Protect Profits With Insurance

Margin Protection Insurance Creates Opportunity to Establish $5 Price Floor for 2024 Corn Crop

MT. JULIET, Tenn. (DTN) -- Farmers could lock in a floor price above $5 per bushel on their 2024 corn crop using margin protection insurance, which will wrap up its price discovery period on Friday.

The federally subsidized, area-based insurance product pays when there's an unexpected decrease in operating margin caused by lower county yields, lower commodity prices, increased input prices or any combination of the above. Farmers can select coverage levels from 70% to 95%, and most use it in conjunction with revenue protection or another multi-peril policy tailored to their individual farm.

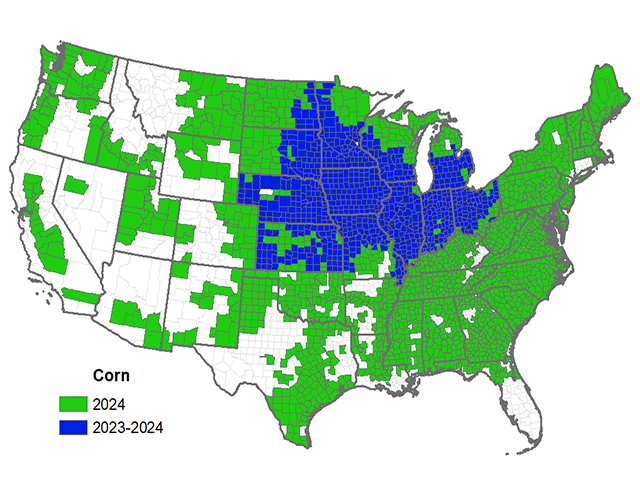

USDA's Risk Management Agency expanded the program to cover most of the Corn Belt in 2024, and Tony Jesina, Farm Credit Servies of America senior vice president of insurance and consumer lending, said he expects continued expansion of acres. For example, there are currently over 2 million enrolled acres in the Midwest, up from just half a million three years ago.

The sign-up deadline is Oct. 2. Usually, it's the end of the month, but Sept. 30 falls on a weekend.

"Margin protection is complex," said Jennifer Ifft, a Kansas State University professor and extension specialist in ag policy.

It's important for farmers to think about their farms' correlation to county yields, input purchasing practices and hedging strategy when making a decision regarding corn crop insurance. A crop insurance agent can help determine if margin protection is a good fit and some offer tools that can model a farm's historical payouts.

Margin protection insurance includes calculating expected costs using futures prices for inputs like diesel, fertilizer and interest rates, as well as estimating other fixed costs. Expected costs are subtracted from expected revenue projections using county yields and the higher of the September projected price or harvest price (if selected) to generate an insured profit margin.

"I think it captures the general level of costs on the farm economy," Ifft said. "But ultimately, most claims are going to be based on price and yields."

That's where the earlier, off-cycle price discovery period could be an advantage, Jesina said.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The discovery period for margin protection insurance runs from Aug. 15 to Sept. 15. It's in February for most other crop insurance policies covering spring crops. Like revenue protection policies, price projections are based on the average daily closing prices for new-crop contracts for the covered commodity.

As of Sept. 13, the projected price for margin protection insurance on 2024 corn is $5.09 per bushel and $12.93 per bushel for soybeans.

"What's your view of the price outlook between now and February when you can lock in that multi-peril policy?" he said. "If you're worried about that slipping away like what happened in 2013 and 2014, that would be a compelling reason to consider margin protection."

For 2023 corn, the margin protection projected price was $6.11 per bushel compared to the spring price of $5.91.

"There's nothing wrong with establishing a floor as early as possible, and if that's above your cost of production, that's even better," Jesina said. "Then you hope you never collect on it."

Ifft said Kansas farmers typically purchase revenue protection with 70% to 75% coverage. That will help a farmer repay an operating note and cover expenses in a bad crop year.

"If you move up to higher coverage levels, you're protecting your profits and that's going to come at a cost," she said. "I want to be clear. Your premiums could double or triple."

That sticker shock will keep some farmers from even considering high coverage options like margin protection, the enhanced coverage option or the supplemental coverage option.

However, her analysis shows the program will pay out more in indemnities than a farm pays in premiums over time.

"You should come out ahead, but you have to have a long-term perspective," she said.

Jesina said it's helpful to compare the cost of margin protection insurance to other hedging strategies. "You'd find that margin protection is significantly cheaper than buying a put."

Farmers will also receive a premium credit on their multi-peril policy that varies by farm.

Jesina said crop insurance decisions used to be a "one-and-done kind of thing," he said. Farmers would pick their insurance in the winter and live with that decision all year. "Our producers have more chips on the table than they ever had before. They've never had more invested than they do now, and you've got to look at risk management as a year-round decision."

RESOURCES

Ifft's explanation of how the program works: https://agmanager.info/…

Farm Credit Services of America details: https://www.fcsamerica.com/…

RMA factsheet: https://www.rma.usda.gov/…

Previous DTN reporting: https://www.dtnpf.com/…

Katie Dehlinger can be reached at katie.dehlinger@dtn.com

Follow her on X, formerly known as Twitter, at @KatieD_DTN

(c) Copyright 2023 DTN, LLC. All rights reserved.