DTN Retail Fertilizer Trends

Average UAN28 Fertilizer Price Drops 9% During January 2023

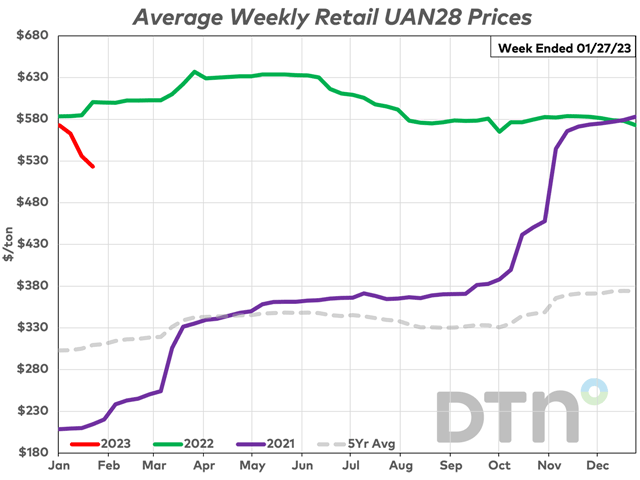

OMAHA (DTN) -- Retail fertilizer prices continue to see significant price declines, according to prices tracked by DTN for the fourth week of January 2023. This trend has been in place since the beginning of the year.

Seven of the eight major fertilizers are lower compared to last month. Of these seven, five fertilizers were substantially lower, which DTN designates as a price change of 5% or more.

Leading the way lower is UAN28. The nitrogen fertilizer was 9% lower in price compared to last month and had an average price of $523/ton.

Potash, anhydrous and UAN32 were 7% less expensive looking back to last month. Potash had an average price of $714/ton, anhydrous $1,237/ton and UAN32 $630/ton.

Urea was 6% lower in price compared to the prior month. It had an average price of $708/ton.

Both DAP and MAP were slightly lower looking back to last month. DAP had an average price of $855/ton while MAP was $865/ton.

One fertilizer was just slightly higher in price compared to a month earlier. 10-34-0 had an average price of $754/ton.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

On a price per pound of nitrogen basis, the average urea price was at $0.77/lb.N, anhydrous $0.75/lb.N, UAN28 $0.93/lb.N and UAN32 $0.98/lb.N.

A recent University of Minnesota blog post titled "Nutrient management on owned vs. rented ground" looked at the various factors farmers should consider when applying fertilizer on owned ground versus rented ground.

Dan Kaiser, University of Minnesota Extension nutrient management specialist and Jeff Vetsch, University of Minnesota soil scientist, wrote that a "build and maintain" strategy may not be the best option for farmers renting ground, especially considering short-term land tenure. However, not applying any fertilizer and allowing soil tests to drop to low levels isn't good either.

"Applying only what the crop needs, which is what we call the "sufficiency approach," makes more sense in situations where you are willing to accept more risk or situations where soils cannot economically be built up to near the 100% critical level," they wrote.

While the sufficiency approach doesn't center on building soil test values, suggested fertilizer rates are typically in excess of crop removal for low-testing soils, with the goal of building soils to near medium soil test ranges. Maintaining soil tests near the 95% critical level makes more sense for renters because a fertilizer application is more likely to be profitable.

Regardless of whether the land is owned or rented, the authors remind farmers about the importance soil testing plays in applying nutrients.

To read the entire University of Minnesota report, click on the following link https://blog-crop-news.extension.umn.edu/….

All fertilizers are now lower compared to one year ago. DAP is 3% lower, both MAP and 10-34-0 are 8% less expensive, UAN32 is 10% lower, potash is 12% less expensive, UAN28 is 13% lower, anhydrous 17% less expensive and urea is 22% lower compared to a year prior.

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

Retail fertilizer prices tracked by DTN show prices are the lowest they have been in 15 months. You can read it here: https://www.dtnpf.com/….

DTN recently published a series titled "Global Fertilizer Outlook" listed here:

To see Global Fertilizer Outlook - 1, go to: https://www.dtnpf.com/…

To see Global Fertilizer Outlook - 2, go to: https://www.dtnpf.com/…

To see Global Fertilizer Outlook - 3, go to: https://www.dtnpf.com/…

| DRY | ||||

| Date Range | DAP | MAP | POTASH | UREA |

Jan 24-28 2022 | 877 | 936 | 814 | 910 |

Feb 21-25 2022 | 874 | 934 | 815 | 885 |

Mar 21-25 2022 | 1014 | 1018 | 850 | 976 |

Apr 18-22 2022 | 1050 | 1079 | 879 | 1012 |

May 16-20 2022 | 1059 | 1083 | 878 | 993 |

Jun 13-Jun 17 2022 | 1046 | 1074 | 879 | 961 |

Jul 11-15 2022 | 1030 | 1052 | 885 | 861 |

Aug 8-12 2022 | 982 | 1032 | 881 | 812 |

Sep 5-9 2022 | 952 | 1009 | 878 | 800 |

Oct 3-7 2022 | 934 | 997 | 869 | 826 |

Oct 31-Nov 4 2022 | 930 | 981 | 857 | 826 |

Nov 28-Dec 2 2022 | 926 | 960 | 831 | 795 |

Dec 26-Dec 30 2022 | 885 | 891 | 765 | 751 |

Jan 23-Jan 27 2023 | 855 | 865 | 714 | 708 |

| LIQUID | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

Jan 24-28 2022 | 817 | 1492 | 601 | 699 |

Feb 21-25 2022 | 837 | 1488 | 602 | 703 |

Mar 21-25 2022 | 881 | 1523 | 622 | 698 |

Apr 18-22 2022 | 906 | 1534 | 631 | 730 |

May 16-20 2022 | 906 | 1529 | 634 | 731 |

Jun 13-Jun 17 2022 | 905 | 1516 | 630 | 730 |

Jul 11-15 2022 | 904 | 1449 | 606 | 701 |

Aug 8-12 2022 | 881 | 1365 | 578 | 678 |

Sep 5-9 2022 | 866 | 1357 | 579 | 658 |

Oct 3-7 2022 | 813 | 1390 | 565 | 652 |

Oct 31-Nov 4 2022 | 759 | 1426 | 583 | 680 |

Nov 28-Dec 2 2022 | 753 | 1416 | 583 | 681 |

Dec 26-Dec 30 2022 | 751 | 1325 | 573 | 679 |

Jan 23-Jan 27 2023 | 754 | 1237 | 523 | 630 |

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.