DTN Retail Fertilizer Trends

All Fertilizer Prices Lower Again

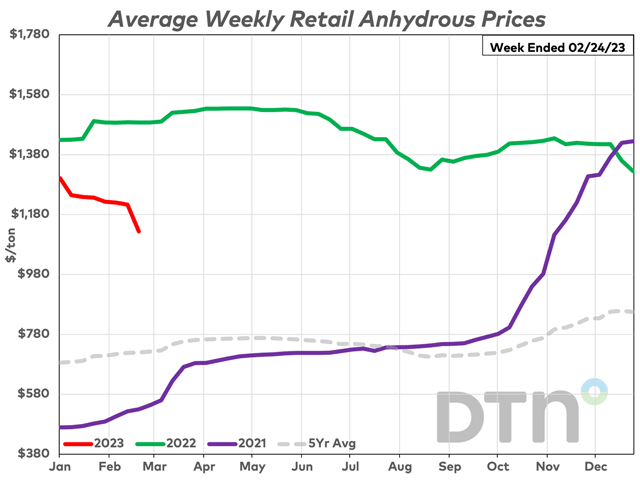

OMAHA (DTN) -- Retail fertilizer prices continue their march lower, according to prices tracked by DTN for the third full week of February 2023. This trend has been with us since before the beginning of the New Year.

All eight of the major fertilizer prices are once again lower compared to last month. Five of the eight fertilizers had a substantial price decline. DTN designates a significant move as anything 5% or more.

Leading the way lower was UAN32 and UAN28 once again. UAN32 was 12% lower compared to last month while UAN28 was 10% less expensive. UAN32 had an average price of $554/ton while UAN28 was at $470/ton.

Anhydrous was 9% lower looking back a month prior. The nitrogen fertilizer's average price was $1,124/ton.

Both potash and urea were 6% less expensive compared to the month prior. Potash had an average price of $673/ton and urea was $666/ton.

The remaining three fertilizers were all just slightly lower compared to the prior month. DAP had an average price of $836/ton, MAP $834/ton and 10-34-0 $741/ton.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

On a price per pound of nitrogen basis, the average urea price was at $0.72/lb.N, anhydrous $0.69/lb.N, UAN28 $0.84/lb.N and UAN32 $0.86/lb.N.

The Fertilizer Institute (TFI) President and CEO Corey Rosenbusch, testified before the House Committee on Agriculture hearing "Uncertainty, Inflation, Regulations: Challenges for American Agriculture" on Tuesday, according to a TFI press release (https://www.tfi.org/…).

Much of Rosenbusch's testimony focused on the fact that fertilizer is a globally traded commodity subject to international pressures and geopolitical events.

"Domestic production of fertilizer accounts for only 7% of global production and 90% of all fertilizer usage happens outside of the United States," Rosenbusch said. "Geopolitical events have been the biggest disrupter to fertilizer markets in recent years."

These geopolitical events include sanctions on Belarus, which supplies 20% of the world's potash supply; China, which is a major exporter of fertilizers, but last year imposed restrictions on fertilizer exports; and Russia, which has historically provided 20% of global fertilizer supplies as the world's largest fertilizer exporter.

Rosenbusch offered solutions Congress could act on to improve domestic fertilizer production and supply.

"Regulatory certainty is perhaps the most significant area Congress could help," he said.

"Additionally, listing potash and phosphate as critical minerals, energy policy that supports an abundant and affordable supply of natural gas, permitting reform to streamline long-delayed fertilizer projects, focusing on USDA conservation programs that empower agronomists and certified crop advisors to help farmers with nutrient management and a focus on supply chain bottlenecks through improved rail service and promoting driver recruitment and retention."

All fertilizers are now lower compared to one year ago. DAP is 4% less expensive, MAP and 10-34-0 are both 11% lower, potash is 17% less expensive, UAN32 is 21% lower, UAN28 is 22% less expensive, anhydrous is 24% lower and urea is 25% less expensive compared to a year prior.

DTN gathers fertilizer price bids from agriculture retailers each week to compile the DTN Fertilizer Index. DTN first began reporting data in November 2008.

In addition to national averages, MyDTN subscribers can access the full DTN Fertilizer Index, which includes state averages, here: https://www.mydtn.com/….

Global fertilizer supply shortages seen in 2022 will likely persist into 2023. You can read it here: https://www.dtnpf.com/….

| Dry | ||||

| Date Range | DAP | MAP | POTASH | UREA |

| Feb 21-25 2022 | 874 | 934 | 815 | 885 |

| Mar 21-25 2022 | 1014 | 1018 | 850 | 976 |

| Apr 18-22 2022 | 1050 | 1079 | 879 | 1012 |

| May 16-20 2022 | 1059 | 1083 | 878 | 993 |

| Jun 13-Jun 17 2022 | 1046 | 1074 | 879 | 961 |

| Jul 11-15 2022 | 1030 | 1052 | 885 | 861 |

| Aug 8-12 2022 | 982 | 1032 | 881 | 812 |

| Sep 5-9 2022 | 952 | 1009 | 878 | 800 |

| Oct 3-7 2022 | 934 | 997 | 869 | 826 |

| Oct 31-Nov 4 2022 | 930 | 981 | 857 | 826 |

| Nov 28-Dec 2 2022 | 926 | 960 | 831 | 795 |

| Dec 26-Dec 30 2022 | 885 | 891 | 765 | 751 |

| Jan 23-Jan 27 2023 | 855 | 865 | 714 | 708 |

| Feb 20-Feb 24 2023 | 836 | 834 | 673 | 666 |

| Liquid | ||||

| Date Range | 10-34-0 | ANHYD | UAN28 | UAN32 |

| Feb 21-25 2022 | 837 | 1488 | 602 | 703 |

| Mar 21-25 2022 | 881 | 1523 | 622 | 698 |

| Apr 18-22 2022 | 906 | 1534 | 631 | 730 |

| May 16-20 2022 | 906 | 1529 | 634 | 731 |

| Jun 13-Jun 17 2022 | 905 | 1516 | 630 | 730 |

| Jul 11-15 2022 | 904 | 1449 | 606 | 701 |

| Aug 8-12 2022 | 881 | 1365 | 578 | 678 |

| Sep 5-9 2022 | 866 | 1357 | 579 | 658 |

| Oct 3-7 2022 | 813 | 1390 | 565 | 652 |

| Oct 31-Nov 4 2022 | 759 | 1426 | 583 | 680 |

| Nov 28-Dec 2 2022 | 753 | 1416 | 583 | 681 |

| Dec 26-Dec 30 2022 | 751 | 1325 | 573 | 679 |

| Jan 23-Jan 27 2023 | 754 | 1237 | 523 | 630 |

| Feb 20-Feb 24 2023 | 741 | 1124 | 470 | 554 |

Russ Quinn can be reached at Russ.Quinn@dtn.com

Follow him on Twitter @RussQuinnDTN

(c) Copyright 2023 DTN, LLC. All rights reserved.