Corn Stocks Deep Dive

Corn, Corn, Who's Got the Corn?

USDA gave us their quarterly reset for old crop use on Friday, March 31, with their release of the March 1 Grain Stocks estimates. That is the main data series for determining quarterly and annual feed and residual use for corn, and revisions arising from this report will be made in the April World Agricultural Supply and Demand Estimates (WASDE) report.

What did March 1 Grain Stocks estimates tell us, and what are some of the implications?

March 1 corn stocks totaled 7.4 billion bushels (bb), which was down 357 million bushels (mb) versus March 2022. They made a small 12 mb revision to the December stocks (to 10.821 bb), but Dec. 1 inventory, as revised, was 821 mb below the previous year and now we're only 357 mb light. Implied second quarter use was 3.42 bb; a year ago, second quarter use was 3.884 bb. Price rationing is real, with consumption slowing at higher average prices and reduced availability.

P[L1] D[0x0] M[300x250] OOP[F] ADUNIT[] T[]

Most of the rationing was in the Western Corn Belt, which we define as Iowa, Nebraska, Minnesota, Missouri and Kansas for our long-term historical purposes. The stocks deficit on Dec. 1 was 571 mb for those states, but it dropped to 326 mb by March 1. The reduction is a combination of fewer exports out of the region, smaller hog and cattle numbers, and a little less ethanol grind due to stiff basis, rail and availability issues.

Along with the tighter supplies, we have tight farmer holding. Off-farm stocks on March 1 were 10% smaller than a year ago, nationally. On-farm stocks were 1% larger. The elevators are holding less inventory and, as of March 1, were unable to buy the corn from the producer. There is an interesting corroboration of that data in the CFTC Commitment of Traders report. We're using the futures plus options data series. The commercial short-hedge position on March 1, 2022, was 1.129 million contracts or 5.64 bb spread across two marketing years and also including some foreign hedge business. On Feb. 28, 2023, the commercial short-hedge position was only 672,263 contracts or 3.36 bb; you have to go back to June 2020 to find a smaller one. After factoring in new-crop hedges and domestic user needs, the elevators appear to own very little uncommitted corn.

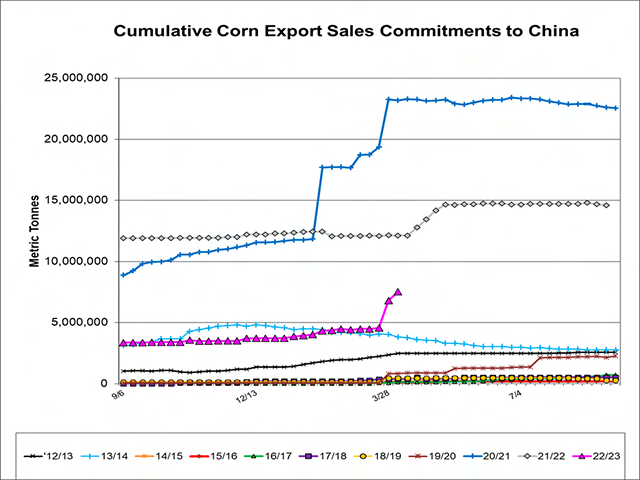

Now let's look at the recent Chinese buying binge. Per USDA weekly and daily reporting data, China has approximately 129 mb of unshipped U.S. corn on the books for old-crop shipment, i.e., before Aug. 31. Much of that unshipped grain was purchased in the last two to three weeks, after May futures dropped below $6.35 or so. We don't know at what price they will quit buying, but we know that Brazilian corn shipments are being crowded out by the need to ship a record soybean crop, and the large winter Brazilian crop won't be available until at least July.

It looks to us like the market needs to buy a lot of old-crop cash corn between now and July. Generally speaking, it takes higher cash prices to do that, either through stronger basis or higher futures or both. It is no accident that the May/December corn spread widened 11 1/2 cents per bushel Friday, with the large corn planting intentions number (91.996 million acres) perhaps adding an extra weight to the December. It's also not an accident that the industry is moving their bids to July and away from May, even with a month left until first notice day. Based on the above information, there would likely be few warehouse receipts available.

Before you get too bulled up, keep in mind that Friday's grain stocks numbers do not mean USDA has to tighten their old-crop ending stocks figure. Even with the Chinese buying, export sales are still not on the pace needed to meet the current full-year forecast. Corn export sales commitments are 77% of the full-year WASDE estimate; they would typically have been 87% by March 23, the last weekly export sales report. If the April WASDE estimate shows tighter ending stocks, it will likely be due to an increase in the feed and residual use estimate. Also, those Chinese purchases aren't shipped, and relations with China aren't exactly smooth right now. That business could still be hung up somewhere due to a Taiwan move or something China does to aid Putin's war effort in opposition to U.S. interests.

Alan Brugler may be reached at alanb@bruglermktg.com

(c) Copyright 2023 DTN, LLC. All rights reserved.