Todd's Take

Are China's Problems Adding to Bearish Pressures in US Corn, Soybeans?

After several years of trading escalating tariffs with the Trump administration, increased demand from China played a large role in lifting U.S. corn and soybean prices higher in the fall of 2020. China eventually bought a record-high 846 million bushels (mb) of corn and record-high 1.305 billion bushels (bb) of soybeans in the 2020-21 season, a year of released pent-up demand that may not be repeated anytime soon.

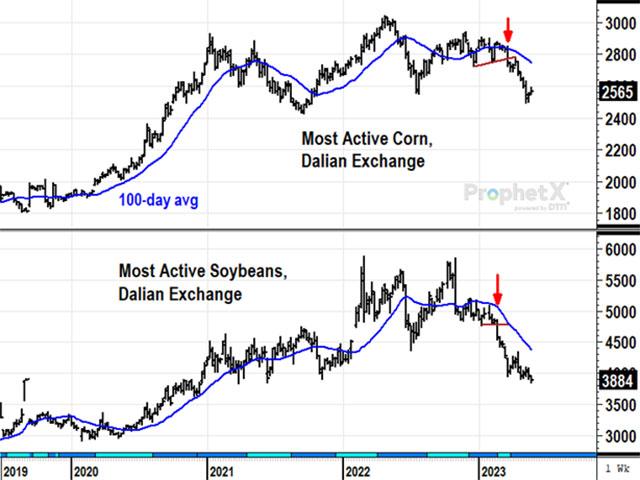

So far in 2022-23, China has bought 293 mb of U.S. corn and 1.142 bb of U.S. soybeans, a disappointment for U.S. corn prices, but an impressive amount of soybeans. On March 1, soybean prices in China began breaking lower and corn prices followed three weeks later. The unexpected price weakness at the time wasn't clearly understood but played a part in leading DTN to recommend forward cash sales for new-crop corn and soybeans. Now, over two months later, new-crop prices of U.S. corn and soybeans are on a downhill slide, and we're just starting to get hints of changes taking place in China.

I recall writing in March that perhaps a combination of African swine fever (ASF) and avian influenza were possible culprits, scaring traders out of China's soy complex, and that still may be part of the story as ASF has been reportedly spreading in northern China. However, ASF in China was much more disruptive to China's hog herd in 2019 than it has been lately and soybean prices never suffered all that much in 2019 as a result.

Just this week, more items about China surfaced that may help shine a light. On Wednesday, May 24, Reuters reported feed mills in southern China began using more wheat in place of corn, and the practice spread to northern China this month. The government has been urging reduced corn and soybean meal rations in livestock feed for at least two years and it appears the industry is getting more serious about trying it.

Another report came from NBCNews.com on Thursday, May 25, saying a new variant of COVID-19 is spreading through the country. XBB is the latest Omicron variant on the rise, and a respiratory disease specialist in China was quoted as saying the new wave started in late April and is expected to reach a peak of 65 million new infections per week by the end of June. Not wanting to sound callous, but China experienced several COVID scares in 2022 and did not show a decline in demand for either corn or soybeans, certainly nothing similar to what we're seeing in early 2023. COVID can scare traders and cause numerous domestic problems, but on a national scale, it has not significantly made dents in the demand for food or feed.

Other reports in this week's news express various concerns about China's economy, and I don't doubt there are plenty of risks and threats to China's economy. An article from Monday's Wall Street Journal talked about China's high rate of youth unemployment. Thursday's New York Times talked about China's high vacancy rates being a sign of a housing crisis. This seems to be a perennial story as I recall 60 Minutes covering the same topic years ago. As I've said many times, it is difficult to get information out of China, but the two indicators that make me suspect something is amiss are the Shanghai Composite Index and spot price of copper. Both have turned lower lately and are trading below their 100-day averages -- signs of a possible slowdown.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A parting concern that traders might have about China these days is related to the current impasse over raising the U.S. debt ceiling. According to USAfacts.org, Japan held over $1 trillion and China held $855 billion of U.S. debt as of 2022. If the U.S. hits the debt limit sometime in June before an agreement is struck to raise the ceiling, the U.S. Treasury Secretary will be in charge of which bills get paid and which do not. Holders of U.S. Treasuries are thought to be high on the list, but nothing is certain and such a default could have unintended consequences, including increased trader anxieties about U.S. relations with China and the instability of all markets, in general.

Early Friday, news reports are saying an agreement to raise the ceiling for another two years is close and I hope it works out for many reasons. Markets don't need the unnecessary paralysis that would come from a government shutdown.

Considering everything above and realizing there could be another factor we don't yet know about, I suspect the bulk of selling in China's corn and soy complex prices to date is a combination of a new record soybean harvest from Brazil, the anticipation of record corn production from Brazil just over a month away and, possibly, some success in limiting corn and soybean meal in feed rations. China's economy appears to be on a downswing and bouts of COVID won't help, but as we have seen before, slower economic performance doesn't mean people quit eating.

The main thing to know is U.S. grain and oilseeds markets appear headed for larger surpluses in 2023. Unlike the situation in 2020, China appears in no position to take those surpluses off our hands. As usual, weather will have the final say.

**

If you missed DTN's Ag Summit Series event, "Crop Updates From the Field" or were too busy to register, here is a second chance. Register now and you'll be able to access recordings of the event in which we visited with farmers from across the country, talked about the latest dicamba and pesticide news and discussed DTN's latest weather and market outlooks. This extended registration period will close on June 5 at 5 p.m. CDT.

Here's the link to register:

There may be a time delay between when you register and when you can access the recordings.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at todd.hultman@dtn.com

Follow Todd Hultman on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.