Kub's Den

Forecasting Natural Gas Prices: How High From Here?

Even if natural gas prices hadn't more than doubled over the past year, grain producers would still be sensitive to this topic. This is the time of year when newly harvested grain may need to be dried down, a process that requires fuel. Drying charges at the elevators are higher this year when natural gas is more expensive (just like everything else). Even on-farm drying charges can range anywhere from 5 to 25 cents per bushel, depending on the efficiency of the system and how wet the grain is to begin with.

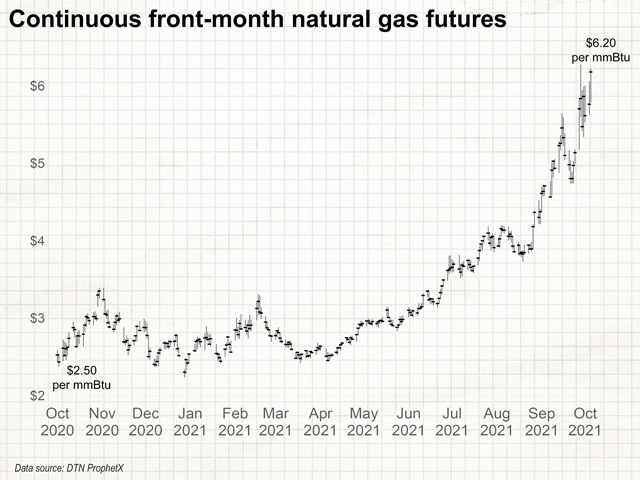

So, let's say you anticipate needing to buy a significant quantity of natural gas between now and March. Should you lock in prices at today's eye-watering $6.20 per metric million British thermal unit (mmBtu) before the rally streaks even higher or should you wait until the craze dies back down?

You need a price forecast.

If you just look at a chart, your gut instinct will likely predict natural gas prices will continue on their current upward path toward infinity. But that instinct is largely dependent on how the chart was drawn. If, instead of looking at daily prices over the past year, you look further back to include 2014's midwinter peak at $6.49 and 2008's summer rally to $13.70 alongside other commodities' bullishness or December 2005's record high of $15.78, then the chart may serve to remind you that this is a market that streaks higher and collapses lower every once in a while. Your gut may predict an imminent pullback. It all depends on how methodically you approach the forecasting process -- whether you systematically consider all the logical influences or whether you let your misguided instincts run away with you.

When it comes to forecasting prices, there are six common errors in thinking, known as cognitive biases, which tend to cause problems.

ANCHORING BIAS

When we give undue weight to the first number we think of (or the first number we hear out loud), that's anchoring bias. Maybe you remember an invoice from last fall when natural gas prices were $3.30 per mmBtu, or perhaps you're still traumatized from paying $4.50 per mmBtu back in November 2018 -- whichever price you think of first, if you let that number color your expectations of what may happen next, you may neglect more important information for a logical forecast. Or how about a headline showing international liquified natural gas prices at $20 mmBtu? Now that's an anchor that could really bias your opinion about how "cheap" U.S. natural gas may be, even at today's $6.20 per mmBtu.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

STATUS QUO BIAS

When we just assume the situation today is going to continue into the future as a default, that's status quo bias (which is very similar to "anchoring," with the anchor set on whatever the price is today). It ignores logical expectations for change and it encourages inaction, which can be very dangerous in markets that we know rarely stay at the exact same price level for long.

CONFIRMATION BIAS

When we seek out information to confirm what we already believe or discount new information that contradicts our existing beliefs, that's confirmation bias. Let's say you form an opinion that natural gas prices have topped out and aren't going to get any higher than $6.20 per mmBtu, so you're just going to wait to lock in a price when things get lower. In that instance, every intraday dip lower will reassure you, and every headline about a mild winter will convince you of your own intelligence. If the rally continues higher, you'll shrug it off as a temporary blip. This is very dangerous because confirmation bias soothes us into thinking we can just ignore all the fundamental news that we don't agree with and don't want to act on. We can fight against it by playing devil's advocate: try to sincerely argue the opposite case against your original opinion and see if you can find more convincing evidence.

OVERCONFIDENCE BIAS

When we get too pleased with the accuracy of our own intuition or judgement, that's overconfidence bias. It leads us to stop looking for alternative explanations and, dangerously, to forget about all the unknown knowns and unknown unknowns that we haven't even considered in our forecasts. Those can be unpleasant surprises.

PRUDENCE BIAS

When we're too cautious with our expectations and we tamp down our forecasts just so that they don't seem too extreme, that's prudence bias. It's often motivated by peer pressure or groupthink (humans don't like to be the only one sticking out from a group) or sometimes by fear for one's long-term reputation. Simply being aware of this tendency can help to counteract the urge.

AVAILABILITY BIAS

When we get overly influenced by the most "available" scenario in our memory -- typically the most extreme event that left the strongest impression -- that's availability bias. It can lead to undue caution if all we're thinking about is past disasters, instead of positioning for more likely neutral or positive situations. Or it can lead to overconfidence, if all we think of is past success and fail to position ourselves for the full range of potential outcomes.

Now, I don't want to say that the old guys are immune from these cognitive biases (because they're obviously not; I'm sure you can think of examples when you or someone you know has fallen victim to each of these). However, there is one good cure for cognitive biases and that's experience. Once you get burned for being overconfident, you swing too far the other way and get hit by prudence bias, so you swing back, and then eventually, after accumulating enough experience, you calibrate your forecasting intuition to not get hung up on any one anchor or past scenario. Ideally, you start to use a systematic process to evaluate all potential outcomes, maybe even a checklist for known knowns, known unknowns, unknown knowns and unknown unknowns, and you remember to play devil's advocate to argue against your own confirmation bias before making any bold predictions.

Unfortunately, elevators and grain producers need natural gas in the very near term to get grain dried. If we don't already have prices locked in from months ago, we can't realistically wait around for a few months for the chart to peak out and collapse. Eventually, it may do so, because the factors pushing prices higher right now are mostly international (pipeline issues from Russia, breakdowns at LNG export plants, lower production during the pandemic) and the countries buying natural gas right now -- Japan and Europe -- are steadily refilling their storage in anticipation of winter. Anyway, U.S. natural gas supply and demand is somewhat insulated from the international market because the fuel must first be liquified and transported before it can be arbitraged at those higher international prices. As long as the Northern Hemisphere doesn't get hit with an unusually cold winter, then global supply and demand may balance back out in the typical fashion. Let's hope so, because global fertilizer production for spring planting will depend on natural gas availability too, but that's a whole 'nother exercise in forecasting.

Elaine Kub is the author of "Mastering the Grain Markets: How Profits Are Really Made" and can be reached at masteringthegrainmarkets@gmail.com or on Twitter @elainekub.

(c) Copyright 2021 DTN, LLC. All rights reserved.