Best Blog of the Week

DTN Ag Policy Blog: Looking at the 2024 ARC-PLC Decision

Enrollment is ongoing for the Agricultural Risk Coverage and Price Loss Coverage for the 2024 crop year. The enrollment deadline is March 15, 2024, at your local Farm Service Agency office.

While the 2023 crop is highly unlikely to generate an ARC or PLC payment, a University of Nebraska-Lincoln webinar highlights new wrinkles to consider for ARC-PLC decisions involving the 2024 crops.

ARC-PLC OUTLOOK FOR 2023-24 CROPLooking at the 2023 crop harvested last fall, the marketing year continues until the end of August. But given the current national marketing year average prices for corn and soybeans, there will be no PLC payment for those 2023 crops.

"There is no doubt there won't be a PLC payment for 2023 to be paid here in 2024," said Brad Lubben, an ag policy specialist and extension associate professor at the University of Nebraska Department of Agricultural Economics. "Prices are high enough that even if we substantially fell off those price expectations, we're a long way from trigging any sort of PLC payments."

PLC only focuses on price, not yield. It is not going to pay out if the national marketing average price for the year remains higher than the PLC reference price.

It would take a 25% to 35% price collapse to trigger an ARC-County payment for the 2023 crop in most counties nationally for corn, soybeans, sorghum or wheat. It is possible there will be ARC payments in some counties that suffered significant yield losses, but Lubben said that's likely to be limited.

"The expectations are somewhat muted here," he said.

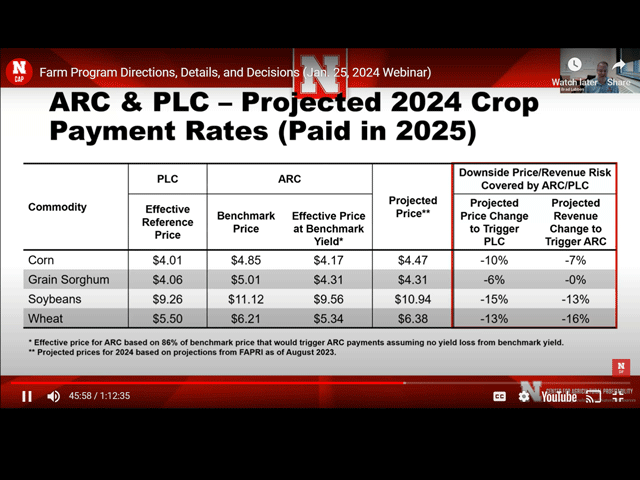

'EFFECTIVE' PRICE KICKS IN FOR 2024The lack of a 2023 payment doesn't mean the ARC-PLC decisions for the 2024-25 crops are irrelevant. That's because a change in the 2018 farm bill, for the first time, kicks in higher, "effective" reference prices for 2024, showing higher reference prices for corn, grain sorghum and soybeans. That's because of the ending five-year Olympic price averages going back to 2018. The reference price for wheat remains at $5.50 because it has not seen as many stronger price years as the other crops.

Effective reference prices for 2024:

Corn, $4.01

Grain sorghum, $4.06

Soybeans, $9.26

Wheat, $5.50

ARC-COUNTY CALCULATIONSThose higher reference prices also roll into the ARC-County equations. For instance, the $4.01 effective reference price for corn changes the math on the Olympic average price for ARC-County, bumping it up to $4.85. Then that is multiplied by 86%, creating an "effective ARC price" of $4.17 a bushel for corn. As Lubben's calculations show, the effective ARC prices look like:

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Corn, $4.17 a bushel

Grain sorghum, $4.31 a bushel

Soybeans, $9.56 a bushel

Wheat, $5.34 a bushel.

Lubben then compared the PLC and ARC effective prices to the baseline price projections for 2024-25 crops from the Food & Agricultural Price Policy Research Institute (FAPRI). Its price projections for 2024 look like:

Corn, $4.47

Grain sorghum, $4.31

Soybeans, $10.94

Wheat, $6.38

Based on those projections, these are the price changes that would be needed to trigger payments -- assuming there is no county yield loss that also factors into the ARC-County equations:

-- Corn prices would need to fall 10% to trigger a PLC payment, or projected revenue would need to fall 7% under ARC-County to trigger a payment.

-- Grain sorghum prices would need to fall 6% to trigger a PLC payment, or projected revenue would need to remain the same to trigger ARC-County payments.

-- Soybeans prices would need to fall 15% to trigger a PLC payment, or projected revenue would need to fall 13% under ARC-County.

-- Wheat prices would need to fall 13% under PLC, or revenue would have to fall 16% under ARC-County.

More forecasts on price projections for the 2024-25 crops will come out on Feb. 15 and 16 when USDA releases its Outlook forecasts for 2024.

PAYMENT POTENTIALPLC and ARC-County each have their areas where one is more dominant over the other in price and yield loss scenarios.

Looking at illustrations of county yields and prices, 140 bushels per acre at $4.47 a bushel will not generate an ARC-County payment because it hits revenue expectations. At $4.02 a bushel, a 140-acre county yield would generate a $20.72 payment.

Lower prices or yield could generate payments that cap out at $67.90 an acre under Lubben's calculations. That's because ARC-County only pays out on a 10% payment of the benchmark guarantee revenue.

If prices fall sharply, PLC pays more because it is not subject to a benchmark guarantee and 10% cap.

When there are shallow price losses, or sharp losses in yield, there is a range of low-yields and higher prices where ARC-County will pay out but PLC will not because the marketing prices remain higher than the reference price.

For more details, you can watch the full UNL webinar here: https://cap.unl.edu/…

The University of Illinois also has a look at PLC and ARC-County for 2024 as well as a tool to download and run calculation scenarios: https://farmdocdaily.illinois.edu/…

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on X, formerly known as Twitter, @ChrisClaytonDTN

(c) Copyright 2024 DTN, LLC. All rights reserved.