Todd's Take

Bullish Corn, Soybean Markets Running Into Bearish Hurdles

Just a few weeks ago, DTN Meteorologist John Baranick and I were giving presentations on weather and markets at Husker Harvest Days in Grand Island, Nebraska, and things were going well. The weather was good at the show and we had good turnouts.

John was basking in the success of having forecast a hot, dry summer long before it happened, and I was happy to report corn and soybean prices were trading at their highest levels in over two months, having largely recovered from spec selling earlier that summer. I had long contended the summer selling was overdone and wasn't showing respect for the tight supply levels in grains. What's more, it was one of the few times I've been at Husker Harvest when prices weren't close to making their lows for the year. Usually, corn prices in mid-September are nothing to brag about, but this year didn't have that hanging gloom.

Judging from USDA's latest estimates, you might think corn prices would still be bullish. On Sept. 30, USDA discovered old-crop U.S. ending corn stocks were 148 million bushels (mb) less than expected at 1.377 billion bushels (bb). The lower total is apt to reduce USDA's new-crop ending stocks estimate of 1.219 bb even more in next week's WASDE report, set for Oct. 12.

Soybeans, however, had a bearish experience as USDA's old-crop U.S. ending soybean stocks came in 34 mb higher than expected at 274 mb. Given the strong demand for soybeans, the increase wasn't large, but the report did spark a 46-cent drop on the day of release.

Long before we arrived at Husker Harvest, corn and soybean prices had been frequently buffeted by noncommercial selling through early summer, responding to worries about inflation, rising interest rates, a rising U.S. dollar and fears about recession. One week after Husker Harvest, the Fed hit markets with another 0.75% rate hike that added another nail of resistance, reinforcing the lid on corn and soybean prices.

However, the bearish pressure on corn and soybean prices lately isn't so much from the outside market worries as it has been about the demand for both crops themselves. While we were at the farm show, worries surfaced about a possible rail strike, and then we heard the good news that a tentative agreement had been reached. Traders are still waiting to see if union members will approve the new contracts and will be understandably cautious until they do.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Soybean export sales are off to a good start in 2022-23, up 9% from a year ago so far. Despite negative headlines in China, the prices of November soybeans and January soybean meal in China were at new contracts highs on Friday, Sept. 30, before going on holiday this week. Prices that high are good indications of demand, but it will be interesting to see how that changes Monday, when China's markets next open.

Corn export sales, on the other hand, are off to a poor start. Only 521 mb have been sold in the first month of 2022-23, 50% less than a year ago at this time. The pace should pick up at some point after Europe experienced extreme drought this summer and Ukraine remains bogged down in war. Thanks to Brazil's successful second harvest, Brazil's corn prices are currently 11% cheaper and will make it tough for the U.S. to compete for a while.

The latest problem -- you probably all know by now -- is the slowdown in barge traffic along the Mississippi River due to lower water levels. After a summer of historically low river reports that included the Thames in the U.K., the Loraine in France, the Rhine in Germany, the Danube in eastern Europe and the Yangtze in China, the mighty Mississippi has been added to the infamous list.

Thursday's Grain Transportation Report from USDA said barge grain movement actually increased 44% in the week ended Oct. 1 to 316,850 tons, but we shouldn't kid ourselves that all is well. The river needs more water and there is not much in either the near-term forecast or the seasonal forecast. The Climate Prediction Center expects drought to expand throughout the Southern Plains to the end of this year.

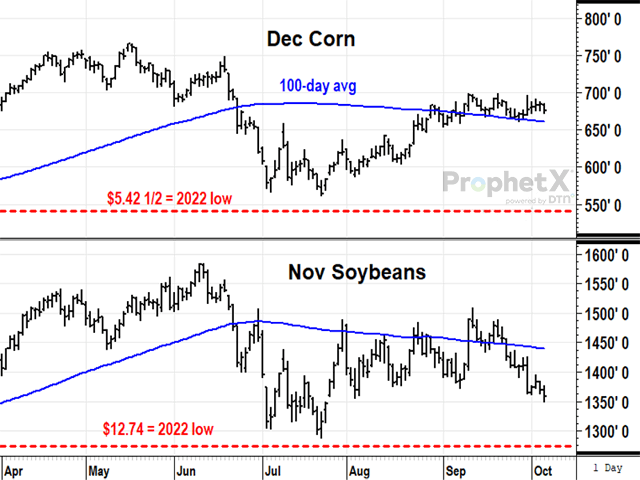

With Brazil winning corn sales on one hand and barges stuck without sufficient water on the other, December corn prices are looking especially vulnerable at Thursday's close of $6.75 1/2, but surprisingly they haven't flinched much yet.

November soybeans have seen the bigger drop of the two since we left Grand Island, down 93 1/2 cents to Thursday's close of $13.58. Bottled up barges on the river also hurt soybean movement, but the most bearish surprise to soybean prices has come from soybean meal.

For much of the summer, commercial demand for soybean meal was extremely bullish as cash prices in Illinois traded at big premiums to the futures board. It was clear meal supplies were tight and demand was more urgent than the market could satisfy.

That all changed after Sept. 21 and it is difficult to know just what happened, but we can see the cash price of meal in Illinois quickly dropped over $100 a short ton, erasing almost all the premium it had over the futures price. The drop was likely some combination of end users fulfilling their needs and expecting more meal supplies to become available as new soybeans arrived from harvest.

December meal closed at a new two-month low of $393.40 Thursday, Oct. 6, bearish news for specs that CFTC says were holding over 129,000 contracts long as of Sept. 27. While further liquidation is likely in the near term, the situation isn't necessarily dire for soybean demand. Even with the recent sell-off in meal, the crush value of soybean products, based on January's closes, pencils out to $3.10 above the cost of soybeans, a rich incentive for processors to keep buying soybeans.

If this isn't your first ride around the block with markets, you know that change is an unending part of the game and there are often surprises around the corner. Markets don't always change that much in three weeks, but it's a good reminder of why it's important to stay informed more often than just once a year. I hope everyone reading will consider a subscription to MyDTN. Find out more at https://www.dtn.com/….

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be found at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.