Todd's Take

Friday's Corn Market Just Got More Frustrating

This past week, I was at the Peoria Farm Show, talking mainly about corn and soybean markets, and laid out what I believe are the most important pieces of information to focus on for making marketing decisions. For me, it's largely about traditional basics. Are supplies of corn or soybeans easy for end users to obtain or are supplies tight? When will the next competing supplies become available? What do basis levels say about demand? After all, who knows more about grain markets than the commercials making the cash bids? Finally, what time of year is it? Grain prices tend to reflect plentiful supplies at fall harvest and tighter supplies in early summer.

If you notice, I don't get caught up a lot in the daily news and latest rumors. There's nothing wrong with being informed and, in my job, it's mandatory. However, I'm not trying to teach farmers how to day trade. In my experience, trying to outguess all the topics that are worrying traders is a losing game and is why many noncommercial traders do not stay in the business long. The world doesn't need more nervous traders reacting to every little thing that comes across the news wire.

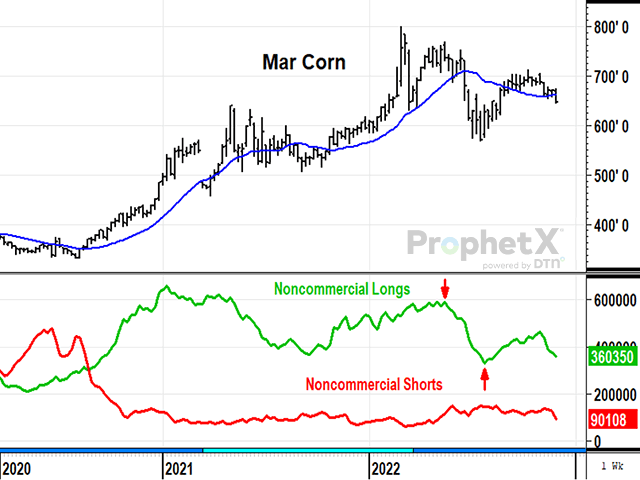

Right or wrong, there are currently a lot of specs in corn, and they swing a big bat of price influence. Just this summer, we saw corn and soybean prices take a sharp dive south as traders saw worsening headlines about the economy go across their television screens. In mid-June, Federal Reserve Chairman Jerome Powell warned of recession and specs wasted no time in dumping their long positions in corn and soybeans.

By mid-July, March corn fell below $6.00 and January soybeans dipped its toe below $13.00. The news was bad, the mood was bad, and prices were falling. But it would have been a shame for any producer to get caught up in the emotional bearishness and sell his or her corn or soybeans at those lower prices. I tried to explain in market comments at the time that the market was showing no respect for the supply situations in corn and soybeans. From a fundamental view, July's lower prices made no sense.

Fortunately for anyone listening, staying focused on the fundamentals was the right choice at the time and both corn and soybean prices rebounded. Soybeans snapped back within weeks and corn took a couple months, but more reasonable pricing did prevail once the specs quit selling.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

This past week's bearish dive in corn reminds me of the situation we saw this summer. In the week ending Dec. 2, March corn fell 25 cents to a new three-month low of $6.46 1/4. From a technical perspective, Friday's lower close looked like a classic bearish break to sell. It is no secret U.S. corn export commitments are off to a horrible start this year, down 48% from a year ago. USDA's ending stocks estimate of 1.18 billion bushels will likely need to be raised at some point, but there are also good reasons to expect better export business later in 2023.

A relatively new concern for corn demand is developing in the ethanol market. The price of Chicago ethanol fell 27 cents in the week ending Dec. 2 to $2.175 a gallon, the lowest close since February. Part of the drop may have been related to the decision to keep rail service operating, which President Joe Biden signed into law Friday. The drop in the ethanol price will also hurt plant margins and adds to concerns about a recent drop in gasoline demand, reported 5% lower than a year ago as of Nov. 25.

From my perspective, the disagreement between the bullish national corn basis and the new bearish price action muddies the water for corn's longer-term price outlook and makes corn's marketing decision more difficult. It also doesn't help that this is typically not a favorable time of year for selling corn. Corn's seasonal high is traditionally in late May.

There have been recent reports of weakening corn basis levels in the Western Corn Belt, but Friday's DTN's National Corn Index settled at $6.60, still the strongest national basis in over 20 years at 14 cents above the March contract -- a strong vote of confidence from the firms that know demand best.

The right answer in this situation will likely come down to the farm's balance sheet. A well-heeled farm where the land is paid for and enjoyed good yields in 2022 is in better shape to give the corn market time to see how prices look in the spring of 2023. A farm that is short on cash or suffered poor yields in 2022 is probably better off cutting its risk by taking advantage of corn's current prices.

As you all know, I can't guarantee the current sell-off in corn will fizzle out the same way it did this summer -- surprises can happen. However, I continue to suspect corn prices will have better days when U.S. supplies become tighter in the spring and early summer of 2023. I don't have any predictive ability regarding what nervous traders will react to next, but it is difficult to ignore the bullishness of a strong commercial basis at harvest time, even after Friday's technical picture turned bearish.

**

This year's DTN Ag Summit will be held virtually on Dec. 12 and 13, meaning you can watch this premiere ag event in the comfort of your favorite chair, at a time that is convenient for you. Check out the topics and speaking lineups at www.dtn.com/agsummit. We'd love to have you join us!

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com.

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.