Todd's Take

Making Sense of Grain Prices' Many Crosscurrents

These days it seems to be easy to make an argument for whatever direction you want grain prices to go.

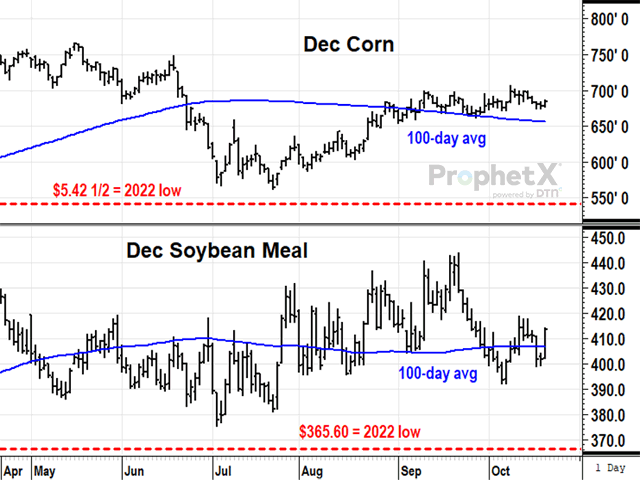

Do you want lower corn prices? Rising interest rates, a U.S. Dollar Index near its highest prices in 20 years and a hawkish Federal Reserve that's intent on bringing down inflation and, possibly the economy with it, would normally be a convincing recipe for lower corn prices. Add to the list recent problems in moving corn down the Mississippi River, a sluggish pace of ethanol production and the possibility of a U.S. rail strike, and the argument for lower corn prices is easily made.

Do you want corn prices to go up? Well, earlier this month, USDA just estimated U.S. ending corn stocks at 1.172 billion bushels (bb), the lowest in 10 years. Excluding the non-exporter China, global ending corn stocks were estimated at 3.74 bb, the second lowest in nine years. And, by the way, even with a dry Mississippi River, the national corn basis is the strongest for this time of year in over 10 years.

Argentina is starting the new season with dry soil, although there is some rain in the seven-day forecast. Fertilizer remains expensive and Brazil uses almost three times more per acre than farmers in the U.S. Ukraine used to be the world's fourth largest exporter of corn but is spending its resources fighting for its life against relentless attacks from Russia. It is not yet clear if Russia will agree in November to keep allowing grain ships to leave Ukrainian ports. Meanwhile, Ukrainian farmers' finances are strained, trying to forge ahead under extremely stressful conditions.

Similar schizophrenic cases could also be made for soybean and wheat prices, as influences from the economy are bearish, while supplies of both remain historically tight. On Oct. 12, USDA's estimated 200 mb of U.S. ending soybean stocks in 2022-23, the lowest in seven years, and 576 mb of U.S. ending wheat stocks, the lowest in 15 years, even after making allowances for lower exports for both. USDA pegged global ending wheat supplies outside of China at 4.53 bb, the lowest in 15 years.

There is no question the world needs more food and feed. In September, USDA's Economic Research Service (ERS) looked at 77 high-risk countries and estimated the number of food insecure people at 1.3 billion in 2022, up 119 million from the total in 2021. The ERS defines food insecure as anyone unable to consume 2,100 kilocalories a day, an average standard for healthy needs (See USDA's report at: https://www.ers.usda.gov/…).

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

It is highly unusual to find a time when Fed policy and outside economic influences were this bearish and physical supplies of grains were this tight. U.S. monetary policies created unusually expensive U.S. dollars in 1985 and 2001, two times when U.S. grain supplies showed large surpluses. In those cases, the bearish conclusion was easy to draw, but 2022 is not the same.

Another bearish economic situation was the financial meltdown in 2008-09. At that time, corn and wheat supplies were more comfortably available in 2008-09 and the U.S. dollar was cheap, roughly a third less than today's levels.

Soybean supplies were tight at that time, however, offering a loose comparison. The U.S. raised a larger, 2.97 bb soybean crop in 2008, but demand for soybeans was so strong U.S. ending stocks tightened from 205 mb in 2007-08 to 138 mb in 2008-09. Even so, spot soybean prices fell from $13.32 at the start of the 2008-09 season to $11.00 by the end of the season, a volatile year that saw prices briefly dip below $8.00 in December.

As tempting as it might be to use the soybean example of 2008 as a template for expecting a drop in soybean or other crop prices in 2022-23, the parallels just aren't that strong. The level of fear in the 2008 market was much higher as financial institutions were at risk all around the world.

Here in 2022, the economy is functioning relatively well so far. The number of U.S. jobs just exceeded their pre-pandemic peak for the first time in September and nominal GDP was up 9.6% in the second quarter from a year ago, up 1.8% when adjusted for inflation. Interest rates are headed higher and there is plenty of worry things will get worse, but there has been little sign of economic contraction in the U.S. yet, outside of the recent hit from Hurricane Ian.

Given the current rut in U.S. oil production, the limitations of drought and war and the inability of the Fed to do anything about either, it is quite possible that we will have higher interest rates, slower economic growth and higher energy and food prices in the months ahead. After all, high interest rates not only discourage demand in the economy, they also discourage long-term investment in oil production -- the one thing needed most to unravel the inflation problem.

For U.S. crops, a return of more favorable weather in 2023 would be the best news for bringing back a more comfortable supply margin, but it is difficult to see that possibility just yet, especially as winter wheat is being planted into Kansas topsoil that USDA says is 82% short or very short of moisture.

As I mentioned at last year's Ag Summit, I miss precedented times.

This year's DTN Ag Summit will be held in the comfort of your favorite chair on Dec. 12 and 13. Check out the topics and speaking lineups at www.dtn.com/agsummit. We'd be glad to have you join us!

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be found at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.