Todd's Take

Recent Rebounds in Corn, Soybeans, Wheat Prices Ignore Federal Reserve

If it seems like outside markets have been worrying about inflation and higher interest rates for a long time, I agree; the conversation began well over a year ago. Early in 2021, rising prices became noticeable as the economy rebounded from the depths of the 2020 pandemic faster than the economy's ability to produce could keep up.

The Fed took a lot of criticism early for not raising interest rates sooner, but frankly, the reluctance was understandable as many facets of the economy were still suffering from the sudden loss of 22 million jobs that took place after COVID first emerged. On Wednesday, Sept. 21, the Federal Reserve announced its fifth rate hike since the pandemic began, putting the new federal funds rate target range at 3.00% to 3.25%.

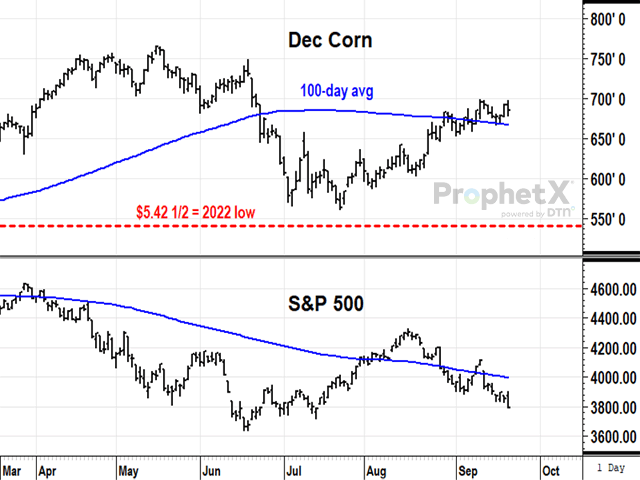

The Fed said it is "strongly committed" to raising rates until inflation is back to 2%. The Fed's latest projections show a 4.6% peak in the federal funds rate sometime in 2023 with a 4.9% rate possible. Stock market investors understandably don't like higher interest rates that reduce stock market valuations. The S&P 500 Index closed 66 points lower at 3,789.93 Wednesday, down 21% from the all-time peak of 4,818.62, reached in January.

Earlier this summer, corn prices were largely able to ignore outside concerns, but support started to give way on June 22 when Federal Reserve Chairman Jerome Powell said the threat of recession was a possible consequence of the Fed's determination to raise interest rates. Noncommercials holding over 500,000 long positions in corn at the time bailed out of over 170,000 contracts in a month, taking December corn prices to a low of $5.64 1/4 by July 22.

As I wrote in this space on July 11, specs in corn, soybeans and wheat overreacted in July and it is encouraging to see the rebound that has taken place in all three prices since (see https://www.dtnpf.com/… ).

Macroeconomic events do have influence over crop prices as we have often seen. But the current situation simply doesn't merit the level of bearish panic some seem to have. As long as demand is active -- and it currently is -- it is the amount of available supplies that matters most to the prices of corn, soybeans and wheat. Supplies of all three are expected to be historically tight in 2022-23 and that fundamental statistic will not be so easy to ignore in the months ahead.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Personally, I have had a difficult time seeing where this new recession has been hiding. The checkout lines at Walmart are as long as ever and the parking lots are always busy. I have made several trips across the Midwest this summer and have noticed no significant drop in traffic. The U.S. Department of Transportation did say its measure of vehicle miles was down 3.3% in July when gasoline prices were high, but also said year-to-date miles in July were up 1.8% from a year ago.

Where are the layoffs? The most recent jobs report from the U.S. Labor Department showed 158.7 million employed in August, still rising from the pandemic low. Where are the headlines of companies going under? I have yet to see anything that suggests the economy is experiencing significant pain yet.

To dig a little deeper, I took advantage of the latest quarterly reports and the free stock screener at Zacks.com. I asked the screener to provide a list of S&P 500 companies, arranged in order of percentage return on assets over the most recent 12 months.

In this nervous environment of rising interest rates, 12 of the 500 companies were drawing down their total assets. Most were cruise lines, casinos and airlines -- companies still hurting from the pandemic.

Eighteen companies showed returns on assets between zero and 1%, a list of mostly banks and large financial companies. These companies traditionally carry a lot of debt and don't generate much return, but usually have enough assets to weather a short-lived storm. Should conditions get worse, these 18 will be the ones to watch and include names like American International Group and Citigroup, two that got into trouble in 2008.

It may not seem like a big difference, but 31 companies were on higher ground, earning between 1% and 2% on assets. Many of them were also banks or financial institutions, in better shape than the previous group. By the time we get to the category of 2% to 3% returns, the list of 36 companies became more diversified and included various energy producers, utilities, insurance companies and a mobile phone provider -- generally solid businesses whose services will be needed in the days ahead.

As I see it, roughly 30 of the Standard and Poor's 500 companies are potentially at risk of encountering financial problems in a slower economy, should one occur. Most of the 30 will likely weather the storm. If there is a more painful scenario ahead, I don't see it yet, but need to also mention there are two fellows on this planet threatening to use nuclear weapons.

More important than our limited ability to predict macroeconomic events, I am fairly confident that over 7.9 billion of us will need to keep eating this winter, while global stores of food and feed will be tighter than we have seen in many years.

Two years after the global pandemic first hit, followed by war in Ukraine and multiple droughts this year, food and feed prices are on track to be higher this winter. Until the Fed proves it can produce oil or food, there is only so much higher interest rates can accomplish.

**

Comments above are for educational purposes only and are not meant as specific trade recommendations. The buying and selling of grain or grain futures or options involve substantial risk and are not suitable for everyone.

Todd Hultman can be found at Todd.Hultman@dtn.com

Follow him on Twitter @ToddHultman1

(c) Copyright 2022 DTN, LLC. All rights reserved.