Call the Market

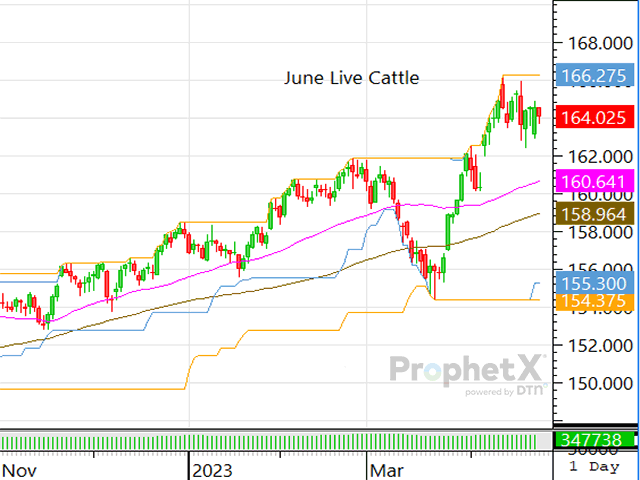

Why Are Cattle Trading Lower When the Fundamentals Are Strong?

If you watched the market during the last week, you noticed the complex seemed to lose focus of its strong fundamental position. Instead, it's taken on a weaker, less aggressive approach in nearly every facet of the business.

Why is that so? Boxed beef demand is still stellar, as just last week choice cuts averaged $306.51 (up $8.60 from the previous week) and select cuts averaged $289.79 (up $7.89 from the week before). Front-end supplies of market-ready cattle are still bleakly thin, and carcass weights continue to be well-below year-ago levels, which offers less product for the market to sell to end consumers.

Last Thursday's actual slaughter data shared that, for the week ending April 8, steers averaged 892 pounds, which was 6 pounds lighter than the prior week and 20 pounds lighter than the same week a year ago. For the same week, heifers averaged 828 pounds, which is 1 pound lighter than the previous week and 12 pounds lighter than a year ago. And, even with the new cash cattle market highs established earlier this spring, beef packers have maintained positive margins. This may seem like an odd point to highlight, given that their margins rarely ever suffer, but monitoring packers' margins is incredibly important through this new phase in the cattle cycle, as packers will not operate in the red for the long term. Thus far through 2023, beef packer gross margins have averaged $275 per head, which stems from outstanding demand and high beef prices.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

So again, I ask, why is the cattle market trading lower this week when the market's fundamentals haven't changed? As annoying and unsatisfying as it may be, the market is trading lower this week as external pressures loom and cattlemen have seemed to forget their position in this current price war.

With pressures of high inflation and increasing interest rates, the economic turmoil of our nation cannot be overlooked. The markets seem increasingly sensitive during this time of year as traders long for newsworthy material. Sometimes that comes in the form of weather changes, planting updates, drought notices, changes in boxed beef prices, throughput variations, etc. At other times, however, it can be much simpler than that, as the market can accept a "mood" when support seems a little too far away to reach.

Cattlemen have also seemed to simply accept the market's recent lapse of focus instead of continuing to drive prices higher. Yes, there was anxiousness throughout the market last week ahead of Friday's Cattle on Feed report, but a COF report comes out once a month. Are cattlemen really willing to throw away trade every four weeks simply because a USDA report comes out?

When packers are in the driver's seat of the market, they don't worry about potential hiccups in their market. Instead, they remain focused on what favors their position and control the market variables that they can. When it comes to marketing cash cattle, feedlots need to do the same.

Last week's Cattle on Feed report shouldn't have been viewed as problematic or bearish, as there are starkly fewer cattle on feed and feeders placed last month than there were a year ago. But because the USDA's numbers varied from analyst projections, traders and packers opted to view Friday's COF report as a weight to hold the cash cattle market back.

Feedlots need to remember that beef demand is still incredible, and market-ready supplies of fat cattle are thin -- so they might as well drive prices higher while the opportunity lasts.

You can lose weekly market battles, but to win long-term price wars, you've got to remain strategic and unwaveringly focused.

ShayLe Stewart can be reached at ShayLe.Stewart@dtn.com

(c) Copyright 2023 DTN, LLC. All rights reserved.