Kub's Den

New Year's Resolution: Good Grain Marketing Habits

If you make a New Year's resolution to "lose weight" and then you go on a gluttonous binge at an oyster bar with sketchy hygiene, end up losing the contents of your stomach and camping out by the toilet for 36 hours, then discover that (ta-da!) you've suddenly "lost" five pounds ... was it a successful resolution? What lessons should you draw from your actions?

I wonder about the lessons we've internalized from the grain markets of the past two years, when "do nothing" has been a wildly successful grain marketing plan, rewarding those who either sold at harvest or -- better still -- locked their crop away in a bin, unhedged, and didn't get around to selling it until the next summer.

The grain markets don't usually work this way. Their seasonality doesn't typically reward these actions.

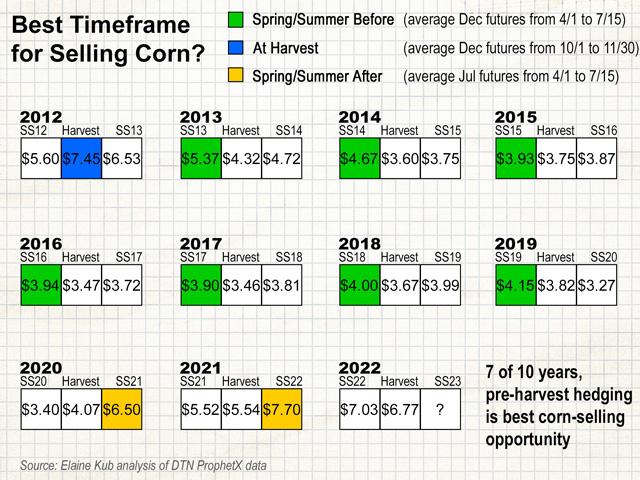

In seven of the past 10 marketing years, the bestselling opportunity for corn appeared in the spring and summer before harvest, when the crop was still an unknown quantity. It's true that spring prices for old-crop corn are generally a little higher than the prices seen at harvest, but the prices that were available for hedging new-crop corn a year previously were usually even better than that.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The tricky part is that each individual producer's crop size is also an unknown quantity in the spring and summer before a harvest, making it a challenging and sometimes psychologically uncomfortable timeframe to be selling grain (when you're not entirely convinced you'll have grain to sell). This is why it takes resolve and discipline -- a New Year's grain marketing resolution, if you will.

Consider young farmers who have only been in the business since 2020 -- a stretch of time when grain prices have done almost nothing except trend upwards. What advice would you give them for marketing their 2023 crop? What habits would you suggest they develop for all the future marketing years of their careers? Keep on wingin' it and hoping the markets will always reward inaction?

Memories are fickle things, so even more experienced farmers who've been doing this for 40 years may feel a stronger pull from the memory of $8 cash corn in the spring of 2022 than from the long, boring slog of locking in new-crop prices near $4 by making regular, disciplined, seasonal sales for the 2013-2019 marketing years. However, those with a long enough memory will also recall every commodity market's relentless habit of eventually dropping back toward an equilibrium price somewhere around the cost of production.

I'm not here to say with confidence that today's corn market, for instance, is immediately going to start falling back toward an equilibrium price below $4 per bushel ... not necessarily yet; not when global feed grain supply still seems precarious (and the U.S. corn stocks-to-use ratio is barely 9%). But for any given roll of the dice, I'd guess the corn market is more likely to move down from $6.50 than up from $6.50.

If I was giving advice to young farmers who want to develop good grain marketing habits, I would suggest they develop an annual practice of locking in prices for some portion of each year's intended production during the spring and summer before harvest.

Call it a New Year's grain marketing resolution and remember that the most effective resolutions are both measurable and action based. "Lose 20 pounds and reach 20% body fat" is more measurable than "lose weight and get fit," so it's the only way you'll definitively know if you've succeeded in your goal or not. "Sell some corn at $7" is more measurable than "sell corn at a high price." However, neither of those measurable goals are action based, so neither is entirely within your control. This is the problem with setting commodity price tag "goals" -- if you sit around and wait for a $7.00 cash corn bid at your local elevator, it may never happen. Far better, in my opinion, is to set action-based goals with timeframe deadlines. For instance: "Lift weights three times per week," or "Lock in new-crop grain prices on at least 50% of expected production by June 15, 2023." Adjust as necessary to make it fit your operation and your own risk preferences -- which hedging tool to use; how much to sell; how early to start; when to set the deadline; etc.

In the end, you'll have set a goal that's both measurable and action based, and you'll have history on your side.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Elaine Kub, CFA is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2023 DTN, LLC. All rights reserved.