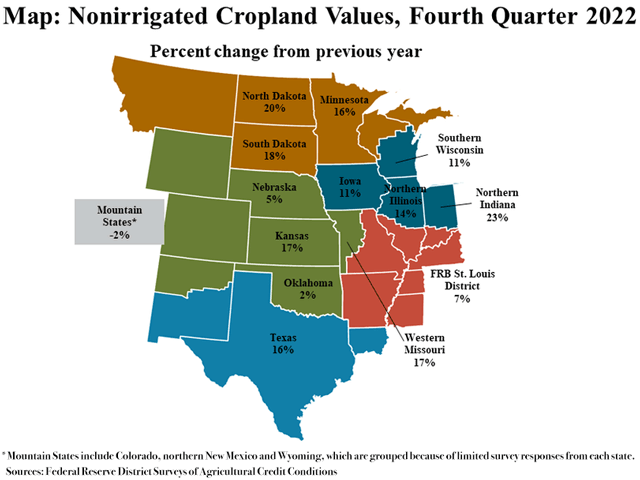

On average, the value of non-irrigated cropland gained 15% in 2022, according to quarterly surveys by Federal Reserve district banks that were compiled by the Kansas City Federal Reserve.

"Farm real estate values increased considerably in 2022 but showed signs of softening during the final months of 2022 as interest rates rose sharply," wrote KC Fed economists Cortney Cowley and Ty Kreitman. "While the value of most types of farmland continued to rise, the increase was the slowest since early 2021."

Interest rates on agricultural loans jumped to decade highs, reflecting increases in the Federal Funds Rate, which is what the Federal Reserve Open Markets Committee adjusts throughout the year. On average, interest rates on agricultural loans climbed by 150 basis points, or 1.5% from the previous quarter. They're about 300 basis points higher than at the same time last year.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

"Benchmark interest rates surpassed returns to farmland owners in recent months, which could put some downward pressure on growth in farmland values going forward," Cowley and Kreitman wrote.

For farmland, capitalization rates are computed as a ratio of cash rents to farmland values. It's been decreasing continuously over the last 15 years. In the Kansas City district, for example, the cap rate fell from 5.4% in 2009 to 3% at the end of 2022. Returns are even lower in the Dallas region, below 2%.

"Conversely, risk-free rates of return rose dramatically in 2022, and the average yield of a 3-month Treasury was 4.2% at the end of the year," they wrote.

Bankers report that strong incomes are supporting repayment rates and overall credit conditions, but they are reporting some softening, with the pace of improvement slowing in the Kansas City and St. Louis districts, while holding steady in Dallas and Minneapolis.

"The outlook for agricultural credit conditions looking ahead into 2023 also remained generally positive, despite some ongoing concerns," Cowley and Kreitman wrote. "Elevated commodity prices continued to support profit opportunities for many producers across the farm sector, but concerns about operating expenses, higher interest rates and intense drought persisted. While improvement in farm income and credit conditions has softened slightly in recent months, farm finances remained strong following especially strong agricultural economic conditions the past two years."

You can read the entire article, "Growth in Farmland Values Slows Amid Higher Interest Rates," here: https://www.kansascityfed.org/….

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her at @KatieD_DTN on Twitter

(c) Copyright 2023 DTN, LLC. All rights reserved.