Todd's Take

Has the Case for Ethanol Come Full Circle?

"The bill I sign today takes a significant step because it will require fuel producers to use at least 36 billion gallons of biofuel in 2022. This is nearly a fivefold increase over current levels. It will help us diversify our energy supplies and reduce our dependence on oil. It's an important part of this legislation, and I thank the members of Congress for your wisdom." -- President George W. Bush, Dec. 19, 2007 https://georgewbush-whitehouse.archives.gov/…

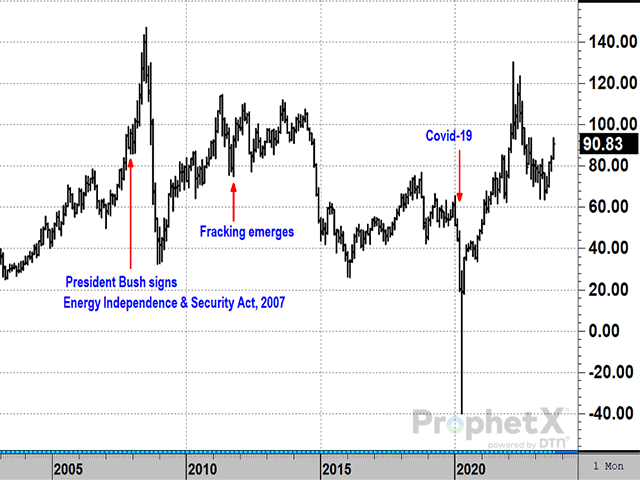

The same day President Bush signed the Energy Independence and Security Act of 2007 into law, spot corn was trading near $4.39 a bushel and crude oil was near $91 a barrel, not far from today's levels almost 17 years later. One might think not much has changed since, but that would be a mistake. Nearly 5.20 billion bushels (bb) of corn were used to make 15.2 billion gallons of ethanol in 2022-23, 38% of the season's 13.73-billion-bushel corn crop, a direct result of the bill Bush signed that day.

The 36 billion gallons of biofuels Bush envisioned have not yet come to pass, but the potential is there for more as the production of renewable diesel from soybean oil and other renewable sources is growing rapidly. Sustainable aviation fuel is another promising market for renewable fuels to keep an eye on with low-carbon benefits.

A lot has changed since 2007. At the time, the market had never seen $90 a barrel for oil, the squeeze was on and policymakers were out of options as OPEC reserves were running low. By June 2008, oil prices peaked briefly above $140 a barrel and then plummeted briefly, to $40 by the end of the year. The financial meltdown of 2008 temporarily solved the problem of not having enough oil and bought the market some time, while a young ethanol industry grew to process 5 bb of corn by the 2010-11 season.

By the fall 2011, hydraulic fracturing and horizontal drilling emerged, ending a 23-year decline in U.S. oil production. The new supply finally sent prices lower in 2014 and the U.S. enjoyed relatively cheap fuel for seven years. The year 2020 was an especially volatile time after COVID-19 first appeared in the U.S. and panicked people into staying home. Saudi Arabia initially responded by increasing production and the price of U.S. crude oil fell to a negative $40 in April 2020. Bankruptcies among oil and gas companies spiked higher in 2020.

The period from 2014 to 2021 was also a tough time for ethanol. As U.S. oil supplies became more available and gasoline prices fell, it was difficult for many to see why ethanol was needed. Bush's intention to diversify the U.S. energy supply didn't seem so important anymore. Political support waned and large oil companies found ways to get around the complicated labyrinth of ethanol regulations.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

The summer of 2022 helped remind many of ethanol's value as U.S. oil production was slow to recover from the financial hits of 2020 and prices rose back above $100. Russia's attack on Ukraine also added to concerns in the energy markets and for a time, the West looked vulnerable to not having enough fuel.

New U.S. President Joe Biden was inaugurated in early 2021, promising to restrain domestic oil production in favor of new green alternatives, but found himself in the awkward position of needing to promote more domestic production as oil prices breached $100. Ethanol became an important fuel-stretcher in 2022, helping hold down prices at one point when U.S. gasoline supplies briefly hit their lowest level in 10 years.

It may sound strange, but the case for increasing ethanol production is even stronger today than it was in 2007. The U.S. again finds itself in a situation where world oil supplies are tight and big decisions are being made by a collaboration of OPEC and Russia. Just as Bush understood in 2007, the U.S. doesn't just need more fuel, it needs more diversified fuel sources. One political party wants to increase domestic oil production and the other party wants more low-carbon fuels. The U.S. currently needs both.

Another reason for increasing ethanol use has to do with the competitive pressures that U.S. agriculture faces in the years ahead. U.S. corn, soybeans and wheat producers have suffered declining world export market share during the past several decades, primarily the result of significant expansion of corn and soybean production in Brazil and wheat production in Russia. Brazil's Ag Minister Carlos Favaro is pushing a plan to convert Cerrado grasslands into 99 million acres of new cropland during the next 10 years, an expansion that does not bode well for U.S. producers and will likely result in years of more corn surpluses ahead.

History suggests ethanol can offset some of those competitive pressures. A look at USDA's average farm price for corn the past 34 seasons, compared to USDA's cost of production estimates shows 13 of the 34 years were profitable. It is no accident that 10 of 13 profitable years for corn happened since Bush mandated biofuels into law. Not surprisingly, the rate of soybean profitability has also improved with the development of the ethanol industry.

At a time when the hunt is on for more low-carbon fuels, you might think ethanol would find open arms from regulators and those advocating low-carbon fuels, but that has not been the case. Unfortunately, the Scientific Advisory Board at the Environmental Protection Agency (EPA) can't seem to locate the Department of Energy (DOE) study from the Argonne Laboratory that the Renewable Fuels Association, the National Corn Growers Association and Growth Energy keep pointing to, among several others. The DOE study says the carbon intensity of corn-based ethanol is 44% lower than that of petroleum gasoline (https://www.ncga.com/…). Other studies have cited even lower carbon emissions and many of today's ethanol plants are achieving even lower carbon scores. Members of the Renewable Fuels Association set of goal of net-zero carbon emissions by 2050 and say they are ahead of schedule (https://ethanolrfa.org/…).

Ethanol was needed in 2007 to give the U.S. a more diversified energy mix, reduce the flow of money to hostile international players and counter the depressing economic effects of chronic corn surpluses. Today, ethanol is still needed for all the same reasons plus it offers a solution in reducing the country's carbon footprint and in protecting U.S. corn and soybean producers from bearish market influences outside U.S. borders.

If EPA truly wants to promote healthier, low-carbon fuels, it needs to wake up, stop playing political games and embrace the science.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.