Todd's Take

Commercial Grain Firms Find Value in Wheat's Cheap Price

I've mentioned flaws in the theory of supply and demand before, which are important points for understanding why markets don't always behave the way we think they should. For the record, I've never favored throwing supply and demand out completely; especially in ag markets where demand is essential -- available supply matters. Traders and the prices they influence do not always behave rationally, but facts also matter, the best we can determine them.

As you might have guessed, I'm referring to wheat prices and the stubborn bearish sentiment that seems to be plaguing traders, especially the past couple months. Friday's (Jan. 13) Commitment of Traders report showed noncommercials (speculators) net short 12,155 contracts of KC wheat and 39,716 contracts of Chicago wheat, two commitments that obligate specs to provide the market with 259 million bushels (mb) of wheat. These promises were made by people not in the wheat business and may not even know what a wheat stalk looks like.

If those same traders had to buy actual wheat at Thursday's prices (Jan. 19), it would theoretically cost them $486.8 million for hard red winter (HRW) wheat and $1.378 billion for soft red winter (SRW) wheat. Of course, that is laughable because there is no way anyone could buy 259 mb of physical wheat without dramatically running up prices. In the case of SRW wheat, USDA estimates the 2022-23 season will end with a surplus of only 90 mb.

This disconnect between the futures market and the real world is a great commission generator for brokers and exchanges, but also distorts market prices and threatens the financial integrity of the exchange. One day, we should not be surprised to find out that allowing specs to hold large short positions in a commodity they don't own could bring down the whole house of cards. All it would take would be some sort of bullish surprise, perhaps a stray Russian missile hitting a nuclear reactor in Ukraine or eastern Europe? Let's see them meet that margin call.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

I admit, I've taken the current situation to an extreme to make a point. For the sake of exchange integrity, the Commodity Futures Trading Commission (CFTC) needs to take a hard look at the practice of allowing speculators to make large supply commitments in the market they cannot possibly keep, secured only by insufficiently small amounts of margin that would quickly disappear in a volatile market. Some day that risk may not be theoretical.

In the current situation, if we go by USDA's cost of production estimates for all wheat in the U.S. of $420.06 an acre in 2022 and divide by the 2022-23 yield of 46.5 bushels per acre, we get an average production cost of $9.03 a bushel for all U.S. wheat. Thursday's closing prices for Jan. 19 pegged DTN's national index of cash SRW wheat at $6.94 and the index for cash HRW wheat at $8.01 -- both well below USDA's estimated production cost.

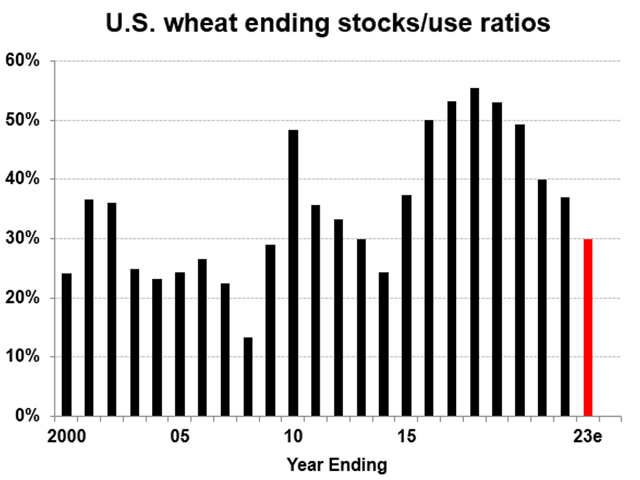

On Jan. 12, when USDA reported a lower-than-expected U.S. wheat total of 1.280 billion bushels (bb) on hand as of Dec. 1, it was the lowest total for that date in 15 years and supported USDA's assertion that U.S. wheat ending stocks will also finish at their lowest level in 15 years on May 31.

U.S. wheat supplies near their lowest level in 15 years do not typically correspond to wheat prices well below their production cost. The 259 mb bluff of supplies promised, but not actually owned by specs has created a disconnect between the current situation and the higher prices low wheat supplies would normally reflect, if specs were not distorting the market.

Of everything I just explained about why wheat deserves a higher price in the market, the frosting on the cake arrived last Friday when the Commitments of Traders report showed commercials net long 12,830 contracts of KC wheat, 43,529 contracts of Chicago wheat and 2,147 contracts of Minneapolis wheat -- all as of Jan. 10. For KC wheat, it was the largest vote of confidence since August 2020, a previous time when wheat prices were about to trade higher.

I warned specs against being short in wheat back in November (see https://www.dtnpf.com/…) and have largely dined on humble pie since, watching prices trickle lower. If you don't want to take my word for it, at least listen to the commercials now long in wheat, a recognition of good value by the firms that know wheat demand best. My two cents for the specs out there holding short obligations in wheat you don't own, consider yourself lucky and get out while you can. Facts do eventually matter.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be reached at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2023 DTN, LLC. All rights reserved.