Technically Speaking

July Soybean Meal Prices Allude to Bigger Problems in 2024

SOYBEAN MEAL:

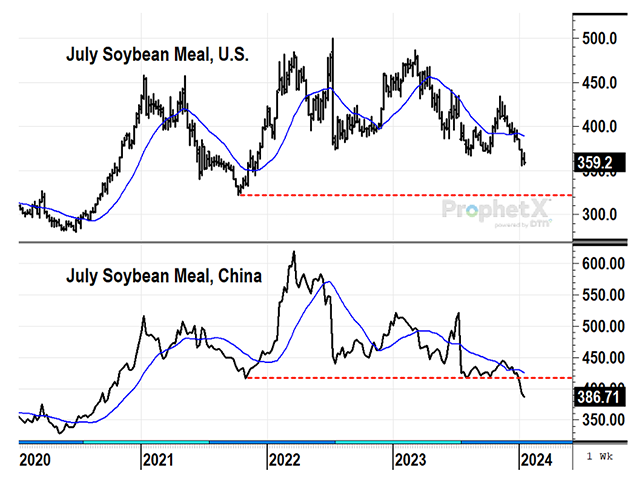

July soybean meal closed down $3.80 at $359.20 in the week ended Jan. 19, continuing the bearish momentum this blog described on Jan. 8 at https://www.dtnpf.com/… . For the July 2024 meal contract, Friday's close was still above the 2023 low of $349.80, set on June 8, 2022. A continuous weekly chart, however, showed Friday was the lowest close for a front-month July contract in two years. In the near term, it will be interesting to see if July meal can find support near or above its June low of $349.80. The Jan. 12 low of $355.40 showed possible support, but we haven't seen enough follow-through yet. This year's bearish factors for meal include the anticipation of increased crush production in the U.S. plus increased soybean production in Argentina, the world's largest exporter of both soybean meal and bean oil. A comparison with meal prices in China, however, suggests a more bearish situation for meal demand, another obstacle to overcome in 2024.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

A look at July soybean meal prices on China's Dalian exchange showed a Jan. 19 close at 3,032 yuan per metric ton, the lowest in over three years and the U.S. equivalent of $386.70 a short ton. Both U.S. and Chinese meal prices are in downtrends, but with China's meal price now below its 2021 low, there is additional concern about the state of demand in the country that consumes 30% of the world's soybean meal -- more than any other country.

For over 30 years, strong growth in China's demand for soybean meal has coincided with the miraculous economic growth the country has achieved. As incomes grew, so did livestock production, along with the rise of a middle class. Soybean meal has long been the feed of choice for producers of pork, poultry and fish. This year, however, two factors likely explain the drop in China's meal prices. A glut of pork in China likely has producers cutting back on hog inventory in 2024 and China's economy has been slowing. Friday's close of 2,832 for the Shanghai Composite Index was the lowest in three years, an indication of China's economic belt-tightening.

Here in the U.S., plant capacity for renewable diesel continues to grow and the National Oilseeds Processors Association just reported a record soybean crush among its members in December. Argentina's soybean crop is in good shape and is expected to increase competition for meal exports by May. Technically, July soybean meal prices are starting 2024 with a bearish break in the month of January. I can't guarantee anything, but the January high of $385.50 may go unchallenged the rest of this year and be a bearish drag on soybean prices.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of commodities, futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com .

(c) Copyright 2024 DTN, LLC. All rights reserved.