Biden's Tax Plan Details

Plan Would Raise Taxes on High-Income Farmers, Complicate Farm Sales and Estate Taxes

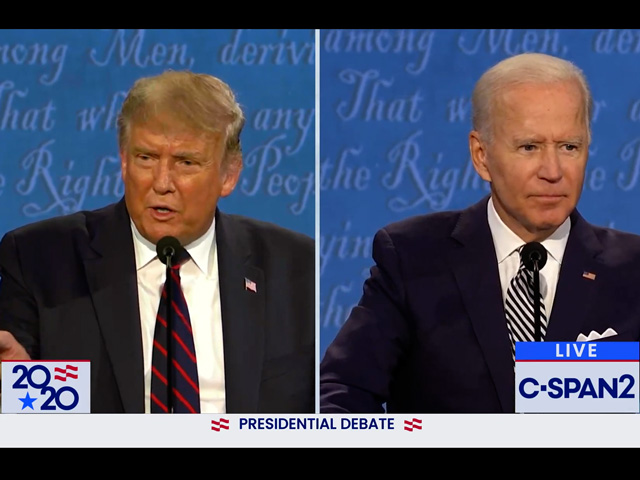

OMAHA (DTN) -- Former Vice President Joe Biden's tax plan would translate into higher annual income and payroll taxes for roughly 80,000-plus farmers and significantly affect taxes in farm liquidations or the handing over of farms from one generation to the next.

Biden's plan calls for raising taxes on people with $400,000 or more in taxable income. For high-end earners, Biden's proposal would roll back many of the 2017 tax cuts signed into law by President Donald Trump.

"Nobody making less than $400,000 will pay a penny more in taxes under my proposal," Biden said during a 60 Minutes interview on Sunday.

For average American families, Biden's plan would increase the Child Tax Credit, provide higher dependent care credits, provide renewable energy credits and expand the Earned Income Tax Credit for workers over age 65.

Rod Mauszycki, a principal in the Agribusiness and Cooperative group at CliftonLarsonAllen and a tax columnist for DTN/The Progressive Farmer, has been studying the Biden proposal and its potential impact on farmers.

"For the majority of our farm clients, you're probably going to see a negligible increase in taxes," Mauszycki said. "So if you are humming along, and you're making $100,000 a year, I don't think it's going to impact you much."

The concern, Mauszycki said, is when a farm hits that $400,000 income threshold, as well as other complications. "When you're retiring, when you die, or when you go bankrupt, that's a real problem," he said. "If you have a bankruptcy or a forced liquidation, you're going to get killed. If you die, your estate could create a substantial taxable situation for your heirs."

The IRS, in its annual Statistics of Income book, doesn't provide an apples-to-apples breakdown of farmers or business tax filers making $400,000 or more in taxable income. The IRS does show 82,223 tax filers in 2017 and 84,715 tax filers in 2018 reported either net farm income or net farm losses on their tax returns, but also had adjusted gross income (AGI) higher than $500,000. That affects about 4.8% of the 1.77 million tax filers who reported farm income or losses on the tax returns in 2018.

Of the 84,715 tax filers in 2018 with farm businesses and AGIs higher than $500,000, the IRS report shows 50% of them -- 42,349 tax filers -- paid no income taxes that year. The IRS states those "non-taxable returns" may have paid other taxes such as self-employment taxes, or taxes on prior-year investments, but they did not pay income taxes on their 2018 income.

In the income range of $500,000 and higher, there also were 42,349 tax filers in 2018 who had net farm income or net farm losses, but paid no income taxes in 2018. The IRS farm incomes and net losses also do not reflect gains from certain livestock sales or crops that qualified for capital-gains treatment and do not count toward regular farm net income or losses, the IRS states.

Another 22,063 tax filers in 2018 reported farm rental income on their returns but also had adjusted gross incomes above $500,000 as well.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

THE BIDEN PLAN

If passed by Congress and it became law -- a big qualifier -- the top tax rate for people with taxable income above $400,000 would go from 37% back to 39.6%, the level before the 2017 tax cuts. Along with that, some itemized deductions such as charitable deductions would be phased out for those earning more than $400,000, the Tax Foundation states, which includes some phase-out for qualified business deductions.

