Global Fertilizer Outlook - 1

Global Nitrogen Fertilizer Market Faces Issues with Availability, Affordability

OMAHA (DTN) -- The many issues facing the global nitrogen market in 2022 are going to continue to test the market in 2023. These include the war in Ukraine, rising natural gas prices, weather and currency concerns.

As a result, the supply and price of nitrogen fertilizers will be subject to the various geopolitical world events. Nitrogen prices are already at high levels and fertilizer analysts don't believe prices will decline any time soon.

Director of Fertilizer for StoneX Josh Linville said nitrogen fertilizer prices in the first quarter of 2023 could be higher for some forms, such as urea. Other forms, such as UAN and anhydrous ammonia, could see steady to higher prices to start the year.

"Fertilizer prices are already high, so prices that even stay fairly steady is not good news for farmers," Linville noted.

Samuel Taylor, inputs analyst for Rabobank Research, said with so much volatility in the nitrogen market worldwide there is very little chance prices will move lower in 2023. The first part of the year, prices could see some pick up, while some flatness could occur in nitrogen prices in the late quarters of the year, he said.

The issue with supply in nitrogen is not going away any time soon and thus this will continue to inflate prices, he said.

"There just is so much volatility in the nitrogen market as we head into 2023," Taylor said.

MUCH UNCERTAINTY IN N

The International Fertilizer Association (IFA) released its Medium-Term Fertilizer Outlook 2022-2026 in July 2022 and said world nitrogen capacity in 2022 was estimated to be just under 160 million metric tons (mmt). (https://www.fertilizer.org/…)

Because of the war in Ukraine, IFA presented three scenarios to reflect the uncertainty in the fertilizer market. An optimistic scenario includes partial recovery of exports, improved affordability and minimal yield impact. A pessimistic scenario would see further deterioration of supply, worsening affordability and chronic shortages. A middle-ground scenario would be pockets of availability and affordability crisis, and trade-rerouting.

Nitrogen capacity would remain at 2022 levels in 2023 in the optimistic outlook, IFA stated. A modest decline of 0.3 mmt is forecast in 2022.

The middle ground would see a slight decline in capacity to about 2.4 mmt N lower than 2021. The pessimistic outlook could drop global nitrogen capacity by 5.7 mmt, closer to 150 mmt of capacity.

The nitrogen capacity outlook in 2026 would range anywhere from under 160 mmt to about 170 mmt, according to IFA.

Part of the cloudy outlook for nitrogen is the amount of nitrogen fertilizer produced in the Black Sea region. Almost one-third of the forecast capacity expansions between 2022 and 2026 are in Russia or Belarus.

The continuing war between Russia and Ukraine makes it questionable at best if these expansion projects can supply the world with nutrients.

FERTILIZER USE DECREASES

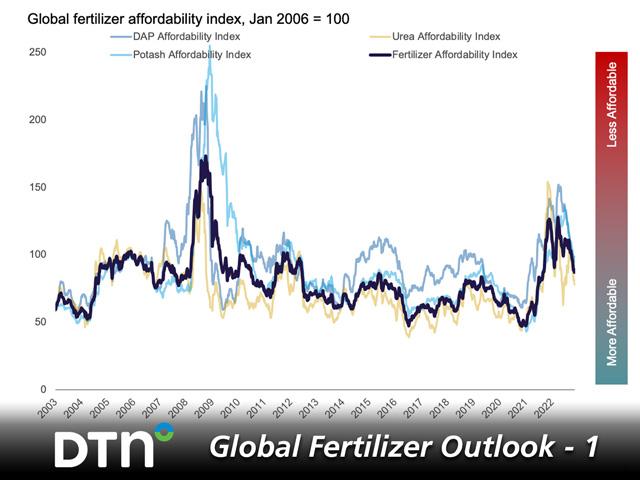

Global fertilizer use estimates fell 1.6% in 2021, to 200.6 mmt, after a 6% increase to 203.8 mmt in 2020. The decline was driven by lower fertilizer affordability, the war in Ukraine and some purchases made in previous years, according to IFA.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Unlike the larger losses seen in phosphorus and potash, nitrogen use decline is modest. Nitrogen was only down 0.2% in 2021 after seeing a 4% increase in use in 2020.

