Todd's Take

The Unsinkable Price of Soybean Meal

We've all heard high prices cure high prices and what goes up must come down; but what the dispensers of such wisdom can never tell us is "When?" When will high prices come down?

I know that is supposed to be an analyst's job, but I have to admit, predicting tops is the most difficult task any analyst faces, as the market environment is full of emotional land mines. First of all, historically, high prices occur when supplies are either threatened or uncommonly tight. For those that need to own the commodity, anxiety runs high as prices rise higher, especially if good substitutes are not easily available. As if a highly anxious market atmosphere were not enough, speculators often become heavily involved, taking prices even higher than they otherwise would go, simply because they are drawn to the uptrend taking place. Tight supplies, nervous buyers in need and a crowd of speculators is a potentially volatile mix that often produces results far beyond the scope of reasonable explanation. Yes, what goes up probably will come down at some point, but when emotions get involved, it can be quite a ride.

This is the type of scenario now starting to develop in soybean meal.

For decades, soybean meal has been the ag commodity that attracted the most demand because of its unique role in providing an easily digestible source of amino acids to livestock. Pork, poultry, aquaculture, dairy cattle -- you name it -- soybean meal is on the list of top feed choices for many high-quality proteins. A rapid rise in soybean meal demand accompanied Asia's economic miracle since the 1980s and meal may one day experience similar high rates of growth in Africa and India.

For well over a year now, DTN has been writing about uncommonly high profit incentives for crushing U.S. soybeans, a feature that continues today. In explaining the higher-than-normal crush margins, attention was often on the bullish impact of the market for renewable diesel being made from soybean oil as this was an obviously new market for soybeans with large growth potential.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Tuesday's report from the Energy Department confirmed the new market continues to grow rapidly as plant capacity for producing renewable diesel and other biofuels expanded to 2.670 billion gallons per year in November, a 141% increase from the previous 12 months. Also, as of November, the amount of soybean oil being used to make biofuels hit 943 million pounds, a 19% increase from November 2021.

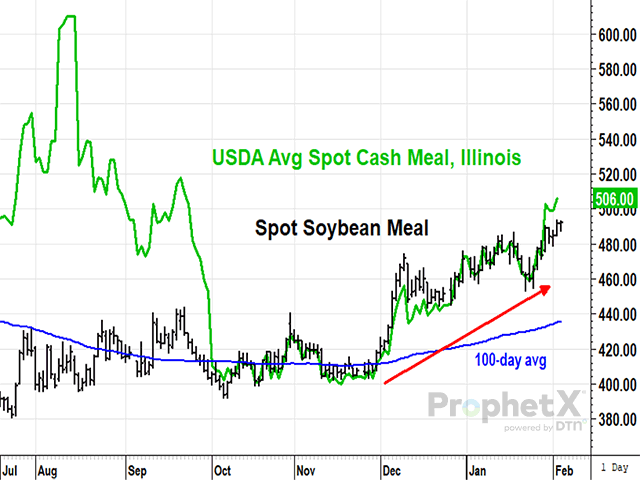

With such rapid change happening, it has been easy to miss just how well the demand for soybean meal has been going. USDA's January estimate shows 53.4 million short tons of demand for U.S. soybean meal in 2022-23, up 1.7%, but of course that is just an estimate. By comparing USDA's cash average price for soybean meal in Illinois to the spot futures price, we can see the Illinois cash meal price had enormous premiums over future prices this summer, at one time over $190 per short ton in early August.

Such premiums were indications of strong domestic demand for soybean meal at a time when the soybean crush slowed to accommodate tighter supplies of summer soybeans available. The premium largely disappeared during fall harvest when soybeans became more available and crush totals increased, making meal available again.

From October until recently, the price of cash meal in Illinois largely tracked with the spot futures price, even as both cash and futures prices started rising in December and January. Just this week, the cash price in Illinois started showing a premium to futures again, closing roughly $14 above the March contract on Thursday, Feb. 2.

Theoretically, meal supplies should be readily available as Wednesday's Fats and Oils report from USDA's National Agricultural Statistics Service (NASS) showed 415,593 tons of meal on hand as the end of December, a 30% increase on the month and up 11% from a year ago. The Illinois cash price tells a different story, however. Thursday's new contract high in March soybean meal is also difficult to argue with.

Technically speaking, it was just two weeks ago, on Jan. 20, when March soybean meal was in the process of posting a bearish weekly outside reversal and had all the appearances of a classic top. Prices had peaked just below a previous high of $494.70 in March 2022, the weekly stochastic was just starting to bend lower and noncommercial net longs in meal totaled a whopping 166,350 contracts, the largest spec position in over four years. The main argument to the potential top idea was that the March contract in meal still held a $12.70 premium over the May contract, a strong sign of commercial buying interest, despite the technical reversal. On Thursday, the March meal contract closed $16.00 above the May.

One of these days, high meal prices will cure high meal prices, or whatever it is they say. But for now, end users of meal should know the pain of high prices is not showing any sign of being over yet. With specs heavily involved, there is plenty of potential for prices to turn volatile, but there is also a good chance U.S. meal supplies will remain insufficient through summer.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.