Biden also would add a 12.4% payroll tax on earned income above $400,000, which would split the tax between employers and employees, according to the Tax Foundation. Self-employed individuals, such as farmers, would pay the full 12.4%, but also be able to deduct 6.2% on their tax returns. Currently, payroll taxes phase out for earners above $137,700. This would effectively create a "donut hole" between $137,700 and $400,000.

So effectively, a farm family making more than $400,000 a year from the farm and other jobs or businesses would pay at least 2.6% higher income taxes, 12.4% payroll taxes and see some of their deductions begin to phase out as well.

OTHER TAX BREAKS AND CORPORATE TAX RATES

Biden also proposes returning the corporate tax rate from 21% to 28%. That would pretty much put an end to farmers using C Corporations for farming because of the higher tax burden.

Other tax breaks farmers use, Section 199A, would also be phased out for filers above $400,000 in taxable income. That deduction is used for manufacturing, of which a crop qualifies. "That's a substantial deduction that you're not going to be entitled to, which is going to create a substantial tax because you're now at 39.6%," Mauszycki said.

Section 1031 real-estate exchanges would also be eliminated for high-income earners.

CAPITAL GAINS TREATMENT

For people with taxable incomes above $1 million, the Biden plan also calls for treating capital gains as ordinary income, which would increase capital gains for those high-end earners from 20% to 39.6%.

The higher capital gains rate could affect farmers forced to liquidate more than those farmers who are retiring. A farmer can typically set up an installment sale or some other arrangement to keep the income lower, but a farmer forced by the bank to liquidate would suddenly appear to have a higher taxable income that could drive up the capital gains on a forced sale, Mauszycki said.

"Now, all of a sudden they will pay federal and state taxes, depending on where you live, up to 50%, you might not have enough money to pay the bank back even if you liquidate all of your assets," he said.

ESTATE TAXES

Another key aspect of the Biden plan would reduce the estate tax exemption back to the 2009 level of $3.5 million and increase the top rate to 45%.

The current estate-tax exemption is $11.58 million for individuals, which doubles to $23.16 million for married couples and a maximum rate of 40%. But without a new act of Congress, the estate-tax exemption already is set to return to $5 million per individual in 2025, plus an inflation adjustment.

The American Farm Bureau Federation last week sounded an alarm that more family farms would be faced with paying the estate tax after 2025 based on rising values of land. Right now, with the national value of farmland at $3,160 per acre, it takes roughly 3,700 acres of land to reach the current $11.58 million exemption. That number varies greatly from state-to-state, based on land prices. An Illinois farm, for instance, goes beyond the $11.58 million exemption at 1,565 acres.

Based on rising costs of land, the $5 million in exemption, adjusted for inflation, could be $5.8 million in 2026, meaning it would take about 1,800 acres to reach the threshold for paying the estate tax.

If Biden's tax plan lowered the estate-tax cap to $3.5 million for individuals, then it would take just over 1,100 acres, on average nationally, to go beyond the exemption level. That would affect about 12% of farmers, but approximately 74% of farm ground. In Iowa, for instance, it would take about 495 acres to meet the $3.5 million exemption. In California, it would take 350 acres.

Along with that, Biden's plan proposes eliminating the stepped-up basis. For one thing, that means children who inherit the farm would not be allowed to re-depreciate equipment that's not stepped-up. There are also some complications when one sibling wants to get out. Under a stepped-up basis, siblings can sell the land to each other at 80% of the market value because they don't have to pay the taxes. Potentially, for land over $1 million in value, the income tax would be 36.9% to sell the land to siblings. So then they would have to charge full value to pay the taxes on it.

Another aspect that comes into play for inheritance: Without stepped-up basis, children inherit deferred tax liability, Mauszycki noted. So for the years of deferring income, deferring taxes and depreciating equipment and assets, the children pick up the tab. "That's going to be an unwanted surprise for a lot of folks when all of a sudden you have this negative capital account and when you die, your kids have to pay it off," Mauszycki said.

American Farm Bureau Federation analysis of estate-tax exemptions: https://www.fb.org/…

Chris Clayton can be reached at Chris.Clayton@dtn.com

Follow him on Twitter @ChrisClaytonDTN

(c) Copyright 2020 DTN, LLC. All rights reserved.