DTN Retail Fertilizer Trends

Three Fertilizers Still Lead the Way Higher

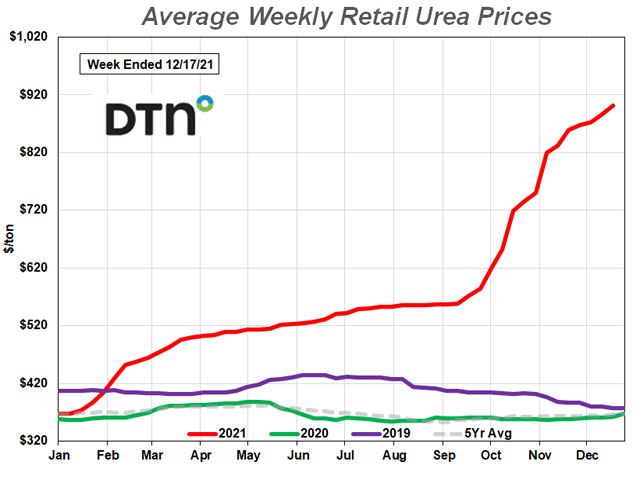

OMAHA (DTN) -- Retail fertilizer prices continued to rise the second week of December 2021, according to sellers surveyed by DTN. There are signs, however, that the climb may be slowing somewhat.

Only three of the eight major fertilizers showed a significant move higher; DTN designates a substantial move as anything 5% or more. This is the first time since the third week of September 2021 that fewer than five fertilizers were appreciably more expensive.

Anhydrous led the way, up 16% from a month prior. The nitrogen fertilizer's average price was at $1,420/ton, which continues to be at its all-time high in the data DTN has collected since November 2008.

10-34-0 was 7% more expensive compared to last month. The starter fertilizer's average price was at $790/ton.

Urea was 5% more expensive compared to last month. The nitrogen fertilizer had an average price of $901/ton, which was also an all-time high.

The remaining five fertilizers had just slight price increases compared to the prior month. DAP had an average price of $858/ton, MAP $935/ton, potash $796/ton, UAN28 $579/ton and UAN32 $663/ton.

On a price per pound of nitrogen basis, the average urea price was at $0.98/lb.N, anhydrous $0.87/lb.N, UAN28 $1.03/lb.N and UAN32 $1.04/lb.N.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Dow Jones reported last week frustrated farmers are having to adjust their spring planting plans because of the considerably higher fertilizer prices. This could lead some producers to shift acres to less fertilizer-intensive crops, while others plan to cut back their overall fertilizer use.

This fertilizer reduction could lead to lower yields and less grain production and translate into higher prices for farm commodities. This situation would further inflate prices of food staples such as cereal and cooking oil, as well as beef and other meats as producers rely on grains to feed livestock, Dow Jones reported.

"It's stressful," said Sean Elliot, a sixth-generation farmer in Iroquois County, Illinois. He plans to grow more soybeans in 2022 instead of planting his usual amount of corn acres, which uses more fertilizer.

Retail fertilizer prices compared to a year ago show all fertilizers have increased significantly, with several fertilizers having well over 100% price increases.

10-34-0 is now 71% more expensive, MAP is 79% higher, DAP is 84% more expensive, potash is 121% higher, urea is 149% more expensive, UAN32 is 162% higher, UAN28 175% is more expensive and anhydrous is 215% higher compared to last year.

DTN surveys more than 300 retailers, gathering roughly 1,700 fertilizer price bids, to compile the DTN Fertilizer Index each week. In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/….

The American Farm Bureau Federation (AFBF) reported farmers are struggling with skyrocketing fertilizer prices. You can read it here: https://www.dtnpf.com/….

The recent DTN Global Fertilizer Outlook series focused attention on what the world expectation could be in 2022. This series examined the supply and demand of nutrients globally as well as what direction fertilizer prices could go in the New Year.

Read the nitrogen outlook here: https://www.dtnpf.com/….

Read the phosphorus outlook here: https://www.dtnpf.com/…

Read the potash outlook here: https://www.dtnpf.com/…

Read what Mosaic says about global issues pushing prices up at: https://www.dtnpf.com/…

| DRY | ||||

| Date Range | DAP | MAP | POTASH | UREA |

| Dec 14-18 2020 | 466 | 522 | 360 | 361 |

| Jan 11-15 2021 | 486 | 551 | 373 | 373 |

| Feb 8-12 2021 | 588 | 642 | 398 | 453 |

| Mar 8-12 2021 | 615 | 690 | 423 | 483 |

| Apr 5-9 2021 | 618 | 699 | 431 | 504 |

| May 3-7 2021 | 634 | 705 | 436 | 514 |

| May 31-Jun 4 2021 | 652 | 712 | 443 | 524 |

| Jun 28-Jul 2 2021 | 677 | 721 | 476 | 542 |

| Jul 26-30 2021 | 695 | 753 | 549 | 554 |

| Aug 23-27 2021 | 697 | 756 | 569 | 557 |

| Sep 20-24 2021 | 709 | 786 | 625 | 585 |

| Oct 18-22 2021 | 810 | 863 | 716 | 735 |

| Nov 15-19 2021 | 825 | 911 | 769 | 859 |

| Dec 13-17 2021 | 858 | 935 | 796 | 901 |

| LIQUID | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

| Dec 14-18 2020 | 463 | 450 | 210 | 253 |

| Jan 11-15 2021 | 469 | 474 | 210 | 247 |

| Feb 8-12 2021 | 512 | 524 | 243 | 285 |

| Mar 8-12 2021 | 581 | 625 | 306 | 344 |

| Apr 5-9 2021 | 605 | 692 | 341 | 378 |

| May 3-7 2021 | 618 | 712 | 358 | 398 |

| May 31-Jun 4 2021 | 619 | 719 | 363 | 412 |

| Jun 28-Jul 2 2021 | 625 | 730 | 366 | 421 |

| Jul 26-30 2021 | 631 | 737 | 365 | 419 |

| Aug 23-27 2021 | 632 | 748 | 370 | 420 |

| Sep 20-24 2021 | 633 | 772 | 383 | 436 |

| Oct 18-22 2021 | 659 | 940 | 451 | 492 |

| Nov 15-19 2021 | 739 | 1220 | 571 | 651 |

| Dec 13-17 2021 | 790 | 1420 | 579 | 663 |

Russ Quinn can be reached at russ.quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2021 DTN, LLC. All rights reserved.