Todd's Take

Corn, Soybean Yield Estimates Approach Crunch Time

It was one year ago this week when Gro Intelligence surprised us with a national corn yield estimate of 167.2 bushels per acre (bpa), a much lower number than any of us expected. To put it in perspective, USDA was estimating a yield of 177.0 bpa at the time and private estimates were buzzing in the 174.0 to 176.0 bpa range. USDA's Crop Progress report gave corn a respectable 61% good-to-excellent rating with Iowa crops rated 76% good to excellent and crops in Illinois at 74%.

Knowing now USDA's final corn yield estimate for 2022-23 was 173.3 bpa, one might be tempted to think Gro undershot, but when you realize adverse conditions forced USDA to eventually take 2.9 million harvested acres off the July estimate, you realize that Gro Intelligence came very close last year, estimating a 13.69-billion-bushel (bb) crop on Aug. 8 versus a final USDA tally of 13.73 bb.

USDA, followers of crop ratings, and the collective private wisdom of market-guessers were all too high in August of 2022 and Gro was the first to point it out. The urban nerds -- armed with little farm experience but lots of data and plenty of computer-crunching IQ -- earned a seat at the table and my respect. This is the approach of the future and Gro is not the only one now taking satellite and weather data more seriously.

As you can imagine, I was very excited to hear Gro's take on crops this week. Unlike any year I can recall, crop conditions have experienced a steep roller coaster ride of stresses. This year started with a fast planting pace, followed by almost no rain in May and June for many areas. Farmers in my home state of Nebraska were irrigating in early May and were discouraged in June, following a dry previous year up and down the western Plains with a dry spring and early summer. Young crops curled in the heat and there were cracks in the soil. This time, however, it wasn't just the western Plains that were hurting. The U.S. Drought Monitor showed a widespread eruption of abnormally dry conditions across the central and eastern Midwest on June 1, followed by a few weeks of worsening conditions. Drought Monitor maps in June resembled 2012 in a year that was supposed to have a more favorable summer from the end of La Nina.

As you now know, much of the Corn Belt has gotten good rain coverage since late June and, from the road, crops look better in many states, peppered by other areas that remain severely stressed. The one nagging question I have about this year is directed at corn. Did this year's early stress rob corn plants of their productive potential, or will these good-looking crops we see from the road be able to recover?

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

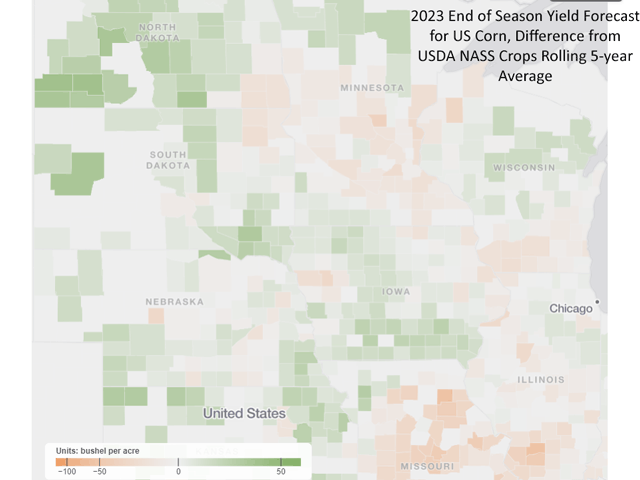

After three days of meetings with Gro, it is clear the team is expecting a healthy rebound in corn's ability to deliver big yields this fall. If you haven't heard already (where have you been?), the Digital Yield Tour with Gro Intelligence estimated a national corn yield of 177.0 bpa on Aug. 8, higher than I expected. The most astonishing estimates to me were yields of 197.3 bpa for Illinois and 189.5 bpa for Nebraska -- two states that had extremely tough starts. Even now, I'm a little stunned at yields that high and argue with myself on the pros and cons.

As usual, Gro had plenty of data and comparisons to support their case and agree at how bad conditions were early. For a time in late June, Gro's yield estimate for Illinois was below 140 bpa. Since late June the yield estimate has increased over 40% for Illinois and over 20% for Nebraska. Those are big swings in crop condition variables in a span of six weeks and, again, I wonder about the lingering effects of corn's tough childhood.

With reservations noted, I do contend Gro has made a strong case this year's corn crop will come in above 15.0 bb, maybe even above the 2016 record of 15.15 bb. We are likely looking at a much larger supply of corn being available in 2023-24, trying to compete with a record crop from Brazil, during a time when interest rates are high and few will be eager to take on the carrying cost of storing corn, commercials included.

Friday's new-crop estimates from USDA will be interesting, but they would be more interesting if we could directly see the results of the producer surveys by themselves. Crops are still developing and weather remains an active influence. As more is learned, crop estimates will narrow significantly the next two months and it will be interesting to see how the year plays out.

Of course, I'm biased, I work for DTN. I am also genuinely glad to have the independent assessment of DTN's Digital Yield Tour with Gro Intelligence to counter the temptations of "backyarditis" and groupthink that plague the yield-estimating process this time of year. Peeling back husks can help assess a field, but the sample size needed won't be available until USDA's following WASDE report on Sept. 12. Until then, it's difficult to find a better method than the folks at Gro provided us in this week's Digital Yield Tour.

See the latest info from the tour here: https://www.dtnpf.com/…

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on X, formerly known as Twitter, @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.