In the medium-term outlook (2024-26), global fertilizer demand is expected to continue to improve. The question remains to what level.

In the IFA pessimistic scenario, global fertilizer demand would reach 194.6 mmt in 2026; that's 2 mmt above the 2019 level, but 9 mmt below the 2020 level.

The middle-ground scenario has world fertilizer demand at 202.1 mmt in 2026, 9.5 mmt above 2019 but 1.7 mmt below the 2020 level.

In the optimistic scenario, the global fertilizer demand would reach 211.1 mmt, 7.4 mmt above the 2020 level.

NATURAL GAS PRICE IS KEY

Among the many issues facing the global nitrogen fertilizer market in 2023, natural gas price is one of the larger factors.

This is especially true in Europe, which saw some nitrogen fertilizer production curtailed this summer because of higher natural gas prices, according to Chris Lawson, head of fertilizers for London-based CRU Limited.

These European production issues affect the world nitrogen fertilizer market with less overall supply available, he said.

The good news is this fall natural gas prices dropped some; this allowed much of the nitrogen fertilizer production shelved earlier this year in Europe to begin again. The bad news is if the European winter is colder than normal, natural gas supplies could decline, and prices could rise again.

"We hope lessons have been learned and there is more hedging against natural gas prices (by European fertilizer manufacturers)," Lawson said.

Questions about European nitrogen fertilizer production levels remain.

WHAT HAPPENS WITH EUROPEAN PRODUCTION?

Linville said he wonders how much of the European nitrogen fertilizer production actually restarted after the shutdown earlier this year.

Some newer facilities probably restarted, but many older plants might not come back online. This would be a negative, Linville said.

He explained that west and central Europe produce roughly 5% of the world's supply of urea, 21% of the UAN supply and about 8% of anhydrous ammonia supply. So, production supply concerns in Europe will filter down and affect supply and price in the global market, he said.

If noticeable price differences are seen in the different forms of nitrogen, Linville said he believes farmers might be more willing to use other forms of nitrogen to save some money. This could then lead to concerns about the availability with the different forms of nitrogen.

WEATHER AFFECTS N

Another factor into the nitrogen outlook in 2023 is how various weather issues will affect the supply of nitrogen fertilizer.

Matt Roberts, senior analyst for Terrain, told DTN every cold snap this winter will lower the natural gas supply, both in Europe and in North America. If either continent sees a cold winter and natural gas supplies are short, this could lead to increased issues with nitrogen fertilizer availability.

U.S. weather issues, specifically the severe Midwestern drought, had a negative effect on Mississippi River levels; the shallower rivers led to barges having less grain going down the river and less fertilizer aboard going back up the river.

"The slowing of getting fertilizer inventories into the Midwest bears watching this winter," Roberts said.

Usually, river levels rise in the spring with rains and the melting snow cover in the northern Midwest. This situation might help next spring, he noted. But the slowing of fertilizer moving north will only cause nitrogen fertilizer prices to rise, Roberts said.

N CURRENCY CONCERNS

Currency concerns will also influence the nitrogen market outlook in 2023.

The Federal Reserve adjusting interest rates will affect how much it costs for North America to import various nitrogen fertilizers. Roberts said weakness in the U.S. dollar on the world market means the price of fertilizer is going to be higher.

Roberts said, like the many other factors facing the nitrogen market in the new year, the condition of the world economy will also affect prices.

An economic downturn worldwide would be negative for the world nitrogen market, he stressed.

"The amount of volatility is just huge for the nitrogen market," Roberts said. "No one can really predict what is going to happen."

**

Editor's Note: This is the first of three stories in DTN's special Global Fertilizer Outlook series. To see DTN's weekly column on Retail Fertilizer Trends, check out https://www.dtnpf.com/….

Russ Quinn can be reached at russ.quinn@dtn.com

Follow him on Twitter at @RussQuinnDTN

(c) Copyright 2022 DTN, LLC. All rights reserved.