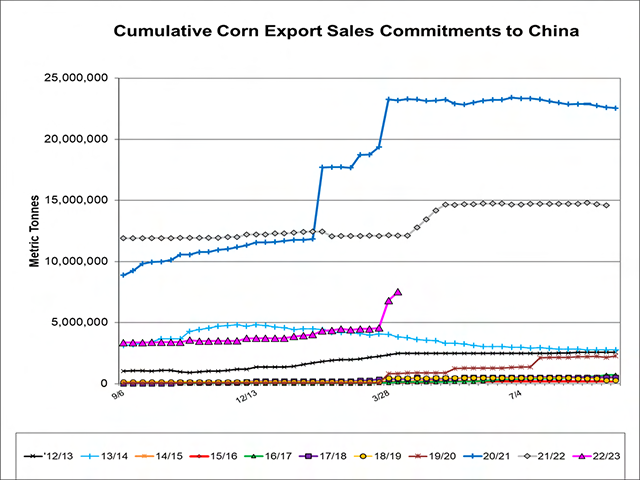

The world corn stocks-to-use ratio ex-China is currently projected to be 11%. That would be up slightly from last year's 10.6% but still very close to the 2012-13 era. That means there is a giant sucking sound for corn exports, and the U.S. is in a position to deliver.